Elon Musk Can't Be Trusted. He Also Can't Be Stopped, Apparently.

Tesla Q1 must be worse than I expected based on the uptick in Elon Musk's unhinged lies, hate speech, interference in US national security, wacko conspiracies—plus his self-flattering fake alter ego.

Tesla’s TSLA 0.00%↑ first quarter of 2024 is going badly.

We can surmise this based on troubling data like already elevated inventory continuing to pile up in every major market despite waves of additional price cuts and incentive boosts which have failed to jumpstart Tesla’s stalled momentum or revive its falling market share—as I projected again in Tesla: Moving The Goalposts Works Until It Doesn't, 1/26/24.

We can also just mark how badly Elon Musk has gone off the rails—his tell when bad news is spiraling out of his control. Forget about work, he spends his purportedly invaluable time rabidly posting lies, hate speech, vulgar attacks on critics, pro-Putin propaganda, and blatant disinformation several times an hour, all day and night on Twitter (now X) in full-blown conspiracy mode.

Over just the past few days Musk has attacked Google GOOG 0.00%↑, liberals, Democrats, “wokeness”, migrants, vaccines, women who take birth control, women who resist “having more babies”, DEI (diversity, equity, and inclusion programs which promote fair treatment and full participation for all people), unfavorable media stories about him, President Joe Biden’s son, competing AI companies outperforming his (which are mostly all of them), liberal billionaire George Soros, and more.

Musk sneered in a tweet about Lucid LCID 0.00%↑ “their Saudi sugar daddy is the only thing keeping them alive”. But I and many others remembered that Musk courted the same Saudi Arabia Public Investment Fund (which I inaccurately named in my tweet as SWF for Saudi Wealth Fund) to bankroll his fake buyout of Tesla in 2018 after it had helped Tesla through its lean years. Saudi Arabia PIF was so spooked at Musk’s erratic behavior that they directed billions to fund Lucid instead. This particularly irked Musk because Lucid’s founder and chief executive Peter Rawlinson was formerly VP and Chief Engineer at Tesla and in charge of its then flagship Model S (which Musk now petulantly denies). Meanwhile, as I observed, Musk relied on his “sugar daddy”, US taxpayers, to fund billions in subsidies which kept Tesla afloat for 18 years before it finally turned a profit.

To lighten the mood—Musk’s mood—Musk was revealed to have created another cringeworthy alter ego on Twitter—he reportedly has several—named Adrian Dittmann so he can flatter himself and his companies on Twitter and right-wing talk shows. I noticed Adrian Dittmann is an anagram for Martiann Tin Dad—as in Mars+Cybertruck+Babymaker. All check out as favorites for Musk, a father of 10 by three mothers.

Where does Musk find so much time to waste? Maybe during his almost daily jaunts typically lasting less than an hour to 3-5 hours in one of his four (heavy-polluting) Gulfstream jets, usually flying from Austin to California and back. Is this to do something that can’t be done by phone? Oh right, phones are for tweeting.

Meanwhile, as all his companies, including Tesla, continue to rack up safety violations, government investigations, and lawsuits, Musk is still trying to dodge the SEC investigation into his $44 billion acquisition of Twitter, as I described then:

Plus the SEC and the FTC are now investigating Elon because he failed to report within legal time limits that he was accumulating his 9.2% Twitter stake with intentions to buy the company—a move that may have netted him a $156 million windfall since he was able to buy the stock at cheaper prices before he announced the news.

Elon's Trying To Get Out Of Buying Twitter—As We Knew He Would, 6/7/22

Musk and Tesla just lost a landmark case in which the Delaware Court of Chancery threw out his “unfathomably” excessive $56 billion pay package that Musk had demanded from his sycophantic and richly rewarded Tesla board while lying to shareholders that it was appropriately and independently valued. Of course, this is mostly the same Tesla board that has rubber-stamped everything Musk has ever done, be it announcing his fake buyout of Tesla which got him convicted of securities fraud or doing so many illegal drugs that the board was concerned he “could harm his companies.”

Musk is also facing intense scrutiny as a US national security threat after he has been exposed as denying access to his SpaceX Starlink and Starshield internet companies—in violation of his Pentagon contracts. His deliberate actions have benefited Putin in Russia and CCP in China at the expense of US ally Ukraine as it battles an invasion from Russia and US military troops maintaining a security presence in embattled Taiwan. The Russian military is also illegally operating thousands of Starlink terminals in occupied Ukraine, which Musk has tried to deny despite having such clarity over specific Starlink terminal operators in Ukraine that he was able to shut down specific terminals just as the Ukraine military was launching an attack on a Russian warship. Putin responded days later by calling Musk “outstanding” and “talented.”

More than just posting and spouting pro-Hitler, white supremacist, antisemitic hate, which he had done for years, Musk has advanced Putin’s agenda by pushing Ukraine to surrender to Russia and warning the US Congress to stop funding Ukraine’s military because “there’s no way in hell Putin is going to lose” the war in Ukraine. Musk’s reported conversations with Putin about his Starlink satellite network (and who knows what else) have become more disturbing following recent revelations that Russia is developing a nuclear anti-satellite weapon to be deployed in space.

In a sane world, such a person would be barred from running any company, much less companies with sensitive defense contracts key to US national security and global communications. He might even be held consequentially accountable for his illegal and potentially criminal activities.

But this is the world of Elon Musk.

Musk’s companies—and the planet—would be far better served if someone else ran his companies.

Not surprisingly, Musk has inflicted substantial destruction on his companies, particularly Twitter (now X), which revealed his glaring failures as a manager (see Elon Musk's "Global Sewer" May Derail Bankers' Trying To Finally Dump Toxic Twitter LBO Debt), and Tesla, where its primary success and lucrative market support trades on the now fading luster from thoroughly debunked myths about Elon Musk.

Tesla, Musk’s only profitable company, has suffered perhaps the most from his acute managerial incompetence, neglect, and abuse. Once the darling of the burgeoning EV industry, Tesla has been starved of vital investment needed to maintain a competitive product line. After nearly two decades, it still produces a paltry line-up of poorly built cars that continue to rank at the bottom in quality and reliability, “supported” by even worse customer service. Musk also ignores looming consequences of Tesla’s self-made demand erosion by building what soon will be severe production overcapacity in all his markets that will further crush already shrinking profit margins.

Instead, Musk drained Tesla cash to fund the quirky and fundamentally flawed Cybertruck and Semi-Truck. Neither will ever sell enough to restore Tesla’s prominence, even if they someday manage to become profitable—which seems unlikely. Musk spends even more cash and limited attention on his notorious, and so far, chronically money-losing follies that probably will never be commercially viable—if they ever get produced at all—like robotaxis, full self-driving (FSD), a humanoid robot, and a supercomputer.

Not only is Musk never going to Mars, but the man lauded as “saving the planet” is himself, like all his companies all over the world, a notoriously lawless and chronic polluter. His human rights record is even worse given decades-long records of regulatory fines and lawsuit settlements for toxic and perilous working conditions at all his facilities. His Tesla factories have been ranked as substantially more dangerous compared with all major automakers combined (see Will Tesla Get Good News This Week?).

Tesla is out of mythological goodwill—and time.

Tesla’s golden era of high double-digit annual growth in deliveries is over. Now nearly two months into 2024, it looks like first-quarter deliveries may land closer to the low end of my projected range of flat to down 3% versus the disappointing 484,507 reported for the fourth quarter (see Tesla: Moving The Goalposts Works Until It Doesn't, 1/26/24).

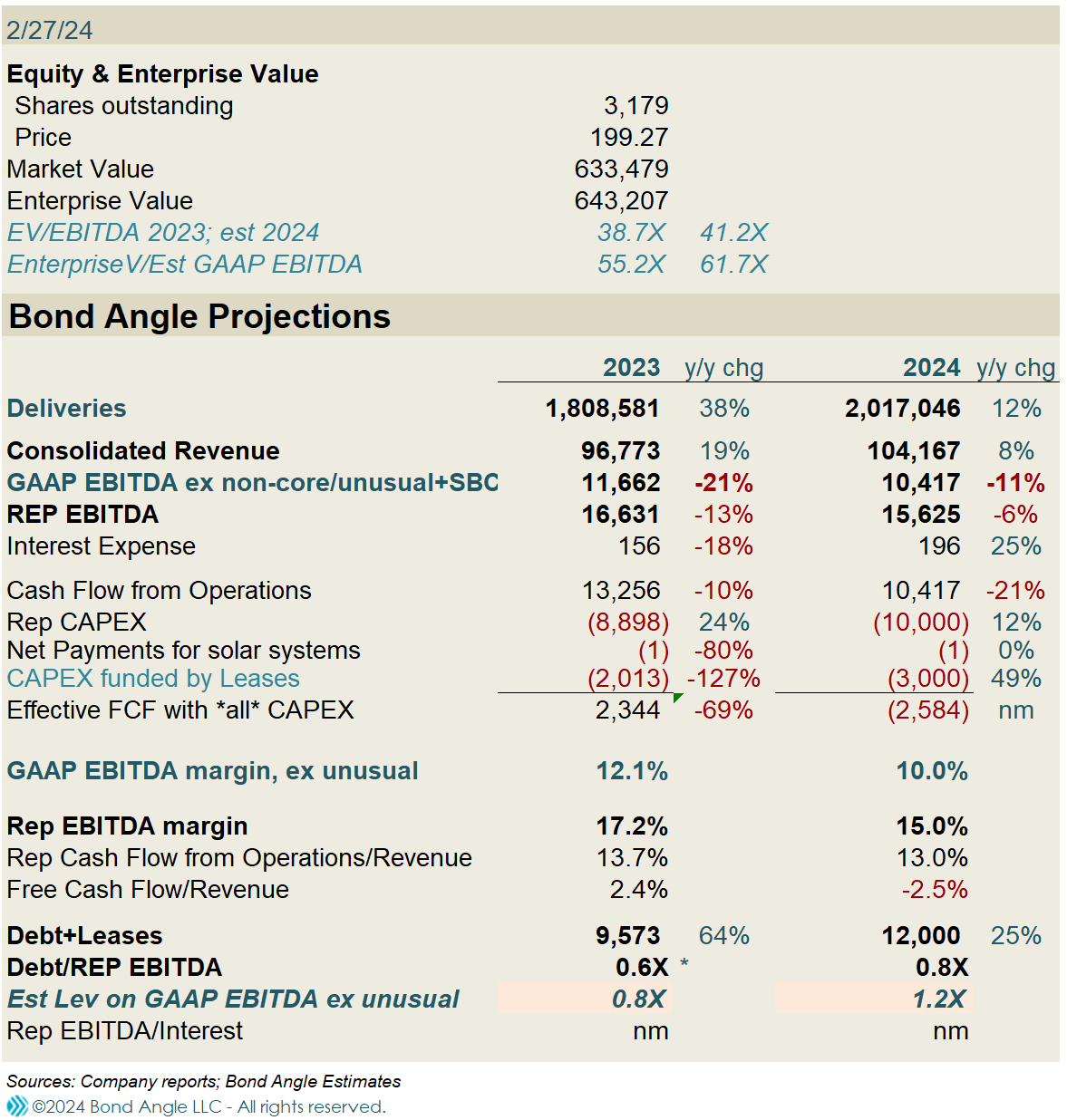

Assuming the first quarter contributes 23.3% of full-year results, this indicates deliveries now just under 470,000 (down 3% vs Q4; up just 11% y/y) for the first quarter and 2,017,046 (up just 12%) for the year. If so, this would confirm the dramatic erosion in demand I have warned that Tesla won’t be able to stop. This indicates revenue at $24.6 billion (up just 5% y/y), EBITDA at $3.6 billion (14% margin; down 380 bps), and net income at $1.97 billion (down 22% y/y).

Falling pricing and shrinking margins point to sharply lower profits overall for 2024, with EBITDA falling for the second straight year to an estimated $15.63 billion (15% margin; down 220 bps) on $104.2 billion in revenue (up just 8% yy) and net income down 31% y/y to $10.4 billion—see attached model.

Stay tuned.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.

Is it unreasonable to speculate that certain foreign entities may be expressing their gratitude for services rendered by directing their financial companies to purchase TSLA stonk, thereby keeping it elevated in spite of seemingly horrendous news. Despite the news last weekend regarding Congressman Gallagher seeking answers from Tesla on the Starlink/Taiwan issue, TSLA opened UP hard on Monday.

Hard for me to believe that 'Retail' is doing this.

With the FED happily giving free money to any and all banks foreign or domestic, I suspect this type of action could be easily accomplished through a difficult to trace labyrinth.

If 'Audit the Fed' ever happened, I fear the torches and pitchfork brigade would descend on the Eccles building.