Tesla Take-Private Plan: Shoot First, Answer Questions Later (If at All)

Elon Musk's explanations generated more confusion than answers and set off more than a few alarms.

CEO Elon Musk revealed more details in an update on Monday about his grand scheme to buy back Tesla Inc. (TSLA) at $420 per share, an idea he lobbed out in a tweet last Tuesday.

But his explanations generated more confusion than answers and even set off more than a few alarms.

Musk admitted he doesn’t actually have “financing secured” as he claimed in that first bombshell tweet that put Telsa in play, which didn’t surprise me. But it turns out his take-private scheme is much further along than market skeptics, including me, expected—by nearly two years—with at least one apparently eager suitor Musk hadn’t even informed Tesla’s board about until a week or so ago. Indeed, Tesla’s board seems to be five steps behind Musk in the whole process.

This is not normal, kids. It smacks of Musk’s typical hubris, yes, but why the urgency to act now? By Musk’s assurances following recently released second quarter results, Tesla finally is on the brink of operating stability sufficient to generate its first-ever profit and positive cash flow over the next two quarters and beyond. If so, this should be the perfect time to ride the Tesla rocket to the moon—not sell.

It’s also possible—and more likely in my view—that Tesla still may be struggling with the torrid pace necessary to meet ambitious targets for dramatic and sustained improvement promised in revenue, profits, and cash flow, trouble which may already be obvious to management now midway through the third quarter. If so, Musk may already be chafing at the prospect of yet another round of market castigation which he believes is wholly distracting and counterproductive to his greater goals for the company.

Musk didn’t even keep Tesla’s board in the loop about his take-private announcement last week.

So we have entered new and potentially hazardous territory wherein a brilliant but famously petulant CEO who just revealed extraordinary secrets about his true intentions for the company could very possibly succeed in converting Tesla into a vehicle where he can be even more obscure.

As a result, deal or no deal I sense that risk has spiked considerably for Tesla’s bonds, particularly the flagship 5.3% senior notes due 2025 which I expect would be left outstanding in private Tesla. Unlike Tesla’s banks and equity holders, which actually can wield some power to affect Musk’s plans and attention, Tesla bondholders probably will just be along for the ride or the wreck with paltry protections at best.

Fiasco, Fast and Slow

Tesla’s turbulence has only escalated since last Tuesday when Musk set investors’ hair on fire with a cryptic tweet that said he is “considering taking Tesla private at $420. Funding secured.” His subsequent tweets fanned the flames; e.g.

“Shareholders could either sell at 420 or hold shares & go private “ and “My hope is *all* current investors remain with Tesla even if we’re private. Would create special purpose fund enabling anyone to stay with Tesla. Already do this with Fidelity’s SpaceX investment,” and “Investor support is confirmed. Only reason why this is not certain is that it’s contingent on a shareholder vote.”

To be clear, much of this is questionable, e.g. Fidelity responded that no such SPE exists related to its SpaceX investment, and investor support is hardly confirmed since this whole scheme has just come to light. Never mind, Musk already was in full marketing mode.

He hit closer to his motive with a public letter to employees titled “Taking Tesla Private” in which he explained how being publicly traded was a distraction for Tesla’s management and employees and counter-productive to the company’s long-term goals, mainly because of “enormous pressures” of meeting his ambitious guidance on a quarterly basis (with limited success, so far) and battling short-sellers and others with “perverse incentives” “to attack the company” and “try to harm what we’re all trying to achieve.”

So in a nutshell, Musk believes taking the company private will save it—and him—from the public glare of accountability so he and his employees can better focus on executing Tesla’s “long-term mission.” Except Tesla now is well into its second decade as a startup, it’s one of the most valuable—or at least most expensive—companies in the world with a market capitalization approaching $60 billion, and yet it still hasn’t generated a penny of cash or profit. And now just as Tesla supposedly is about to finally turn red ink into green Musk suddenly wants the company to slip back into comparative obscurity in the land of “no questions asked.”

But the market hung on “$420 per share.” Traders and analysts and reporters as well as SEC lawyers and Tesla’s board members and bankers spit coffee all over their desks and hit the phones. Reporters and analysts immediately began to flood the financial universe with volumes of discussion and reports dissecting the idea from every angle.

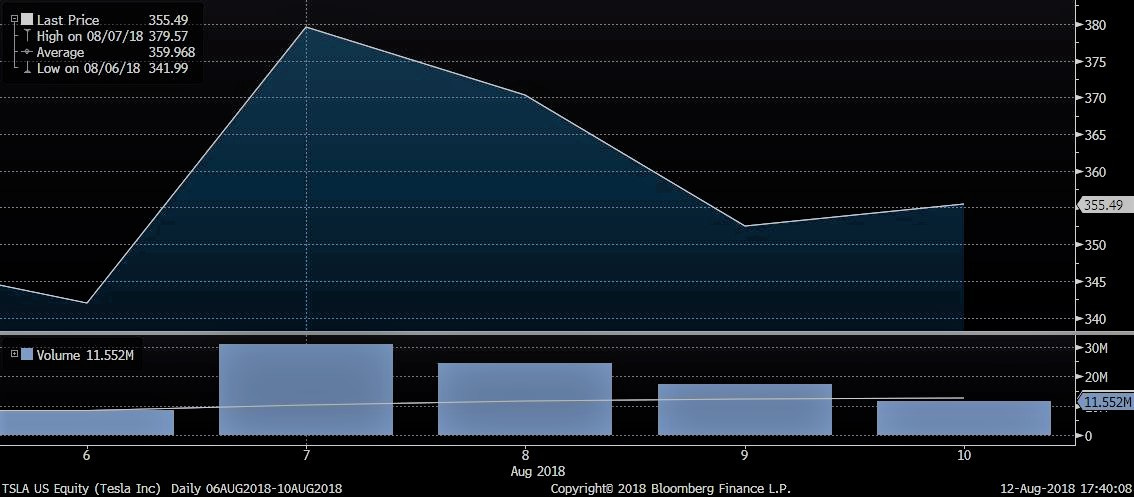

It was quite a stunt, one that generated a $12 billion swing in Tesla’s market cap as the stock spiked from $342 to $380 and back to $355 by Friday’s close, on the highest trading volume in four years, as investors struggled to make sense of Musk’s intentions and whether he can actually pull off what could be the largest take-private transaction ever at roughly $80 billion.

Who’s Minding the Store?

Tesla’s board, however, has been consistently three steps behind the action at every juncture. It was caught off guard by Musk’s bombshell tweet on Monday, and nearly 30 minutes ticked by before the company finally notified the exchanges to halt trading in Tesla stock “pending news.” There had been no mention of any take-private scheme in the company’s 10-Q filing the previous day, and as of this writing the company still hasn’t filed an associated 8-K as would be expected (though, remarkably, probably not required by the SEC).

The official public response from Tesla’s board didn’t come until Wednesday with a three-sentence statement confirming only that Musk “last week, opened a discussion” about “taking the company private,” saying:

“This included discussion as to how being private could better serve Tesla’s long-term interests, and also addressed the funding for this to occur. The board has met several times over the last week and is taking the appropriate next steps to evaluate this.”

This made it even less clear why the board was so completely unprepared to respond to the news if it had indeed been talking about the idea with Musk for more than a week. By Thursday, Tesla’s stock and bonds had mostly reversed heady gains from Tuesday as investors became wary of the dearth of concrete facts that should have materialized.

Was there a potential deal with known parties associated with Musk’s “funding secured?”

Why were no major investment banks aware of anything this big brewing?

Why was Tesla’s board so much in the dark about everything?

Not surprisingly the SEC was quick to initiate inquiries on concerns of potential failings by Musk and Tesla regarding full and timely disclosures and potential stock manipulation. Other questions took shape around Musk’s offline conversations with potentially significant parties.

But only after the market closed Thursday did news surface that Tesla’s board will hire advisors to evaluate Musk’s take-private plan and meet the next week to formalize its proper vetting and potential execution.

Sources told Bloomberg the board expects Musk to recuse himself from these discussions and will need to hire his own advisors.

Sure he will. Additional reporting Friday afternoon by Bloomberg said Musk and his advisors already are “seeking a wide pool of investors” to back his plan to take the company private “to avoid concentrating ownership among a few new large holders.” I also expect Musk will prefer investors that, like Tesla’s board, don’t offer much of a challenge to his leadership no matter what he does.

By late Monday night, Musk tweeted:

“I’m excited to work with Silver Lake and Goldman Sachs as financial advisors, plus Wachtell, Lipton, Rosen & Katz and Munger, Tolles & Olson as legal advisors, on the proposal to take Tesla private”

But then late Tuesday night Bloomberg reported Goldman and Silver Lake said they still actually have no signed deal with Musk.

Chalk this up as yet another troubling example where Musk seems to believe “feels true” is the same as “being true,” and characteristic of how ridiculously chaotic this whole episode has been from the start. It also demonstrates further action pushed forward without preparedness, as if events are being driven by a comparatively sudden and mysterious urgency.

Especially since Musk has been talking with potential investors about taking Tesla private for nearly two years.

Q’s in Charge, Not Captain Picard

Less than an hour before Musk fired off his bombshell tweet on Tuesday The Financial Times reported that Saudi Arabia Public Investment Fund has built up a $2 billion stake in Tesla “this year.” This places it among Tesla’s largest stockholders following Musk—the top holder with a 20% stake.

Coincidence? Nope. Musk admitted in his Monday “update” that Saudi PIF has approached him “multiple times about taking Tesla private” starting in “the beginning of 2017,” with the aim of diversifying its investment concentration in oil. Musk claims they have met a number of times since then. Reports Monday night confirmed that Saudi PIF remains even more committed to being part of “any investment pool that emerges to take Tesla private.”

This revealed considerably more interest versus reports which surfaced last week indicating only that Musk had discussed his take-private plan with Saudi PIF. Another report over the weekend said Saudi PIF wouldn’t consider getting involved with such a plan without “seeking guidance first from Softbank.”

That’s Japan’s massive Softbank Group Corp (Adr) (SFTBY US), which is very interesting since Musk reportedly also approached SoftBank about taking Tesla private last December. Those talks are said to have stalled over disagreements about Musk’s continuing control in the resulting entity.

Musk may have addressed that sticking point by pledging to hold his controlling interest near 20%. In any case, he reported Monday that his last meeting with Saudi PIF was July 31st, and whatever was concluded prompted Musk to advise the board on August 2nd that he wanted to take the company private and his number was $420 per share—a 20% premium to the last trade.

Musk admitted that Saudi PIF’s enthusiasm plus its obvious wealth convinced him he had “funding secured” for whatever take-private plan emerged—even though being true and feeling true are not the same thing and shouldn’t be publicly promoted as such (no doubt he and the SEC will have such a chuckle over that later).

And speaking of the SEC, I suspect they might find it problematic that Musk made five separate stock purchases since early 2017 during periods when he said he was meeting with Saudi PIF about taking Tesla private, including three in May and June of this year when Saudi PIF also was quietly building its stake with the specific intent to promote the scheme to fruition. Awkward.

About That Fine Print…

With Tesla now officially in play, Musk seems to be trying to minimize any disruption to Tesla’s capital structure and control dynamics (particularly anything that would diminish his dominant control). This is by far the least expensive outcome since it could greatly reduce funding necessary to execute the plan. Also important, this would avoid a change-of-control event that could trigger a potential repurchase of $1.8 billion in Tesla’s 5.3% senior notes due 2025—which I believe will be a primary goal in the take-out plan.

The 5.3% notes were heavily oversubscribed when issued about this time last year at a meager 320 bps spread, despite sporting a triple “C” credit quality rating which reflected Tesla’s rapidly escalating debt on persistently negative EBITDA, its continued prospects for significant operating pressures, and laughably weak covenant “protection” afforded bondholders. They have traded at increasingly hefty discounts ever since and were last seen near 90.9—up a couple of points on the take-private speculation. That’s still a paltry 401 bps spread; 6.9% ytw, only 50-60 bps wide of average high yield cash bonds, which frankly is astonishing given Tesla’s atrocious credit metrics with negative EBITDA and significant cash consumption versus a whopping $10 billion in total debt. The bonds could easily drop 3-5 points if Tesla’s operating performance falters, which could happen before any take-private deal materializes.

It’s hardly likely Tesla could get a better deal now if it tried to refinance the notes, and leaving them in place greatly reduces funding needs for the buyout.

A private Tesla presents potentially substantial risks for the 5.3% bondholders if, as I expect, the notes are left outstanding:

· Starting with even more severe difficulty in trading. That no doubt will worsen as other unfavorable realities materialize such as a likely slump in publicly available information—a huge problem if Tesla’s operations continue to struggle as I suspect. We also already know that Musk plans to add debt via a prospective $500 million loan he hopes to get from China to help fund the construction of Tesla's Gigafactory there.

· Let’s not forget we also are dealing with a CEO who is taking his company private so he never again has to answer to reporters or market analysts. He certainly wouldn’t be the first CEO to ignore interests or concerns from bondholders. I recall that top management at the former Valeant Pharmaceuticals (VRX) ignored bondholders for more than six months in 2016 when it fell into technical default for failing to file financial statements as required by the SEC, even though it kept talking to its bankers and even equity market analysts on a fairly regular basis.

· So obviously any curtailing of information flow is a substantial impairment for investors in a troubled company, and remember Tesla’s 5.3% notes are classified as 144A which by design have limited trading restrictions and nominal reporting requirements. The 5.3% note indenture requires Tesla to continue to file SEC reports, but only as long as Tesla remains registered with the SEC. I recall companies (e.g Landry’s Inc.) that withdrew regular reporting on outstanding bonds after the company withdrew SEC registration upon converting to private status.

· Severe illiquidity and limited information about the company’s performance, financial condition, and prospects are bad enough, and likely to trigger further credit quality downgrades, but there’s even more to worry about if Tesla’s prospects go south.

· The 5.3% notes are unsecured and so have zero claims to assets and likely poor residual asset coverage at best if Tesla founders. This leaves holders with virtually no bargaining power to address any problems.

· By comparison, I’m sure Tesla’s banks will require revisions in all existing credit facilities to tighten up their protective covenants and claims to vital assets, preserve as much cash as possible, and create an ample as possible margin of safety to strengthen their claims.

· For example, Tesla’s banks might insist on prescribed minimum limits for available liquidity in amended credit facilities, and so could have the power to block payment of interest on the notes to preserve cash if Tesla’s liquidity falls uncomfortably short.

· Look out for the distressed scenario. While most critics who expect Tesla to fail predict bankruptcy as inevitable, a more logical outcome in a distressed scenario is that Tesla's banks and dominant equity stakeholders band together to squeeze bondholders; e.g. “invite” unsecured bondholders (who have zero bargaining power and likely no meaningful asset coverage remaining for the bonds) to accept pennies on the dollar in a distressed debt exchange to preserve cash and better ensure Tesla’s survival. This bolsters the banks’ superior claims while reducing total debt and preserving equity, and throws bondholders under the bus—win, win, ouch!

I see a more simple resolution for Tesla’s roughly $2.6 billion in convertible notes, mainly because they’re problematic whether Tesla goes private or not and need to be dealt with anyway. For one thing, there is a “fundamental change” clause that requires the converts to be repurchased at par with cash, and a take-private event clearly qualifies. But while we wait to see if a take-private deal takes shape, $1.3 billion in convertible notes mature between now and the first quarter of 2019—no more than seven months from now.

That signals a serious potential drain on Tesla’s available cash, already down another $430 million in the second quarter to $2.24 billion. Cash could be further reduced if Tesla fails to neutralize its hefty consumption in operations as it has projected for the second half of this year. And with a take-private deal in the works, I doubt Tesla’s banks will be keen on the company draining what’s left of its $1.2 billion in available credit either. I imagine the best solution for Tesla will be to persuade most if not all holders of its convertible debt to accept stock in private Tesla. In that case, dilution would be comparatively nominal and it would knock off nearly a third of Tesla’s massive debt load.

We all understand that Musk really, really hates being criticized, and he certainly has drawn a lion's share of it over the years (though he's also adept at creating much of the controversy perennially surrounding him). He may also feel that what he may see as heroic efforts to meet Tesla's increasingly difficult hurdles have not been appropriately appreciated (tent production assembly facilities, for example).

Fair enough.

But I suspect Musk hates being wrong even worse, and his biggest miss ever could be just ahead. If so, he could be experiencing severe performance anxiety ahead of missed guidance, again, if Tesla’s operations continue to underperform as I suspect. If so, potentially dramatic liquidity pressure on heavier than expected cash consumption in operations could crash into hefty near-term debt maturities versus evaporating cash, creating Tesla's biggest and most damaging crisis of confidence with investors.

Make It So

Nevertheless, I think odds are better that Musk can pull this off. Tesla has been a powerfully polarizing market darling for years, and I don't see that changing anytime soon given plenty of investible cash on the sidelines and the market so keen to be there for its long-awaited pivot to profitability. Love it or hate it, Tesla is still a hot stock. And remember, even bond investors couldn't get enough of Tesla's new notes, which were heavily oversubscribed despite their low-junk ratings, skinny yields, and dismal covenant protection versus limited upside at best—bonds that have traded up on the take-private speculation.

Musk believes, ideally, that 2/3 of existing shareholders will roll into private Tesla, including his own 20% stake. It’s less clear how many of Tesla’s top 10 holders after Musk, which control 49.8% of the outstanding shares, will be able to stay in even if they want to. Musk’s charisma won’t be enough to offset internal policies mutual funds and other holders may have regarding holding restricted equity. Some of Tesla’s top 10 equity holders (after Musk) are obviously more committed than others, and some also hold a meaningful position in Tesla’s bonds.

It’s likely Musk can succeed if he can preserve a simple majority of existing shareholders to avoid a “change of control” event, and there’s even a fair chance he gets a controlling block near 60%. If so, he may only need to lock in $30-40 billion in funding (with actual agreements, not optimistic tweets) to take out the rest of Tesla stock at his $420 per share price.

That's still a challenge, but not unmanageable especially if Musk can attract additional interest from other sovereign wealth funds which, as shown in the chart below, could easily match or exceed Saudi PIF's $2 billion investment as pocket change. Investment banks and private equity funds are also logical alternatives, though they tend to want control and a clear exit path after 3-5 years—which doesn't seem to align with Musk's grand plan.

SoftBank, for example, has invested heavily in self-driving Cruise technology developed by General Motors Co (GM US), as well as burgeoning ridesharing players Uber Technologies (0084207D US), DiDi Chuxing Inc., and Grab. Yet SoftBank reportedly already waved off investing in Tesla over concerns about Musk's control and the company's already pricey valuation as well as concerns about its flagging operating performance as the segment becomes ever more competitive.

These concerns aren't going away; indeed they will escalate rapidly if Tesla continues to miss critical performance targets, and that may be revealed as soon as third-quarter results which will be reported near the end of October. That means Musk's plan to fast-track to the finish line with fewer but larger investors can backfire if too many big names decide fairly quickly they don't want to play. His work is cut out for him—I estimate Musk may need to attract a fresh pool of 10-20 large investors to fill the gap.

Even then, it likely will take months for this drama to play out. Headline risk likely will be acute as big names surface and disappear as potential key parties, and supposedly “certain” deal terms leak and evaporate. All this will be helmed by Musk, a notoriously unreliable narrator, and Tesla’s feckless board.

General market enthusiasm for the deal may even be enough to overshadow potentially disappointing third quarter results, since taking Tesla private has locked in attractive upside, so far. However, if Tesla fails to produce the dramatic turnaround it has promised, and I expect it will fail to do so, such goodwill and expectations for completion of any take-out plan could very well evaporate if disappointing fourth-quarter results are reported next February.

This creates a 6-7-month window.

Be Careful What You Wish For

At this point, I see odds better than 50/50 that Musk may succeed in his dream to take Tesla private. It’s also possible that Musk is proven exactly right and that newly won freedom for the company to achieve and execute without the dark overhang of ongoing public accountability will in fact lovingly nurture Tesla into the spectacular success it was always meant to be, eventually.

It’s also possible that Tesla’s rivals might sprint ahead in the meantime while it regroups, while Musk becomes less adherent to production targets, while he devotes more attention to a myriad of Tesla and other pursuits, diverting precious resources Tesla needs now more than ever. Further stalls or limitations in production, worsened by liquidity restraints, could impair Tesla’s sales momentum and market cachet with customers increasingly less interested in waiting indefinitely for delivery (which may already be happening given the sharply increased warranty costs for rising defects and failures in later models).And private Tesla will have to compete ever more aggressively for funding versus an increasingly crowded field when it is also no longer the newest or most exciting shiny object out there.

After all, Tesla’s rivals, many of which are far better capitalized with mature operations, show no signs of slowing down.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.