Tesla may buy as much as 10% in LG Chem's LG Energy Solution

Insiders say Tesla may buy as much as 10% in LG Energy Solution, the battery business about to be spun off as an eagerly awaited IPO in December from LG Chem Ltd (051910 KS).

Tesla may buy as much as 10% in LG Energy Solution, the battery business about to be spun off as an eagerly awaited IPO in December from LG Chem Ltd (051910 KS) according to unnamed sources talking to Korean Times.

If so, it's unclear if the Tesla's share would come out of LG's remaining 70-80% stake or out of the already limited indicated public float.

If the rumors are true, and that's far from confirmed, some speculate that Tesla may be planning to hand off actual battery making it is designing to an experienced partner, such as LG's LG Energy Solution.

That would make sense given the enormous execution risk Tesla already has created be electing to make its own batteries using its own proprietary concepts still likely years away from confirmation at commercial scale—if they work at all (see my report Nikola's Troubles And Tesla's History Shadow Battery Day).

Handing off actual execution to a credible battery manufacturer also would greatly increase confidence both in Tesla’s battery tech concepts and their likelihood of success at more reasonable costs—and potentially in a shorter amount of time (still years, though in my view).

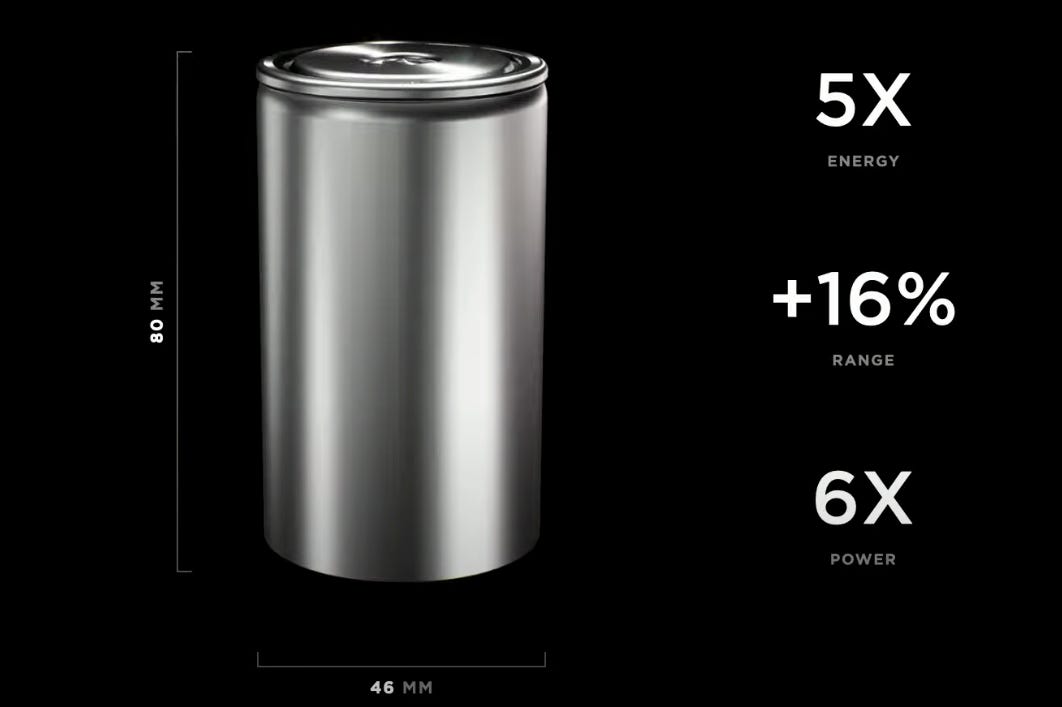

That confidence was shaken last week on Tesla's Battery Day event when investors realized Tesla's "reveal" actually was a laundry list of promising but far from proven concepts for a new larger battery, battery chemistry, manufacturing techniques, and even structural design changes that will also, if they work at all, delay production for several more years on already late new models.

I had warned about these risks again in my latest report, but Tesla fans were, as usual, overly optimistic. Tesla stock tumbled by 21% to $383 per share after Battery Day, before recovering somewhat to $407 today.

I'll have another report out directly which evaluates Tesla's announced battery technology and projections. In the meantime, I remain guardedly optimistic that Tesla is at least considering a credible partner like LG early enough in its battery making pursuits to better ensure its success. Investors will be watching, no doubt, for any news from LG that may or many not confirm this latest rumor.

And of course, as in all things Tesla, it is just as likely we never hear of it again.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.