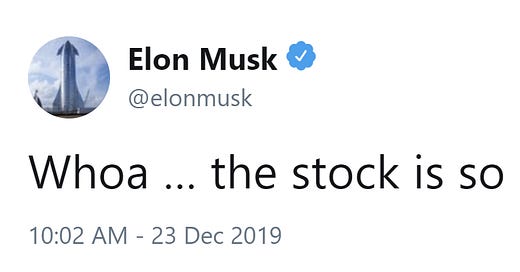

"Funny" Elon Musk Jokes About Tesla Stock "High" at $420

Tesla CEO thinks Tesla's stock *high* is funny because, you know, $420.

Tesla CEO cracked wise today in a tweet about the stock *high* when it briefly hit $420.

That is hilarious considering, as I noted in Tesla's Q3 "Magic" Fades Quickly In Q4:

Q3 reported "profit" was not actually *profit* (again) because it was generated using one-offs, unusual items, & dicey accounting while core operating margins shrank on falling revenue

M3 *demand* has proven to be incremental which has not been sustained and MS & X demand remains in freefall

Cash/liquidity relies on increased borrowing and low-key equity raises

Q4 revenue & "profits" likely will be down y/y on projected Deliveries up 14% (& management lowered guidance versus previous targeted Q4 up 14-58% to get 360-400k for the year)

So yes, Elon. Very funny. Now do near-bankrupt WeWork, which was valued at $47 billion just a few months ago.

Softbank Group just laughs and laughs about WeWork's spectacular collapse—or not (see my latest on that debacle in WeWork Is Foundering While Softbank Struggles With Its Bailout on 11/27/19).

But it's good to remember that equity price on a cult stock can be a poor indicator of the company’s underlying value and risk.

Look for more discussion in my upcoming report.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.