Will Tesla Get Good News This Week?

It's been raining recalls and lawsuits and government probes. January monthly sales were sad. Tesla's profitability has a serious asterisk. Will February results look better?

Tesla (TSLA) didn’t need Russia to attack Ukraine to have another bad month. As February comes to a close the stock is down 23% ytd at near $810 per share and down 35% versus its peak last November.

We could call it another run of bad luck, except all Tesla’s problems are entirely of its own making.

Despite the luxury of 18 years of opulent funding and unprecedented indulgence by customers, regulators, technology partners, suppliers, and adoring investors, Tesla is still just a poorly run automaker that makes defective cars, and is led by a arrogantly reckless and thoroughly unrestrained CEO.

This year, as I have warned, the bills appear to be coming due.

Let’s start with recalls. So many recalls. Nearly 1.5 million cars recalled so far this year—nearly 4x the 360,000 cars delivered in the US in 2021.

This included recalls addressing phantom breaking—the car suddenly initiates a stop from highway speeds. Heat pumps that don’t work in freezing weather, a stubborn problem also complained about all over the world. Autopilot programmed to run through stop signs. Boombox sounds that block proximity warnings to pedestrians. No chimes when driver fails to put on a seat belt. Failed windshield defroster that impairs visibility.

Not only has the pace of Tesla’s recalls spiked, the volume is troubling versus industry results. As Barron’s notes, Tesla has generated more recalls than all carmakers except Ford, by a hair.

I suspect Tesla’s safety issues are arguably even worse than recorded since Tesla has long been known to fail to report defects as required and has been forced to execute recalls by regulators the US and China. It’s also been caught in the US and China when it quietly fixed issues on the sly to avoid recalls.

Not surprisingly, Tesla’s fleet continues to rank poorly in customer surveys and quality evaluations, as affirmed by JB Powell and Consumer Reports.

Nevertheless, Tesla investors tend to shrug off such problems if they don’t worry the stock price. A big mistake which is getting bigger every year.

That’s because Tesla’s poorly built quality cars have long been overly expensive to buy, insure, and repair, made worse by Tesla’s notoriously poor customer service which seems to have only worsened over the years.

Tesla’s fleet also is comparatively old. Model Y, launched in March 2020, is a slightly bigger Model 3 with a hatchback, and Model 3 was revealed in 2016. Model 3 was a smaller, notably spare version of the 2012 vintage Model S—with dramatically worse flaws and defects which Model Y share. The painfully flawed Model X, launched 2015, has always been substantially more problematic to build and maintain versus its comparatively modest sales contribution.

Dozens of truly new EVs have been revealed and/or launched every year since 2016 with 2022 expected to be a particularly strong record year of new EVs to market.

With so many new models now available in every major market where Tesla competes, offered by seasoned, credible automakers which can far more credibly build and support quality cars, buyers no longer have to put up with Tesla’s arrogant nonsense.

Tesla’s persistent safety issues also tend to spark regulators’ interest and, as I long have warned, US agencies are now run by a new administration with refreshed staff and budgets aiming to restore responsible government oversight dismantled during the Trump Administration.

Hence the spike in recalls as well as stepped up government investigations into deadly crashes into emergency vehicles and phantom braking and Autopilot failures and more. Sadly, this didn’t happen in time before someone using Tesla’s Autopilot finally killed people, as so many of us have feared.

Which of course, means more expensive lawsuits—as I have expected. The latest wave in lawsuits highlight Tesla’s terrible working conditions for workers—including several involving pervasive racism.

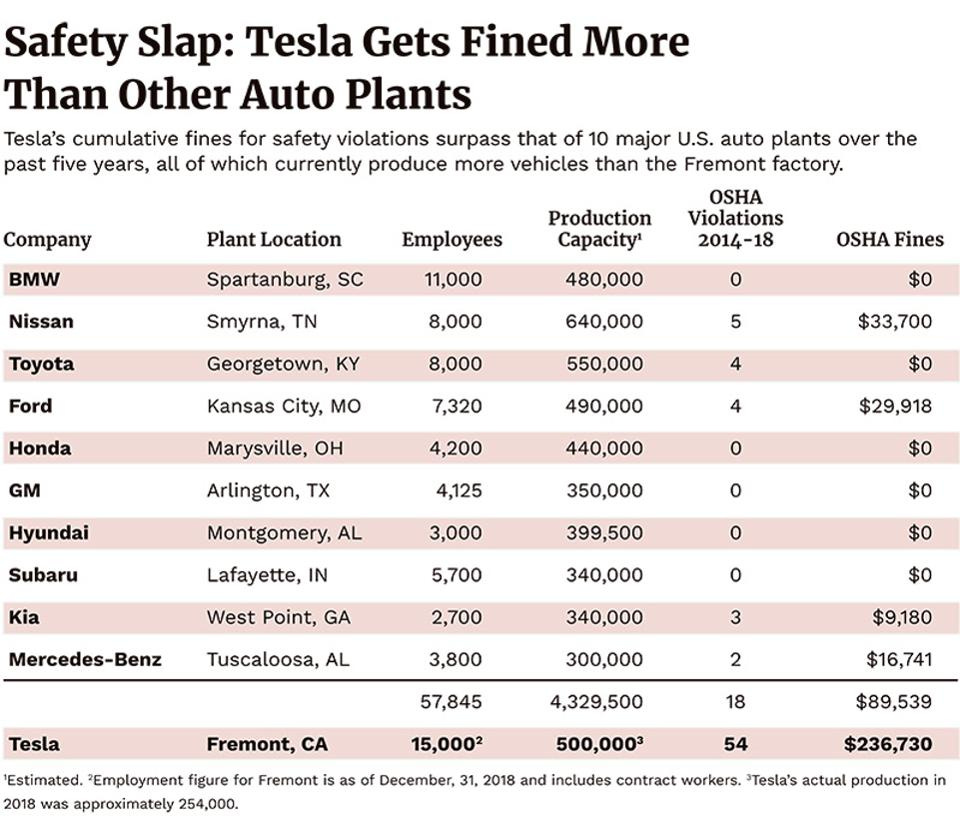

Again, this isn’t news that Tesla’s factories can be perilous places to work. As I detailed, for example, in Tesla's Plan B 2.0; Y Not, 3/10/19:

Continuing layoffs could make such problems worse since Tesla has targeted for reduction its more expensive—and more seasoned—employees which included the elimination of its quality control department at its primary factory in Fremont.

Insufficient staffing, weak quality control, and notoriously poor management oversight could aggravate Tesla's atrocious manufacturing safety record, already dramatically worse versus all other US automakers combined:

And in The Trouble With Tesla’s Arrested Development, 7/17/19:

Employee injuries and job-related illness for 2018 were three times higher versus 2017's record pace. Bloomberg reported, "The sharp increase in the number of days away from work suggests a greater severity of injuries, said Deborah Berkowitz, who served as OSHA’s chief of staff under President Barack Obama and called the data “alarming.” The rise in the average time missed — to 66 workdays in 2018 from 35 the year before — is a “red flag,” she said."

So it was distressing but not surprising when Tesla fired employees who attempted to unionize to improve working conditions. Tesla also failed to meet health safety standards during Covid-19 restrictions and then fired employees concerned about their safety as I noted in Tesla: Who Is The Enemy Now? 5/17/21:

Elon Musk is not a doctor or infectious disease specialist. But he spread dangerous information and false claims about COVID-19, including debunked data and treatments, made explicative-laden rants against community safety protections, defied health official orders, endangered his workers who were threatened with firing and loss of unemployment benefits if they didn’t come to work during the pandemic when, as they feared, the factory wasn’t safe.

But of course, Tesla is Elon Musk, an unscrupulous, autocratic, out-of-control CEO largely unchecked by board governance. For years, that hasn’t been a problem, as I wrote in Nikola's Ex CEO Trevor Milton Arrested for Lying to Investors. Some Ask, "What About Elon?":

"The SEC Musk was defying was chaired by Jay Clayton, a Trump appointee who, in his former life, defended clients mired in corporate shenanigans, including Deutsche Bank (DBK GR), UBS Group AG (UBSG SW), Volkswagen (VOW GR), Softbank Group (9984 JP), The Weinstein Company, Bill Ackman’s Pershing Square Capital Management, and Valeant Pharmaceuticals."

And in Nikola's Milton Just Hired Elon's Lawyers, 8/6/21:

Few lawyers have been more helpful to Elon Musk than Jay Clayton, given his astonishing leniency over the fake buyout as well as Elon's atrocious behavior and glaring dismissiveness of the terms of his conviction and his relentless animosity toward the SEC in particular.”

But now Jay Clayton is gone. The board’s profound failure to hold Elon Musk accountable has also come into renewed scrutiny with Gary Gensler heading the SEC, which now is investigating Musk’s lack of compliance with his generous 2018 settlement for securities fraud. Then came news last week that the SEC is investigating Musk and his brother for insider trading.

So Tesla makes poor quality cars in badly run factories led by a terrible CEO, and the bills are coming due in 2022. Check. At least it’s finally profitable right?

Not so much, as it turns out.

Follow The Money

Only a few weeks ago Tesla had topped market expectations with record revenue and profits reported for the fourth quarter of 2021. Revenue was $17.7 billion (up 65%) mostly on $15.9 billion (up 71%) in Automotive segment sales up on better pricing as well as volume growth. Reported adjusted EBITDA was $4 billion (23% margin) versus $1.8 billion (17% margin) last year. Results included $314 million (down 22%) in energy credits, which mostly accounted for the difference versus my estimates for $17.4 billion (up 62%) in revenue with EBITDA just under $3.5 billion (20% margin, up 290 bps) (Look Away From Elon Musk To Gauge Tesla's Prospects—and Looming Risks, 12/31/21).

Revenue for the year tracked my estimate at $53.8 billion (up nearly 71%) and reported EBITDA slightly more profitable at $11.6 billion (21.6% margin, up 320 bps). Leverage is indicated near 1x, in line with my estimate, on roughly $9.1 billion in debt and leases—investment grade credit quality, as I projected.

Sounds good, right? Sure. But then Tesla and CEO Elon Musk revealed that Tesla will not release any new models in 2022, despite previous long delayed projections and acute competitive pressure. Instead Musk pivoted back to the dubious Autopilot FSD, robotaxis, and Tesla Bot—more like Musk vanity projects which aren’t likely to materialize anytime soon or contribute much in revenue or profit should they ever appear (which isn’t likely).

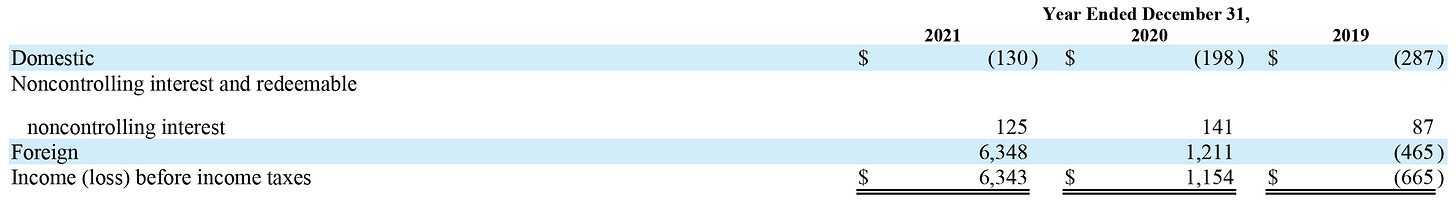

Even less amusing was that Tesla’s domestic operations are still seriously unprofitable. Domestic revenue was $24 billion for 2021 (up 58%), which accounted for 45% of consolidated revenue. But domestic operations generated a pretax loss of $130 million—barely improved versus the $198 million loss in 2020 despite an $8.8 billion increase in revenue. By comparison, foreign operations generated an 83% increase in revenue and all of Tesla’s reported profit—again—a substantial $6.3 billion versus $1.2 billion in 2020.

The astounding profitability differential indicated for foreign operations makes no sense, especially since they mostly comprise Tesla’s new Shanghai factory which was ramping up during much of the periods reported and new factories tend to dramatically less profitable versus mature facilities. One troubling explanation could be that Tesla has continued to capitalize costs beyond appropriate duration for the China factory, and potentially excessively. If so, this also suggests Tesla may also have been grossly overrepresenting how profitable are its US auto segment operations where the company has boasted dramatically higher gross margins versus industry standards. If true, neither maneuvers seem sustainable as vehicles to continue to inflate profits—a potentially even bigger threat to reported margins than I have projected for this year and beyond.

Revenue as well as profit may be under pressure unless Tesla can meet ample market targets, which seem ambitious versus my estimates for 2022 revenue at $69.6 billion (up 29%) on roughly 1,250,000 deliveries (up 34%) and EBITDA at $13.9 billion (20% margin).

And Tesla only has the first two comparatively easy quarters this year as results still include incremental expansion from Model Y ramp up and exports of MIC Models 3 and Y into Europe and elsewhere before lapping record second half results in 2022.

Meager January monthly sales already indicated a disappointing start to the first quarter. February monthly totals will start drifting in later this week.

Stay tuned.

Tesla repurchased its 5.3% senior notes in the third quarter of 2021 as I projected, though I doubt we’ve seen the last of Tesla as a bond issuer:

Now stay tuned for the second step I described: a quickly shopped, likely $2-4 billion inordinately low coupon bond deal, accompanied by a bump in credit quality ratings potentially to low investment grade (see Tesla's Car Business Finally Turned A Profit. Really. Time For A Big Bond Deal). It could even be appealing... if it’s priced at T+100 bps or better.

Until then, I have Tesla: Not Rated.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.