What Really Happened to Tesla's latest Ex-CFO?

Tesla's Q3 10-Q reveals CFO Zach Kirkhorn was fired. It also made Kirkhorn reveal any whistleblower efforts, threatened him if he talks—then declare Tesla broke no laws. Is Tesla setting up ex-CFO?

Tesla’s (TSLA 0.00%↑) sudden replacement in early August of CFO Zach Kirkhorn was terse, spare, and unexplained—never a good sign with a significant management shake-up.

This left people to wonder why the apparently well-regarded Kirkhorn would, after thirteen years with the company, including the last four as CFO, abruptly “step down” as Tesla reported with no clear path forward.

That was hard to accept given how invaluable Kirkhorn has been described to be in keeping Tesla’s operations on track despite Elon Musk’s volatile incompetence.

I have detailed many times over the years how Elon Musk is a terrible manager and even worse boss (see, for example, my report Dear Elon: There's Nothing Funny About Hitler, 2/17/22, my story in Business Insider, “Elon Musk gambled big on Twitter. Tesla is going to pay the price,” 12/5/22, and my report Elon Musk Doesn't Want You To Get Too Attached To Twitter's New CEO, 6/15/23).

Kirkhorn, by comparison, has long proved to be extremely capable of getting impressive results without abusing the talent. Tesla’s board even considered him as a potential successor to Musk. The Wall Street Journal wrote a gushing tribute on Kirkhorn only five months ago titled, “The Executive Who Keeps Tesla Rolling Isn’t Elon Musk.”

I had expected that poorly concealed truth to trigger the prickly, thin-skinned Musk to fire Kirkhorn out of sheer jealousy. But several months and a strong second quarter ticked by and Kirkhorn seemed safe.

Until he wasn’t.

The timing of his departure in early August seemed precarious. Kirkhorn had just closed days earlier on Tesla’s record-sized $2.5 billion sale of bonds backed by auto leases, which the company pursued despite having to pay substantially higher rates of 5.7-6.6% for 3-yr paper amid unfavorable market conditions. We now know from Tesla’s Q3 10-Q that it needed that cash to replenish the sharp drop in ytd cash from operations as Tesla’s profits and cash flow dropped sharply in the third quarter on disappointing sales that trailed market expectations—a problem that’s not going away (see Tesla's Problem is Fading Demand, Not Disruptive Factory "Updates", 10/4/23).

The cash raise occurred the same week Reuter’s revealed how Tesla lied about driving range estimates on all its cars and then schemed to divert customers who complained. The report added to a burgeoning body comprising years of similar complaints (including by me) to trigger another of several wide-ranging federal investigations.

The Reuter’s report landed the same time Elon Musk decided to rename his chronically failing but strongly branded Twitter platform as “X”, as if all his other bone-headed actions weren’t killing it fast enough already (see Elon Musk's Latest X-ceptionally Bad Idea, 7/26/23).

This came not long after a US Senator raised concerns with the SEC about Elon Musk’s “conflicts of interest, misappropriation of corporate assets, and other negative impacts to Tesla shareholders” such as reportedly misappropriating cash and assets from his companies for his own personal pursuits. The latest example was the outlandish glass house to be built as his personal residence by Musk with Tesla cash in the middle of a lake at Tesla’s Austin Plant (which triggered another federal investigation).

If so, it wouldn’t be the first time. I’ve warned since 2019 about Elon Musk’s “propensity to treat his companies like his own personal slush funds” (see Elon Is "Saving" Twitter To Death, 11/28/22, and Is Elon About To Tap Tesla For Billions in Debt To Bolster Cash—And Help Him Buy Twitter?, 10/19/22, and Tesla: Shanghai Surprise, 1/29/19). Sure enough, we recently learned Musk “borrowed” $1 billion from SpaceX to help him cover his large cash shortfall to buy Twitter.

These events were just a sample of mounting pressures for Tesla over a 2-3 week stretch in the middle of an exceptionally troubled third quarter, as I expected, when no amount of price cuts or expensive incentives would be enough to save its flagging sales momentum.

Now we know Zach Kirkhorn was suddenly going through some things at the same time. Tesla’s 10-Q included a copy of his severance agreement which indicates Kirkhorn actually was fired.

The document indicates Kirkhorn was told on Friday, August 4th, “Your employment with the Company is ending. As of August 4, 2023 (the “Separation Date”) you are no longer serving as Master of Coin and Chief Financial Officer.”

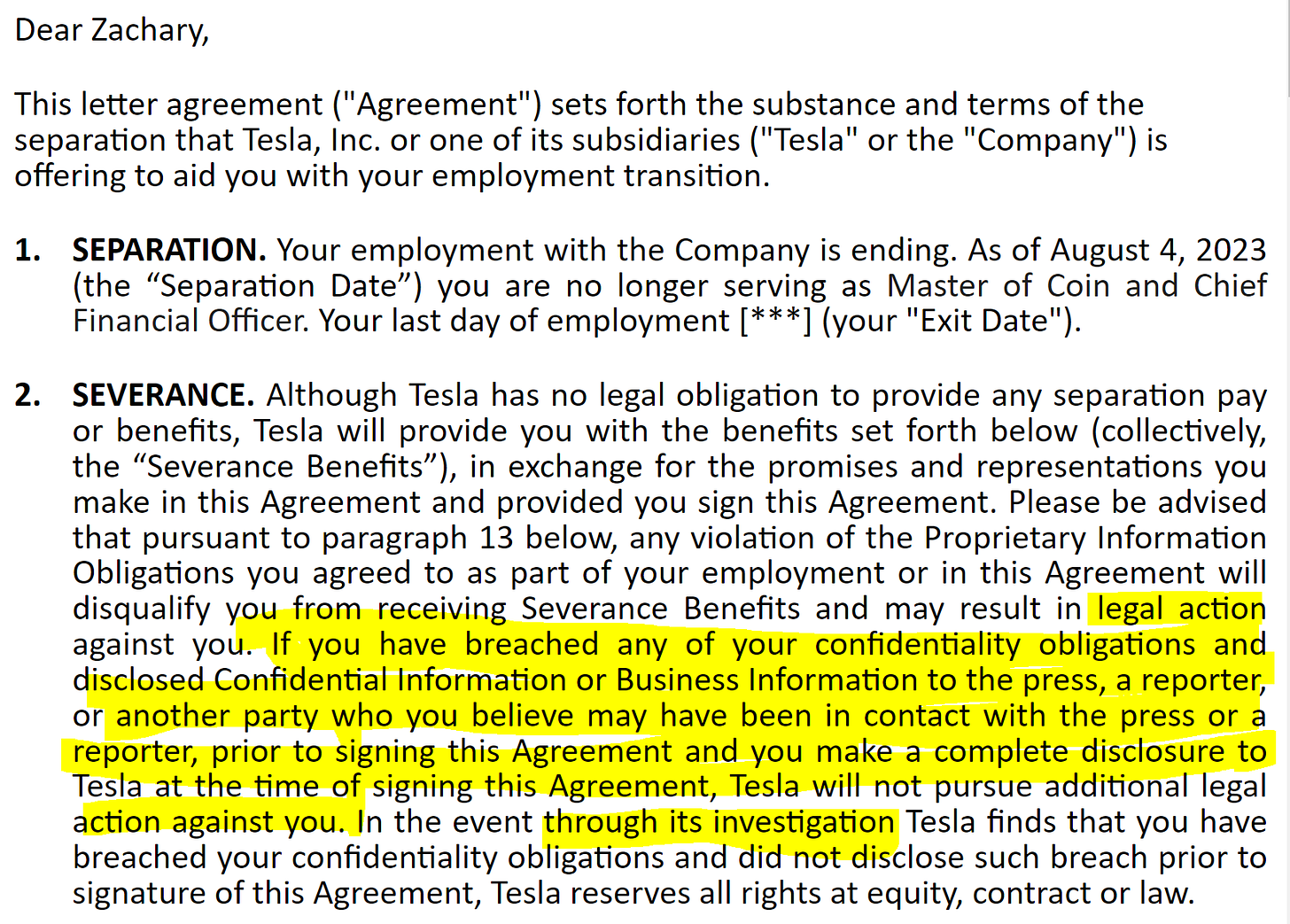

In the very next paragraph Tesla threatens Kirkhorn with “legal action” if he talks to the press:

This seems unusually aggressive to me, even for Tesla, especially if Kirkhorn is the primary guilty party for some undefined offense and not Tesla.

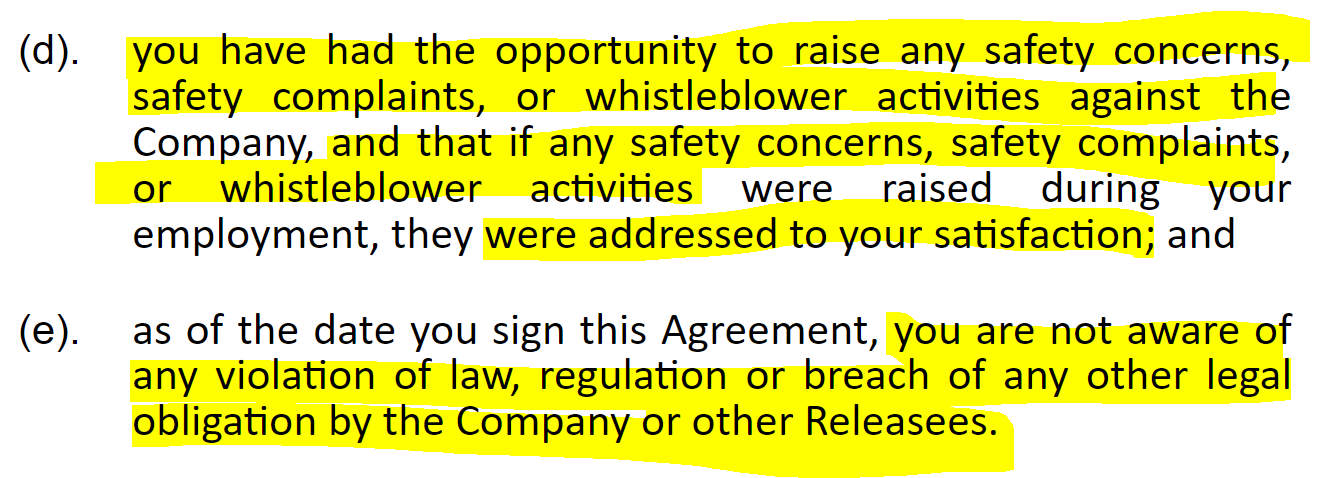

Then Tesla required Zirkhorn to disclose any “whistleblower activities” he may have pursued, as well as declare that any relevant concerns “were addressed to your satisfaction.”

Why would Tesla demand this if it has done nothing wrong?

To be clear, whistleblowers are protected by federal law and companies may not threaten or coercer people who file such complaints with government authorities.

So, even though Tesla just did that in writing to Kirkhorn, Tesla required Kirkhorn to certify that the company hasn’t violated any regulation or broken any laws.

Not surprisingly, the document goes on for several dense pages which require Kirkhorn to agree in writing that Tesla is completely covered under seemingly any circumstance while warning Kirkhorn, in turn, that he faces perpetual risk of severe penalties and legal turmoil from Tesla if he opens his mouth.

The company does finally acknowledge far later in the document that it actually can’t stop Kirkhorn from cooperating with any government investigations, but then it also warns Kirkhorn that he can’t profit from any resulting legal action against the company—which seems like Tesla overstepping its intentionally intimidating but not clearly defined legal territory.

Some might observe that this was a typical “boilerplate” NDA required of any exiting high-level executive, but I’m not convinced. Tesla’s language seems pointedly directed by very specific language to keep Kirkhorn eternally quiet about something substantially dangerous to Tesla.

It may take a while, but I’m guessing we will find out.

Stay tuned.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.

Great article! I'm curious: what do you make of Kirkhorn selling $2m worth of TSLA stock right before he got fired; $1m of which he sold the day before his firing was announced?

https://www.benzinga.com/news/23/08/33673010/tesla-cfo-zachary-kirkhorn-sold-shares-days-before-stepping-down-new-cfo-also-sold-shares-prior-to-t