Tesla - Now We Know The Y, But Not the How

Tesla rushes out the reveal of its long overdue model y, and we are underwhelmed.

The eagerly awaited and long promised Model Y is out and it looks...like Model 3.

That's OK, just no shock and awe which Tesla really needed to jumpstart sales momentum--and a wave of sorely needed cash reservations.

Tesla (TSLA) unveiled Model Y on, perhaps not coincidentally, March 14th which also is Pi Day. Pi is the fundamental ratio which demonstrates that all circles are related--as Model Y is overwhelmingly related with the seminal Model 3 which contributes 75-80% of the newcomer's platform and technology.

Which means Model Y may be originating with Model 3's many inherent problems, as I discussed in Tesla's Plan B 2.0; Y Not, just as Tesla also is juggling the ramp-up of the newly launched $35,000-base model of Model 3 along with sales expansion into Europe and China as well as building a new plant on a shoestring in Shanghai.

All this just as the company also has lurched into a radical new online-only sales model with apparently little if any considered preparation (see Tesla's New Plan: Buy Before You Try).

No wonder Tesla's Vice President of Engineering Michael Schwekutschjust quit, an ominous signal.

Another is that Model Y won't be available until late 2020—at best—which is much later than expected. It's still not clear when or where Model Y will be in full production or, even more critical, when Tesla will make even a penny of profit on it. Model 3 only recently became marginally profitable, excluding the likely money-losing $35k version, and sales of more profitable but aging Models S and X are in accelerating decline.

And, as I observed last week, Tesla's track record of long delays in delivering new models coupled with Model 3's alarming quality and reliability may seriously diminish the hoped-for early bird reservation cash which the company sorely needs to ease its liquidity crunch. At the same time, the pending arrival of Model Y over the next year or so is likely to further dampen already waning demand for Model 3.

In any case, it's too late for Tesla to preserve profitability in the calamitous first quarter, if not for the full year.

It Looks Ok, But Just Ok

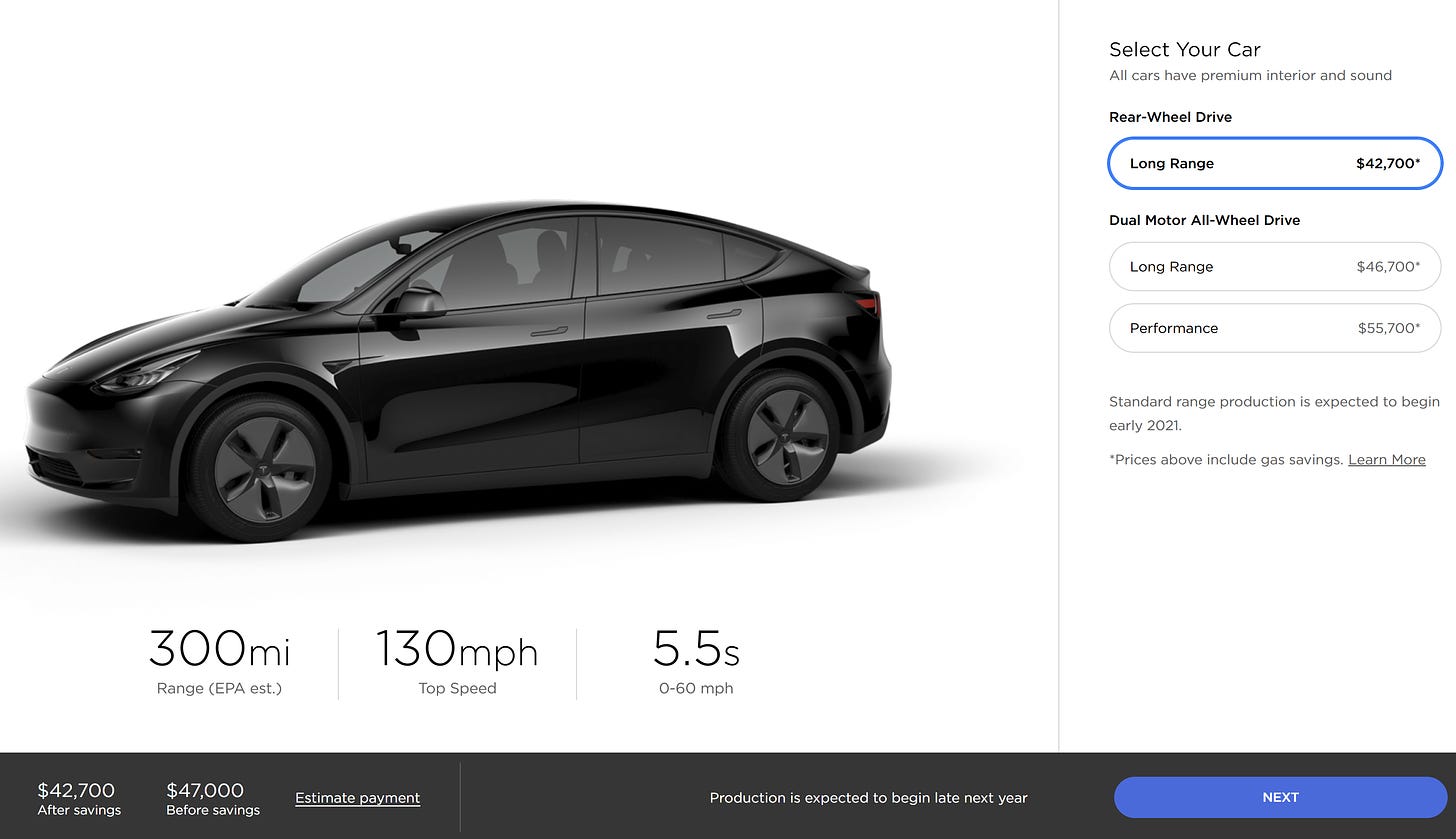

If you like the Model 3, you'll like Model Y, but you won't be dazzled. They are equipped almost identically and it's hard to tell the two apart. This also means Model Y is comparatively small, so the optional third-row seat shouldn't be taken seriously except for children.

Even my Golden Retriever Tucker would find it too confining (and what! no window?) so this $3,000 option probably won't be a big seller.

Compared to the Jaguar I-PACE or the Audi e-tron, both arguably among the most exciting newcomers at the moment, Model Y looks a bit tame and sparsely appointed. That said, it also will cost considerably less with initial pricing for the first available Model Ys at $47,000 for the Long Range version (projected 300 mile range) and $60,000 for the Dual Motor Performance version (280 mile range). The $39,000 base model with a modest 230 mile indicated range won't be available until 2021—equivalent to geologic time in an increasingly crowded EV universe, especially if Tesla remains true to form and delivers it late.

One plus is that surely range will be substantially extended over the next two years versus today's still problematic limits.

By comparison, the Jaguar I-PACE starts at $69.5k for 234 mile range—but it's also luxuriously appointed, comparable to Tesla's still pricey Model X (base version now priced at $78.95k; 295 mile range).

Similarly, Audi e-tron starts at $74.8k, and offers multiple fast charging options with range still unpublished but likely exceeding 300 miles.

Importantly, the Jaguar I-PACE is available now in the US and Europe and the Audi e-tron may be reserved for $1,000 for delivery in late 2020-2021.

The difference is that Audi probably will deliver the e-tron on time as promised, if not earlier, while Telsa seems more likely to miss targets as it typically does due to its perpetual operating stress and continuing liquidity pressure—both exacerbated and often caused directly by Elon Musk's reckless management.

My sense is that Model Y may also be prohibitively dated before it materializes at scale in two years, joining Models 3, S, and X with fading popularity.

Back From the Future, There's Trouble Brewing at Home

With just two weeks left in the quarter, there's not much time for even the most heroic sales gimmicks to salvage Tesla's dismal sales performance so far.

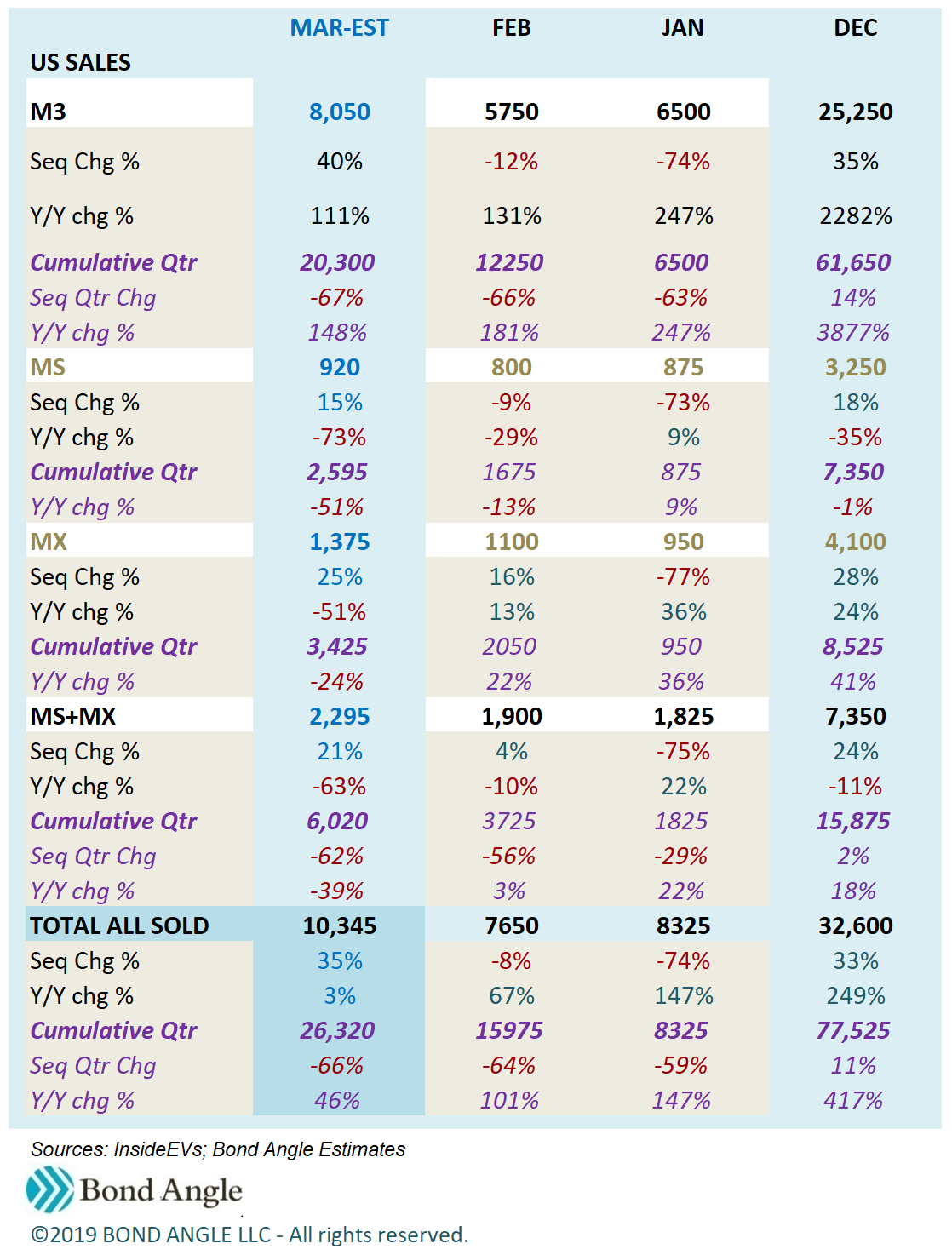

Total US sales of all models were down 64% through February versus the first two months of the fourth quarter to just 15,875 deliveries after monthly sales dropped 8% in February versus the 74% plunge in January.

As a result, even when I generously estimate a larger versus the typical third-month surge, this time for demand potentially spurred by dramatic price cuts plus the newly available $35k Model, deliveries for the US in the full quarter still are tracking as the weakest since the second quarter last year when they totaled 26,197:

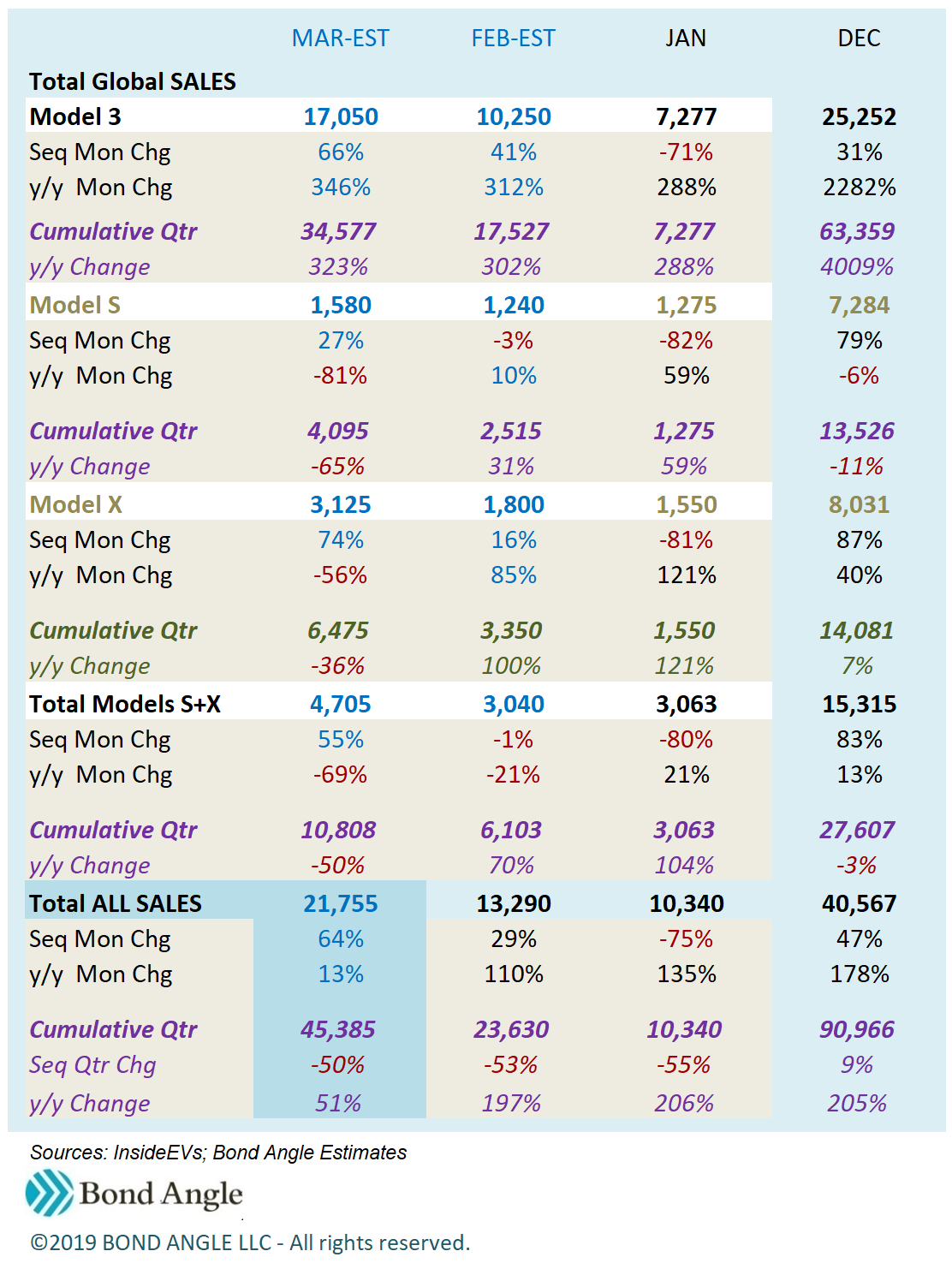

Traditionally the US has comprised more than 80% of Tesla's total sales, and the first two months generated some 2/3 of the quarter, but this quarter Tesla has deliberately focused on supplying its expansion into Europe and China with new markets for Model 3.

Signs are, however, that March demand trends remain tepid in the US. If so, I estimate that even with more encouraging results overseas, deliveries for the full quarter may decline 45-50% versus the December quarter, trailing even diminishing market consensus estimates.

If so, the low end of my estimated range could produce sales like this:

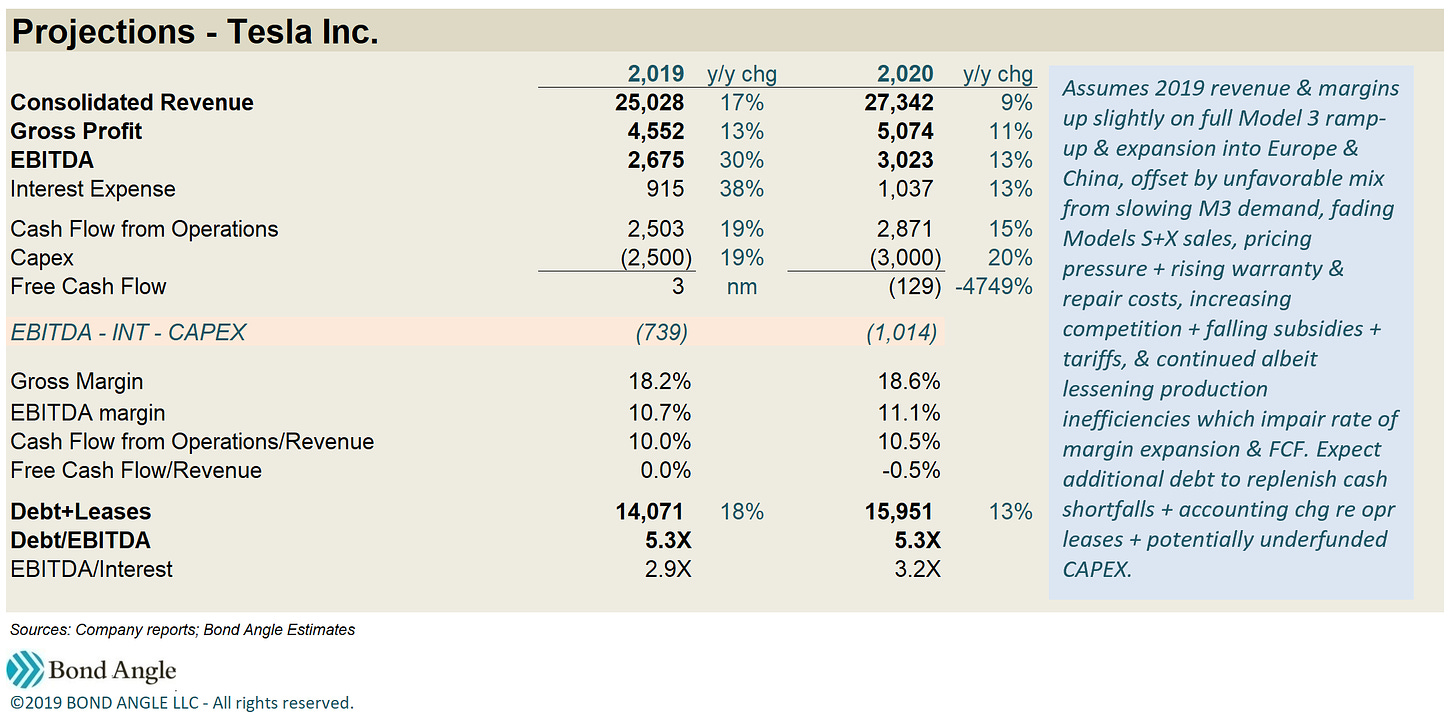

First quarter auto segment revenue also may decline 45-50% versus the fourth quarter on plunging deliveries and mix weakened by three price cuts already this year. This will be only partially offset by service revenue which has been increasing on escalating repairs (largely on pervasive problems with Model 3) which in turn also erodes already pressured profit margins that Tesla is attempting to salvage by slashing labor and overhead costs to the bone (even to the detriment of quality control which only perpetuates its problems). I estimate consolidated revenue for the first quarter at $4.15-4.47 billion (up 21-31% y/y but down 38-43% sequentially) and $420-470 million in EBITDA (10.2-10.5% margin), producing a net loss near $130-185 million versus $91 million net income in the fourth quarter and the $710 million loss last year.

If so, this indicates potentially $300-400 million consumed in operations before debt payments of at least $920 million to retire the convertible bond due March 1st—which evaporated Tesla's cash cushion.

It's no secret that Tesla has borrowed heavily for years to keep operations afloat as it ramped up now three models to mature production. However, this continued even in the second half of 2018 when Tesla reported positive free cash flow. The trouble is, as I detailed in my report Great Magic Trick Tesla; Now Do It Again, Tesla's core operations remained unprofitable and were not cash flow positive even in the "miracle" third quarter of 2018 without substantial boosts from accounting maneuvers and unusual items which persisted to juice fourth quarter results as well (see Tesla - Truth and Consequences).

In the meantime, Tesla's total debt (including capital leases) has steadily increased almost every quarter for the past five years, and was up $1.7 billion y/y at the end of 2018 to $11.971 billion even after paying off $440 million in debt due in the fourth quarter, keeping leverage uncomfortably high at 5.8x even with EBITDA for the year tripled to a record $2 billion.

Already Longing for the Good Old Days

The second half of 2018 also may have marked the peak in Tesla's commanding market strength, as signaled by now three price cuts so far this year which haven't reignited formally voracious demand as expected for the Model 3, much less the aging luxury Models S and X. Indeed, as I observed in Tesla's Plan B 2.0; Y Not, I expect the Model Y will likely replace Model 3 sales rather than augment total sales.

Tesla also faces strident competition from exciting rivals rolling out now and into the next year just as the market becomes bloated with new supply and global economic conditions stall.

There's a good chance Tesla may struggle the rest of the year to recover from this quarter. Indeed, it took months for Tesla to finally secure a loan from local Chinese banks as promised to fund its Shanghai factory (see Tesla: Shanghai Surprise).

Even then the wary bankers only agreed to $500 million in short-term, limited purpose financing, barely enough to get the factory up and running—much less versus the more than $2 billion it will cost to build out the factory even to half its projected 500,000 car annual capacity (although indications suggest demand may be far lower by the time the factory is completed).

Tesla then was able to convince its US bankers to chip in another $500 million to extend its available credit to about $750 million on its ABL facility, which already had a balance of $1.5 billion drawn as of December 31st. Another $1 billion is available on its nonrecourse warehouse line as leases increase.

This still isn't enough available credit to fund Tesla's negative cash flow plus construction and ramp-up of its Shanghai factory.

In the meantime, it could easily cost $2-3 billion in capex or more just over the next year to develop and launch the Model Y, the pickup, the semi, and the roadster—all of which Tesla has promised to roll out in 2020—as well as build out charging stations and customer service and repair centers as sorely needed. There's also another $1.3 billion in debt due by the end of this year and at least $1.88 billion due in 2020.

Just as Tesla is becoming an even more troubling credit risk for its banks as well as investors, losses are mounting and cash consumption is spiking in what is turning out to be a disastrous first quarter.

This is why, as I have suggested, that Tesla moved so urgently to slash pricing and headcount multiple times in the past two months, even blurting out a seemingly ill-conceived and poorly executed launch into an online-only sales model and initiating massive store closures (which it walked back almost immediately).

If Tesla seemed desperate, maybe that's because it is.

Cash was poised to drop to just $1.2 billion or less in the first quarter and to less than $700 million in the second quarter—before aggressive borrowing to fund cash shortfalls and refinance debt, which Tesla has done every quarter for years:

It's not enough. Tesla needs at least $6 billion in new cash to fund known capex and debt obligations through next year and, at present, it doesn't appear to have sufficient borrowing capacity or credible prospects for a sufficiently ample boost in free cash flow generation to accommodate its needs. My below-market estimates for 2019 remain little changed versus my December forecast (see Tesla: Down to the Wire), and my estimates for 2020 results also track well below even reduced market estimates:

See attached model for Bond Angle's historical and projected results.

My estimates indicate Tesla's debt may increase by nearly 20% this year, and by more than 10% next year if, obviously, Tesla's skittish bankers are persuaded to allow it. If they aren't so inclined, Tesla's pipeline and production deadlines are threatened—along with its revenue and profit potential.

If so, Tesla faces prickly options of delaying further its promised deliverables—which already has cost the company valuable market share as well as its edge as early market mover—or trying to issue new bonds and/or sell stock to raise capital while still under investigation by the SEC and the Department of Justice for potential misstatements of Model 3 production levels.

I expect:

Tesla will further delay the production ramp-up of its pipeline to at least 2021, not including Model Y which should be met with decent demand. This strategy helps preserve cash but also reduces Tesla's competitive position and growth and profit prospects amid an increasingly more challenging business cycle, and

Tesla will borrow significantly more debt, keeping leverage uncomfortably high for the foreseeable future.

Maintain “Underperform” on TSLA 5.3% Senior Notes due 2025, little changed at 87.2 (7.9% ytw; 546 bps). That’s a meager 103 bps of spread per turn of estimated leverage in 2019 on potentially increased borrowing to offset cash shortfalls—hardly adequate compensation for such a volatile issuer with such precarious prospects. Given Tesla's persistent uncertainty and escalating risks, we could see 3-5 points additional downside from here.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.