Twitter: Take the Money And Run

Twitter has accepted Elon Musk’s hostile $54.20 bid. Now they have to sell billions in pricey & yet likely still underpriced bonds vs already weak ops & truly ugly PF credit quality & dicey prospects.

Well now, he actually did it. Elon Musk convinced Twitter (TWTR) in a matter of days to accept his lowball hostile bid to take the company private at $54.20 per share, surprising doubters like me who were skeptical he actually was serious and not just a bored mega billionaire looking for laughs (see Elon Buying Twitter? Probably Not).

After all, Musk says he is saving the “future of civilization” by making Twitter the platform for free speech around the globe, and all that. Hopefully without shutting down Twitter’s public relations department in the process like he did at Tesla (TSLA) two years ago so he could ignore questions and feedback and criticism from journalists and regulators and pretty much anybody he doesn’t like—as one does as the proclaimed bastion for freedom of speech (see Elon Buying Twitter? Probably Not).

We’ll see. Meanwhile, it’s less clear that Musk “won” Twitter, since no other bidder stepped up to top his $54.20, which was down 26% versus the stock peak last year. Twitter stock still was trading well below that at $51.20 as of Monday’s close—up less than $3 on news of the deal. On Tuesday the stock slumped back below $50.

For good reason. Deal terms revealed so far leave out important detail about where Musk will or even if he will get all the cash he needs to close the deal at some still undetermined date, subject to shareholder approval. And if the deal does close, Twitter’s already strained financial condition will be crushed under billions of expensive new debt its operations can’t afford to service.

No wonder Twitter’s existing bonds have traded lower as the drama has played out—even before the severe credit quality rating downgrades I have warned clients to expect.

Careful what you wish for, Elon

Twitter finished its best year ever in 2021 with revenue up 37% to $5.1 billion. It still reported a net loss of $221 million. Indeed, Twitter has yet to match profitability it managed in 2018-2019 despite almost doubling revenue.

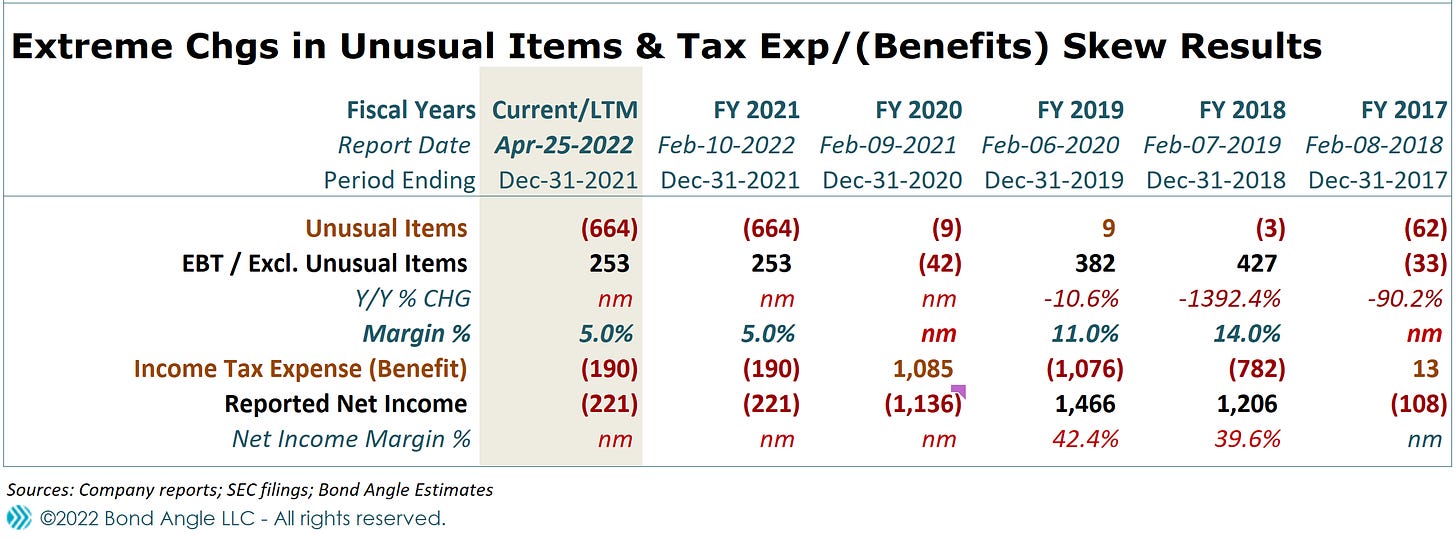

This becomes clearer when I focus on pretax income, unusual items, and drastic swings in tax expense every year:

Note that 2021 pretax margin, excluding unusual items, has only recovered to 5% of revenue, down from more than 2-3x that in 2018-2019. Note also that 2018 was significantly more profitable versus 2019 at the pretax level, which was then skewed by non-comparable tax benefits.

Normalized net income actually declined 11% in 2019 to $238.4 million (6.9% of revenue; down 190 bps). That’s still far better versus 2021, when net income as similarly adjusted remained weak at $158.1 million, just 3.1% of revenue.

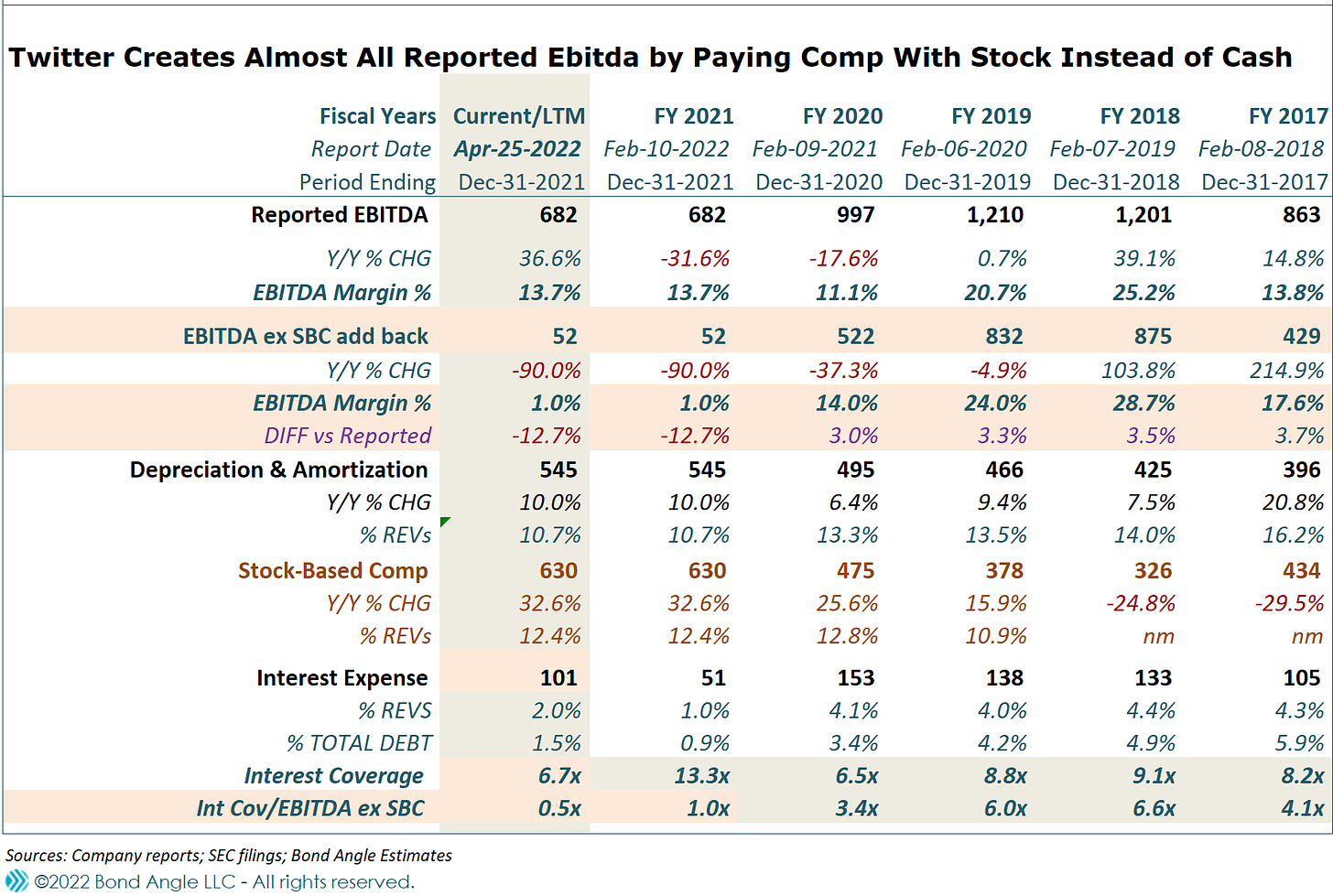

EBITDA is even more problematic, mainly is because Twitter pays out a substantial amount of compensation in stock instead of cash. Then it adds back that stock-based compensation expense when calculating reported EBITDA.

Not only does this juice reported EBITDA, it also nets Twitter substantial tax breaks which boost its reported profits—and whittle reported losses.

This dramatically misrepresents Twitter’s operating costs and profitability. Stock-based comp was 12.4% of revenue in 2021, nearly as high as 13.7% margin for the resulting reported EBITDA it mostly created. SBC was higher than depreciation expense—another noncash expense that also gets added back to reported net income to get EBITDA.

EBITDA plunges every year when I strip out the stock-based comp add back, and became barely positive without that boost despite strong revenue growth. In 2021 SBC accounted for almost all EBITDA reported.

When I added the annual interest expense for the new $1 billion in 5% senior unsecured notes sold a couple of months ago pro forma interest coverage dropped from 1x on unvarnished EBITDA (ex SBC) to 0.5x. Meaning Twitter can not afford to service its debt if it actually paid that compensation in cash instead of stock.

So what will happen when Twitter goes private and its stock is withdrawn from public trading? Private stock the receiver can’t easily sell or even value is dramatically less appealing—no matter how much Twitter needs it to plug the bottom line.

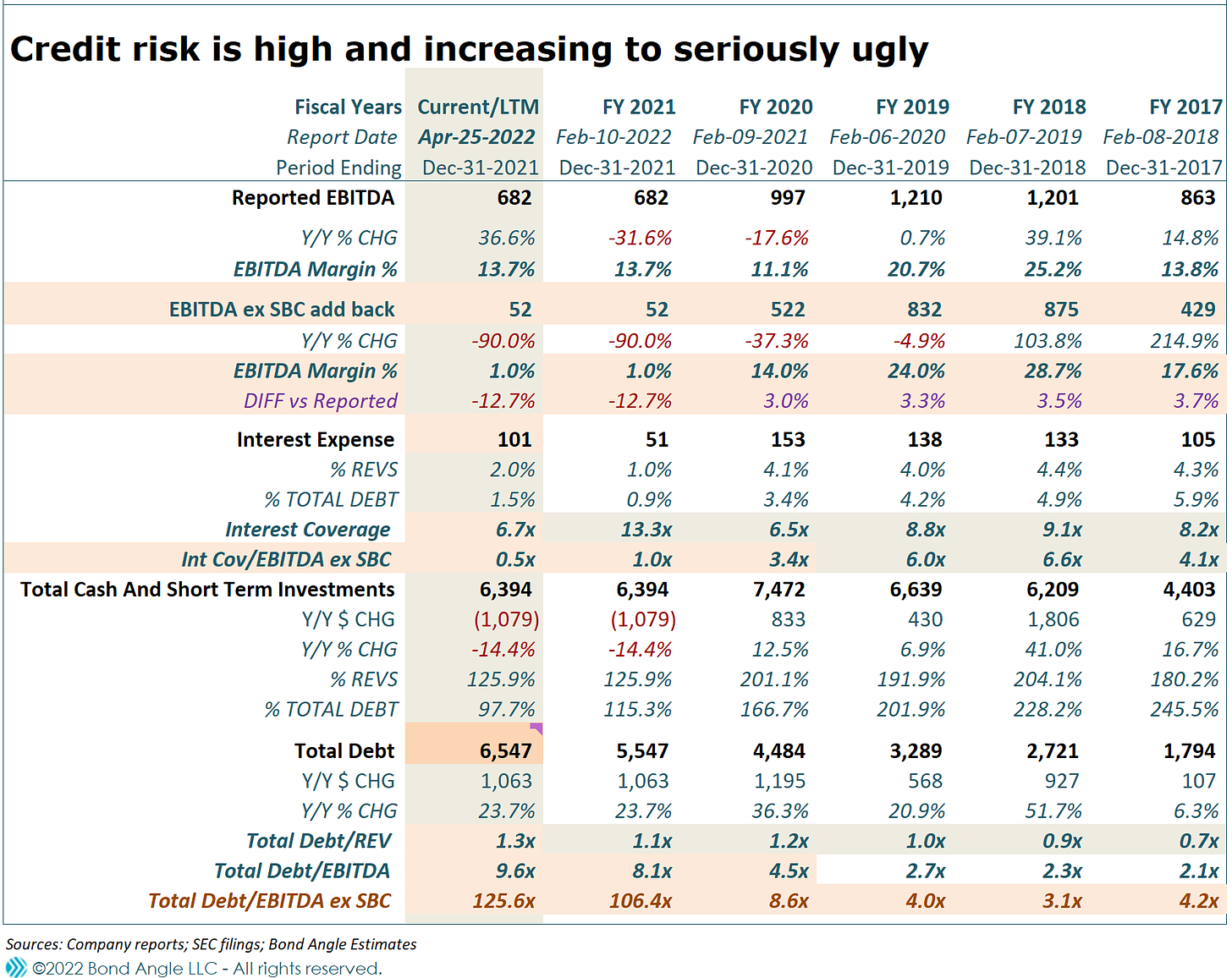

This plus Twitter’s already high and worsening leverage is enough to draw a credit quality downgrade on its debt right now, even before the expensive LBO kicks in.

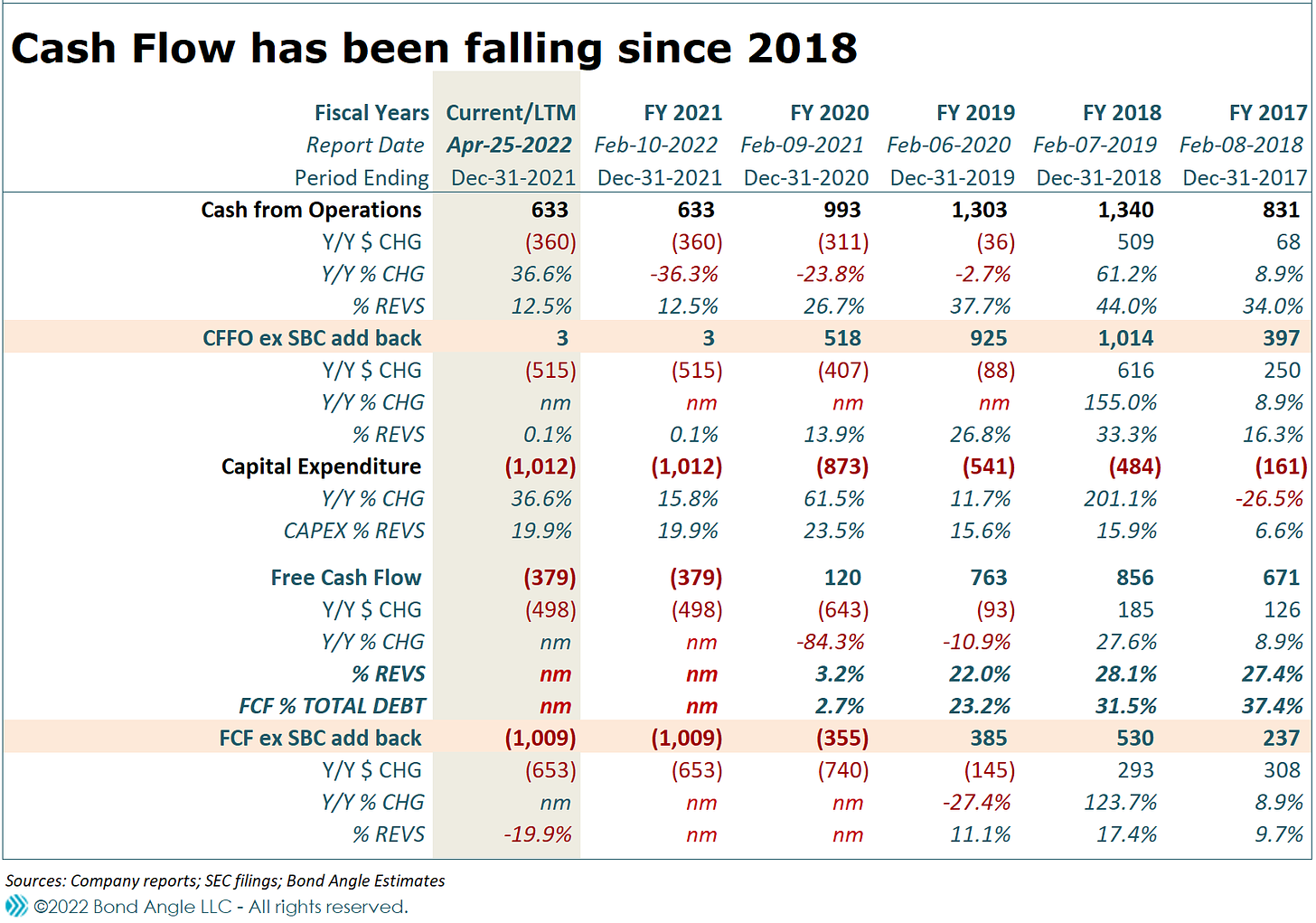

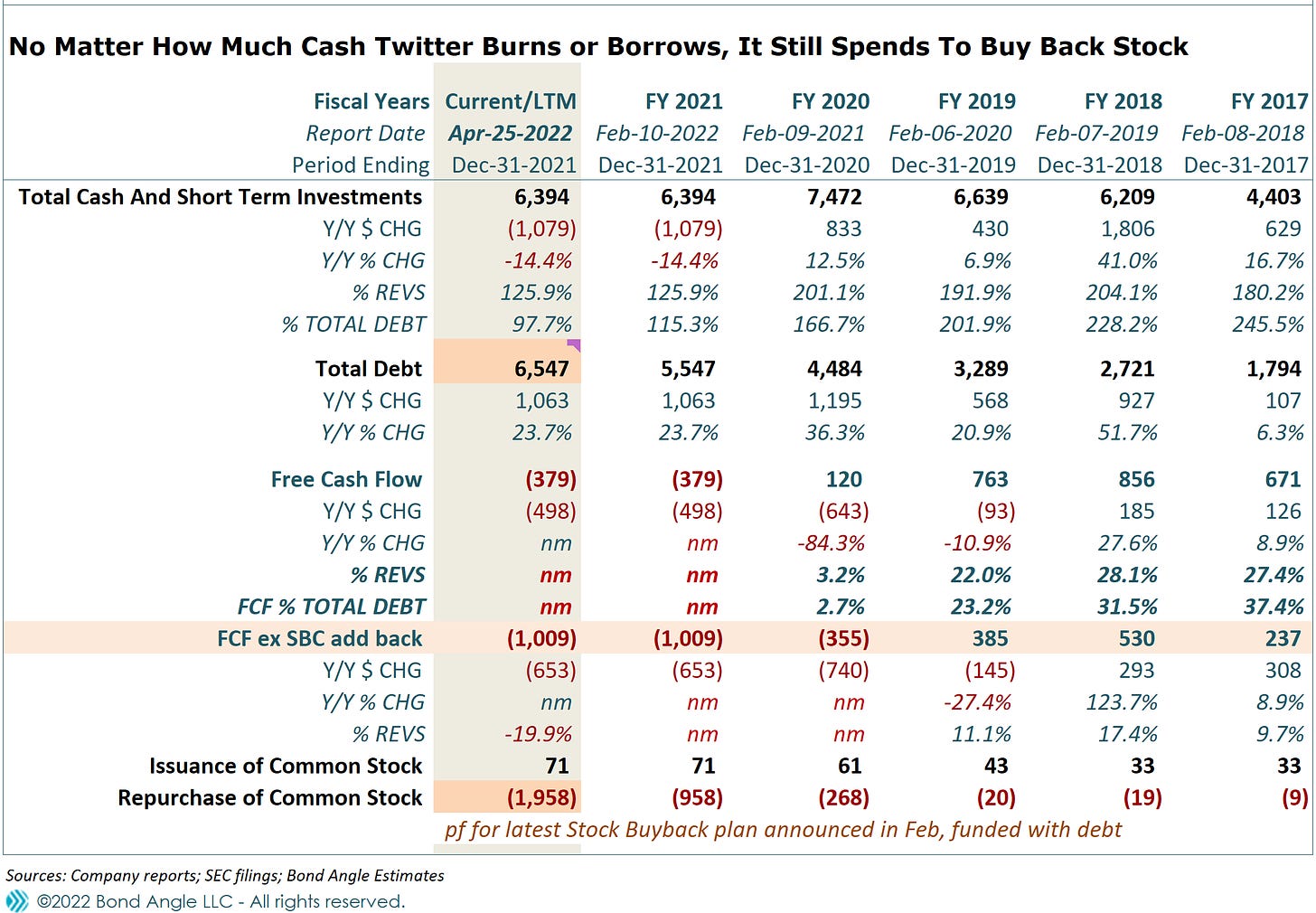

Cash flow generation has been under even greater strain, with reported cash from operations down significantly every year since the 2018 peak. Meanwhile, CAPEX has grown every year by an even faster rate and burning cash. Free cash flow (CFFO less CAPEX) dried up accordingly, and Twitter consumed nearly $400 million in 2021.

When I again stripped out the SBC add-back, it’s apparent that Twitter hasn’t been able to finance its operation with cash since 2019. Twitter has borrowed every year to plug cash and cover the shortfall, driving debt steadily higher to a level which it now can’t afford—before it layers on massive LBO debt from Elon Musk’s buyout.

But does Twitter worry? Nope. Burn a little cash, burn a lot. Twitter has been papering the walls with stock buybacks to boost EPS and appease grouchy stockholders. Note that with its latest $1 billion stock buyback plan, announced in February, Twitter may possibly burn another $1 billion in cash on top of the $1 billion in bonds it just borrowed.

It gets worse. The pace of revenue slowed markedly, and margins shrank further, and in the last two quarters of 2021. Twitter burned nearly $700 million in the second half of the year, with more than $1 billion consumed when I stripped out $340 million in SBC added back.

It’s a troubling trend I expect will continue whether the company is sold or not, starting with what I expect will be disappointing earnings for the first quarter of 2022 which are due out this week.

No Wonder Twitter Was Suddenly Happy To Sell To Elon

There’s plenty of discussion about how problematic it will be for Twitter dealing with Elon Musk as an owner and a boss and a person, including from me (Elon Buying Twitter? Probably Not) and in my extensive coverage on Tesla (as in my recent Dear Elon: There's Nothing Funny About Hitler).

The short version: Twitter is a mess, and Elon doesn’t solve chaos—he brings it. So if the deal goes through, which is not yet certain, I expect an exodus of talent. Smart, innovative, creative, efficient creatures tend to work poorly with fractious, needy, truth-challenged autocrats like Elon.

This is very bad timing since Twitter literally is at ground-zero of some of the most urgent questions today relating to social behavior, appropriate speech and its oversight, corporate versus government versus individual rights and obligations—all of which are areas where Elon has fallen tragically short. Many times on Twitter (again, see Dear Elon: There's Nothing Funny About Hitler).

It’s not clear to me what consequential improvements he actually will bring to Twitter that will turn on the money machine and offset all the problems he will bring as Twitter also tries work out of the pit it’s been digging.

Even his best game still just has him well into the bottom half of the top Twitter accounts. And he really tries hard to grow more fans, the best way this 50-year old man knows how.

So, other than his “funny” tweets, his best idea to grow Twitter is…grow ads? Already trying that. Make it subscription based? Also suggested but troubling since it could just as easily kill Twitter. Twitter’s problem has long been that its most engaged patrons also don’t want to part with money.

Bring back toxic characters like Donald Trump? Sure, though that would evaporate the effort Twitter put forth to reduce online harassment, disinformation, bullying, and toxic speech. Childish insults, lies, committing crimes, racism, misogyny, and hate mongering sells. And Elon’s surely done all of that himself. On Twitter. But Trump already said he’s not coming back to Twitter, unless he’s just a lying liar.

Meanwhile, I do expect Twitter’s legal jeopardy to spike as it has at Tesla as Elon operates at least as recklessly as he does with Tesla—except in China where he’s downright obsequious because China is Tesla’s most important market by far (see Forget Elon's Twitter Spatter. Tesla's Got Trouble In China) and he knows the CCP won’t put up with his nonsense. Period. (see Notice How Tesla Behaves So Much Better For China Than The US?).

Elon might introduce a new risk for Twitter not shared by its social media peers by boasting loud and often that Twitter will not restrain free speech on his watch. His free speech mantra could become a trap, for example, when Twitter must confront some truly egregious content at some point, as it inevitably will. And just in case, Brussels has already warned Elon that “Twitter must comply with the EU’s new digital rules under his ownership, or risk hefty fines or even a ban, setting the stage for a global regulatory battle over the future of the social media platform.”

Not that Elon’s been restrained at all, so far. He was convicted of securities fraud for his Twitter posts. He’s been especially vulgar to people and government authorities on Twitter. He’s invoked Hitler insults at his enemies on Twitter. So his complaints seem more like meat for the mob.

Twitter and potential bond buyers it will need have more than Elon to worry about with the LBO.

Bond Buyers Beware

Preliminary terms of the roughly $46.5 billion financing package were filed last week:

A commitment letter from the bank syndicate offering to provide $13 billion in debt:

a) a senior secured term loan facility in an aggregate principal amount of $6.5 billion,

(b) a senior secured revolving facility in an aggregate committed amount of $500 million,

(c) a senior secured bridge loan facility in an aggregate principal amount of up to $3 billion and

d) a senior unsecured bridge loan facility in an aggregate principal amount of up to $3 billion ((a) – (d) collectively, the “Debt Facilities”)A commitment to provide a margin loan to Elon for up to $12.5 billion, backed by some 64 million of his Tesla shares (roughly a third of his total stake) worth more than $60 billion, so a 5-1 ratio of collateral to loan was required to borrow his own money.

A commitment by Elon to somehow come up with the remaining $21 billion due, from somewhere, sometime before the deal closes.

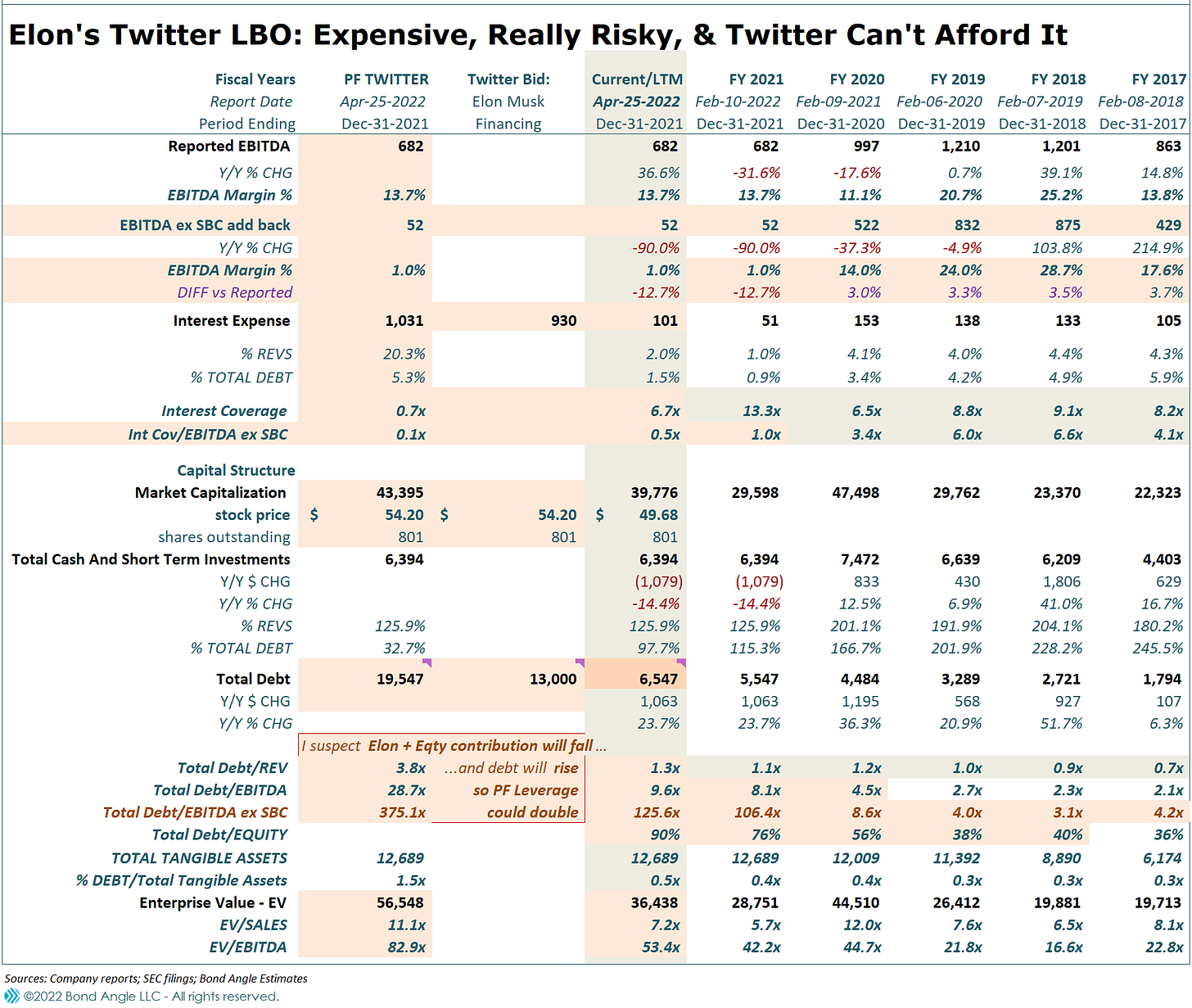

Super. Here’s how scary that already looks:

The debt piled on here, $13 billion on top of more than $6.5 billion as of the first quarter, absolutely crushes Twitter’s already stressed financial condition and credit quality. Indicated pro forma leverage could jump to near 30x:

That sonic boom you hear will be Moody’s and Standard & Poor’s dropping their ratings on Twitter’s debt several notches to potentially “triple C”.

If so, that boosts prospective interest rates on the new bonds to perhaps 8-12% in order to entice investors to buy.

Which will increase already untenable interest costs so high that even reported EBITDA doesn’t cover.

That’s not all. Elon has substantial flexibility indicated and lots of time to haggle. I suspect his cash contribution via the margin loan will shrink over time, perhaps substantially, especially if I am right about Tesla’s troubled prospects this year and Tesla stock falls precipitously, which can’t be ruled out.

I expect similar reductions could happen to the vaguely sourced $21 billion.

If one or both are true, I expect that the shortfalls will be plugged into the debt package and dumped on bond buyers.

And the final and perhaps most ominous risk I see that could prove to be the most shocking is that Twitter could elect to withhold SEC registration on all its bonds after the deal closes and the public stock is gone.

This would eliminate the requirement for timely financial reports prepared and filed publicly according to SEC reporting standards designed to protect investors. Elon would just love this.

Investors would be stuck with unregistered bonds, which would crash bond pricing and virtually eliminate investors’ ability to easily and accurately value the bonds—much less trade them.

My Twitter LBO Is So Ugly Even My Dog Won’t Play With It

Twitter looks best from a distance. The idea of Twitter seems even better. Owning Twitter is far less fun.

I still doubt that Elon put much time in effort into buying Twitter until after he let the idea fly. Elon is more about the fun. If so, the more he gets into the weeds of the deal the greater the chance that he sours on it. The best case for him, and his ego, is that he goes through with the deal, but only after greatly reducing his overall financial risk. There’s still a good chance he finds an excuse to leave in a huff without paying the check—but better to leave with a bruised ego and keep his most of his fortune.

Twitter is less damaged if Elon doesn’t buy it, but it’s still is big trouble.

This is what Elon Musk just bought. So, is he really a winner, as his fans are celebrating? Or is he a bag holder?

We’re going to find out. Stay tuned.

Twitter’s 3.875% senior notes due 2027 were seen trading at 99.5 (3.72% ytw) and the new 5% senior notes due 2030 were seen at 96.1 (5.7% ytw). I rate both as Underperform.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.

As I projected in "Twitter: Take the Money And Run" (https://bit.ly/3kgAMgf), Elon is already trying to whittle his expensive personal contribution and substantial risk in financing his dicey $TWTR deal by soliciting other people's money: https://twitter.com/VickiBryanBondA/status/1521199694730469377

Me to @lopezlinette at Business insider:

"Elon didn't so much win Twitter," Vicki Bryan, a credit analyst and CEO of research firm Bond Angle, told Insider. "He may be the bag holder who gets the company no one else wanted to buy, and is much weaker than reported numbers and market pricing suggest."

See why I think so in "Twitter: Take the Money And Run."

Read the the Business Insider story:

https://www.businessinsider.com/elon-musk-twitter-takeover-money-sucking-quagmire-tesla-spacex-debt-2022-4?utmSource=twitter&utmContent=referral&utmTerm=topbar&referrer=twitter