Forget Elon's Twitter Spatter. Tesla's Got Trouble In China.

Deep dive shows why Tesla can't afford to struggle in China, which it needs to juice its margins, create *all* its profits & cash flow, & fund most of billions spent on capex. Aging MY won't save it.

Tesla (TSLA) is struggling like all its competitors to restore production in China as the country persists with stringent lockdowns to battle the worst Covid outbreak there in two years. Its Shanghai plant was shut down by Chinese authorities for the third time last month on March 28th and has remained closed every since.

Recent reports say the company is joining others like Toyota (TM) and Volkswagen (VWAGY) in tapping employees to live and work continuously on campus under constant health monitoring in a “closed loop” strategy to restart production.

That’s tentatively good news for Tesla just ahead of reporting first quarter results after the market closes on Wednesday. But, as I long have warned, Tesla’s deeper problems in China were escalating long before the recent lockdowns at Shanghai (see my most recent discussion in Tesla China Deliveries: Weaker And More Important Than You Think).

In that report I warned that overly ambitious projections from Tesla and market consensus for record and accelerating results per quarter for every single quarter this year left no room for weakness, much less in the first quarter out of the box.

That confidence was shaken when Tesla only managed first quarter deliveries which trailed even the low end of the projected 312,000-320,000 range of reduced market estimates with deliveries at 310,048, up 68% y/y but up just 0.5% versus fourth quarter results (see Tesla Q1 Deliveries Come In Under The Wire).

Moreover, as I noted then, that the slight beat to the high end of my 300,000-310,000 estimated range came from “higher than expected sales of long struggling Models S & X which came in at 14,724, a surprising jump versus 2,030 (down 83%) last year and the highest since 18,966 (down 3% y/y) in Q420. Models 3 & Y were lower versus my 298,000 estimate at 295,324 (up 62% y/y).”

I had suspected increasing weakness in China would factor in Tesla missing expectations:

Model 3 local deliveries in China fell more than 66% y/y in February to 4,607 following the 78% y/y drop in January to just 2,988. That put first two-month results at 7,595, down 72% y/y and the lowest versus the same period in any quarter since Q1 2020.

At this rate Model 3 China deliveries need to top 31,500 for March—a new monthly record—just to match peak quarterly results of 39,139 generated for Q4 2021 when buyers were rushing to buy before subsidies dropped. Yet even this would fall well short of market estimates targeting more than 41,000 for the quarter.

This again leaves all the heavy lifting for Model Y, which still is ramping up sales incrementally versus last year. Except Model Y came up comparatively short in February at 18,593. That was up 302% versus nascent results last year, but down 20% versus the second month in the fourth quarter—a sudden and significant slowing in sales momentum. As a result, Model Y first two-month results at 34,951 are down 4% versus the same period in the fourth quarter. This means monthly Model Y deliveries need to hit a new record at 41,969 for March so first quarter deliveries can even meet Q421 results at 76,920. Even so, this still would trail market estimates by more than 15,000.

Tesla China Deliveries: Weaker And More Important Than You Think).

Sure enough, Tesla fell well short of even meeting fourth quarter results with 65,754 total deliveries in China for March, up 85% y/y but down 7% versus December.

First quarter results trailed the fourth quarter by 7% at 108,300, up a strong but notably slower 56% y/y. That paled versus the 138% y/y increase for China EV sales, led by the 423% y/y increase by BYD Co. which delivered 286,329—now regularly blowing past Tesla.

And this time Model 3 and Model Y both trailed Tesla’s December monthly results at 26,024 (down 14% vs December) and 39,730 (down 2%), respectively.

Model 3 was down 36% y/y to 33,619 for the full quarter, marking its third straight double-digit y/y decline.

Model Y was up 355% for the full quarter at 74,681, but that was down 3% vs December as I expected as its ramp-up pace slowed markedly in the last two months of the quarter.

Tesla is not just losing market share in China at an increasing rate, most of its China-based competitors now have begun to export cars to compete with Tesla in Europe and other markets.

And, as I have warned, losing ground in China is a much bigger problem for Tesla than missing market expectations (see Will Tesla Get Good News This Week?).

Tesla’s US Operations Lost How Much?

Last year was the first time Tesla (TSLA) reported a healthy yearly profit net of billions in energy credit subsidies that had helped keep it afloat for most of its nearly 19-year history.

Consolidated net income in 2021 jumped 677% to $5.5 billion on a 71% increase in revenue to $53.8 billion. All it took was an 87% increase in deliveries to 936,222.

Cash flooded in as a result, with cash flow from operations up 93% to $11.5 billion and free cash flow (after capex & solar equipment spend) was up 84% to just under $5 billion. Sweet.

It wasn’t until Tesla filed its 2021 10-K report that we could see, buried well into the notes starting at page 86, that the truth was far less encouraging.

Here’s what I see:

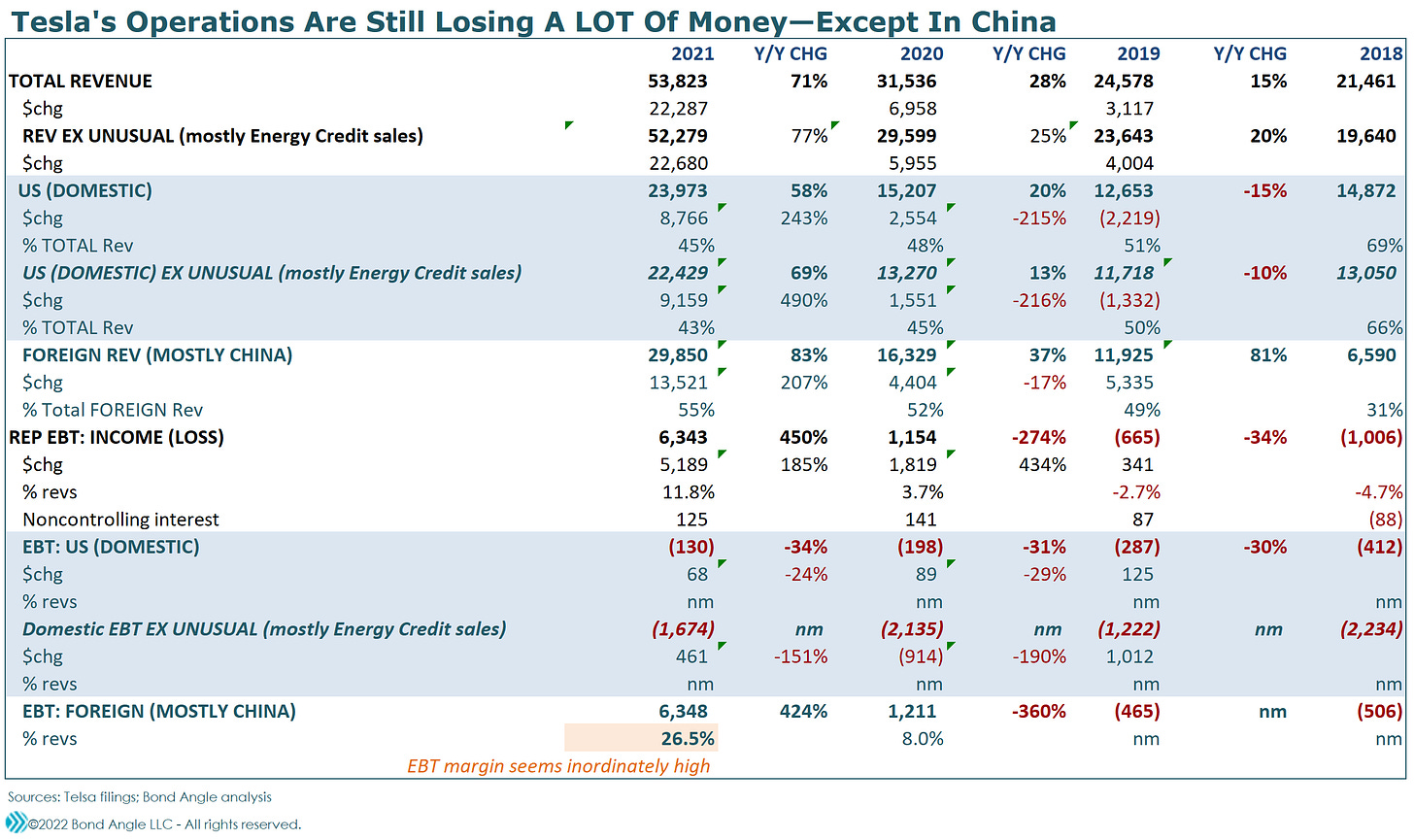

Tesla generated the majority of its revenue growth outside the US, mostly China, in 2020 and 2021, which also offset falling US revenue in 2019—before the Covid pandemic.

Foreign revenue, mostly China, was up 207% in 2021 versus the 58% increase in US revenue. Foreign revenue increased by $13.5 billion—1.54x the increase logged by US operations.

Tesla’s US revenue has dropped to 43% of consolidated results, net of energy credit sales which remain sizable and vital to offsetting major losses from US operations.

Even after increasing US revenue by nearly $9 billion in 2021, US operations still lost $130 million—a paltry $68 million improvement. When I exclude energy credit sales, US operations lost a whopping $1.7 billion despite increasing similarly adjusted revenue by $9.2 billion.

Foreign operations, mostly China, generated a 424% increase in pretax income to $6.35 billion in 2021—again more than accounting for all of Tesla’s reported profit.

One caveat—I don’t believe for a second that foreign operations credibly produced a 26.5% pretax margin (up 185 bps) on revenue. This seems to confirm my concerns that Tesla is juicing those profits:

The astounding profitability differential indicated for foreign operations makes no sense, especially since they mostly comprise Tesla’s new Shanghai factory which was ramping up during much of the periods reported and new factories tend to dramatically less profitable versus mature facilities. One troubling explanation could be that Tesla has continued to capitalize costs beyond appropriate duration for the China factory, and potentially excessively. If so, this also suggests Tesla may also have been grossly over representing how profitable are its US auto segment operations where the company has boasted dramatically higher gross margins versus industry standards. If true, neither maneuvers seem sustainable as vehicles to continue to inflate profits—a potentially even bigger threat to reported margins than I have projected for this year and beyond.

Will Tesla Get Good News This Week?, 2/28/22)

That said, even if margin remained near 2020’s likely also juiced 8%, Tesla’s foreign operations—mostly China—still produce all the profit and all the cash the company generates from operations—on just 23% of Tesla’s long term assets. Talk about efficiency!

US operations remain deeply in the red. When I excluded foreign pretax income and US energy credit sales from reported consolidated income, US operations lost another $2.4 billion in 2021—barely improved versus 2020.

This means any and all of the reported $699 tax expense Tesla paid for 2021 was for overseas operations which offset losses in the US.

And this is where we take in that Tesla also reduced its US tax obligation with a $7.1 billion US tax break related to claiming sizable stock-based compensation, which was $2.1 billion for 2021—mostly for CEO Elon Musk who takes all his pay in stock so he and Tesla can avoid paying any US taxes (see Elon Buying Twitter? Probably Not). Tesla’s stock-based comp has been as high and higher than US-based depreciation the past three years.

In any case, I consider Tesla's working SG&A severely understated as a result. So I add stock-based comp back in to calculate Tesla’s effective operating expenses, income, and cash flow.

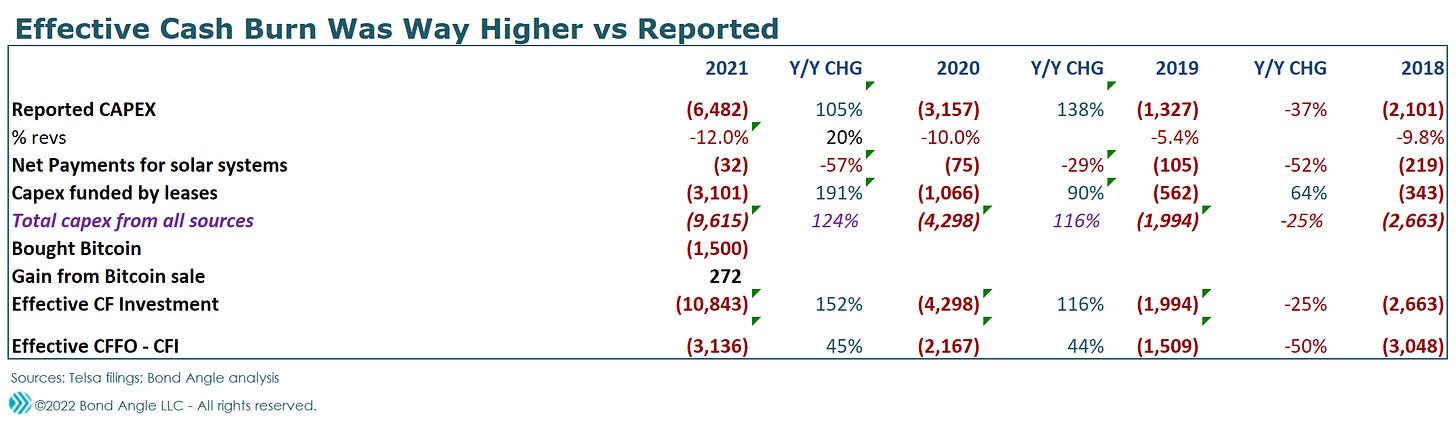

Not surprisingly, effective cash from operations was closer to $7.7 billion versus $11.5 billion as reported, when I excluded energy credit sales and stock based comp. And without $6.35 billion in foreign operating income—mostly China—US operations generated less than $1.4 billion:

Cash flow from foreign operations—mostly China—plus $3 billion in funding by leases was crucial in covering what actually was much higher effective capex at $9.6 billion versus $6.5 billion reported.

So, yes. Tesla reported a record year of profits in cash flow in 2021.

Also true, Tesla’s US operations are still bleeding an astonishing amount of cash. As a result, it needed extensive contributions from a massive surge in overseas profits plus sizable energy credit sales, generous accounting maneuvers, huge tax breaks, and lease funding for a third of its actual capex to cover its even larger operating cash outlay plus debt repayment—and US cash still fell by $2.3 billion.

It’s a good thing Tesla cash stored up from more than $13 billion it sold in stock in 2020, because odds are margins and profits in China are shrinking this year even faster than its sales.

Stay tuned.

Tesla repurchased its 5.3% senior notes in the third quarter of 2021 as I projected, though I doubt we’ve seen the last of Tesla as a bond issuer:

Now stay tuned for the second step I described: a quickly shopped, likely $2-4 billion inordinately low coupon bond deal, rated now at low investment grade as I expected (see Tesla's Car Business Finally Turned A Profit. Really. Time For A Big Bond Deal). It could even be appealing... if it’s priced at T+100 bps or better.

Until then, I have Tesla: Not Rated.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.