Softbank’s Son “Feeling The Force” With Options Funded With Cash It Had Pledged To Protect

I uncovered serious concerns re CEO Son's secret multi-bill $ options scheme—how he funded it, what and when he failed to tell investors, unforeseen fallout, & more.

Softbank Group (9984 JP) was revealed on Friday as the massive NASDAQ whale helping to drive unprecedented option volume in recent weeks with its multi-billion dollar call-buying spree in the biggest tech names, as reported by Financial Times and The Wall Street Journal which confirmed speculation Thursday by Zero Hedge.

Softbank's option trades added to $40 billion in call-buying over the past month traced to retail investors. The resulting frenzy netted Softbank $4 billion in option trading gains—on paper—on its own $50 billion notional exposure.

By comparison, Softbank's newly acquired long positions in Amazon.com Inc (AMZN US), Alphabet Inc Cl C (GOOG US), Microsoft Corp (MSFT US), and Tesla Motors (TSLA US) are worth just $2 billion, almost all that's left of the $10 billion Softbank spent late in the June quarter buying and selling mostly tech stocks at heady prices. Those holdings now are also subject to sharp declines triggered when Softbank's option scheme was revealed. Sure enough, Softbank lost $9 billion in market value on Monday.

There's plenty of intense scrutiny underway to understand these trades and what their impact ultimately proves to be. I'm more interested in Softbank's drastic change in strategy and its alternative deployment of cash from $40 billion raised in stock fire sales forced by its wary banks and legacy mega-investors who cut him and Softbank off after decades of seemingly endless billions in available funding when his recklessness netted Softbank and Vision Fund tens of billions of dollars in record losses.

This certainly is not what Softbank told investors to expect mere weeks ago.

Instead, Softbank's actions signal arrogance, or desperation, or worse—that CEO Masayoshi Son feels unrestrained and back in his Star Wars Zone with $40 billion in fresh cash.

What Else Is Softbank Not Telling Us?

Here's what we do know:

Softbank only disclosed buying and then selling more than half of $10 billion in “highly liquid listed shares” in the June quarter, reported August 11, implying less than $4 billion was still long as of June 30th.

This emerged as Softbank surprised investors by announcing its plan to become an asset manager of publicly traded stocks, its own in-house hedge fund.

The new $555 million investment management fund was already invested in 30 mostly tech names and funded 2/3 from the company and 1/3 from CEO Masayoshi Son. Coincidentally, 555 also is slang in Japanese gaming culture for go, go, go.

Barron’s pulled together the following list of what Softbank bought. Most names, as you can see, also have dominated heavy volume trading all year, with astonishing prices (read overvaluations) to show for it (I’m looking at you, Tesla. See my report “Things People Believe: Flat Earth, Faked Moon Landings, and Tesla $2100” on 8/23/20.)

Go, indeed. Now we know that Softbank did not disclose the $4 billion it planned to spend in the subsequent two weeks on $50 billion notional exposure in potentially out-of-the-money option trades on many of the same major tech stocks it just bought—roughly equivalent to its resulting trading gains it has netted on paper, and substantially more versus its remaining long positions.

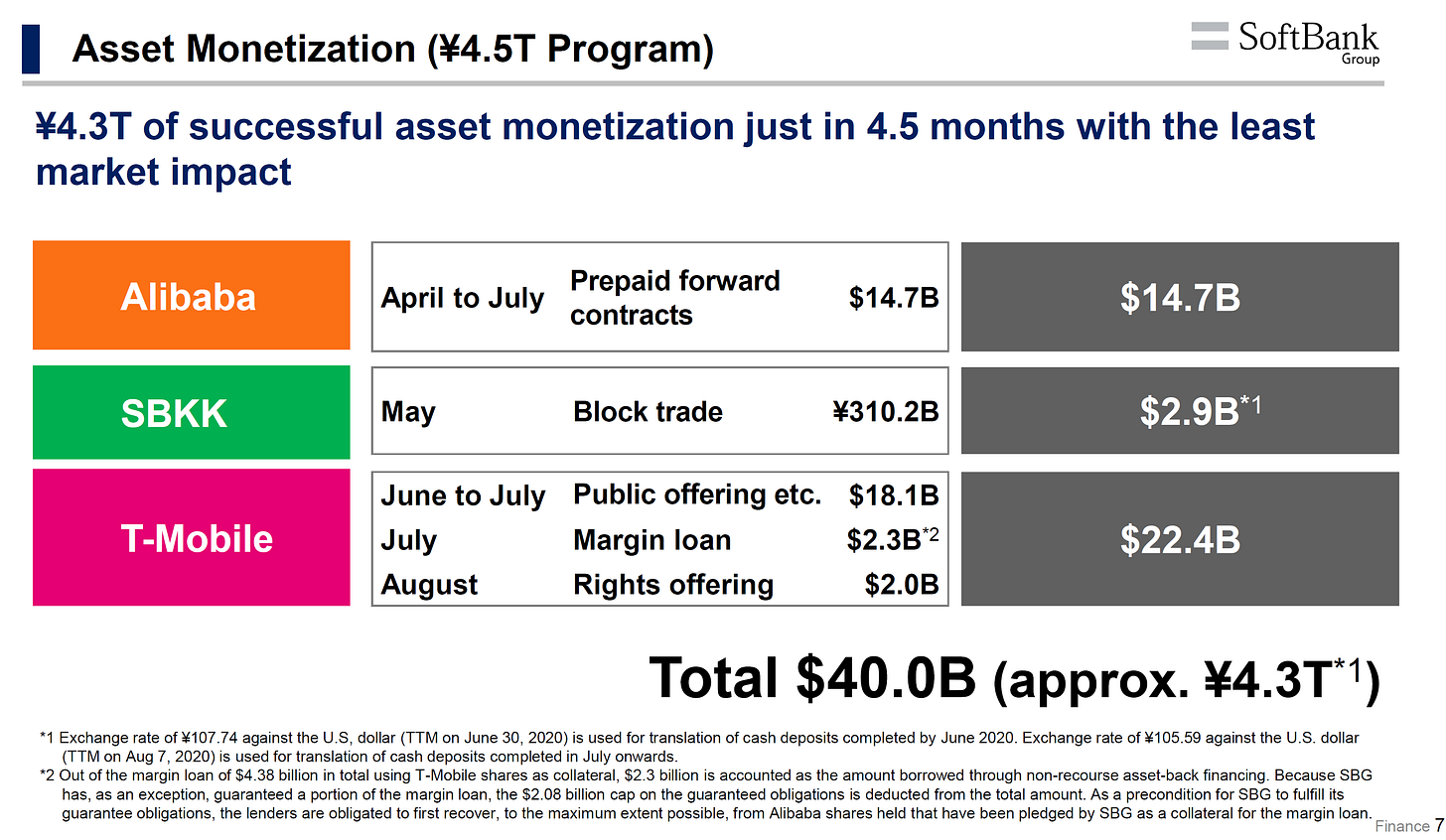

What Softbank did tell investors was dramatically different. The good news was that it had raised $40 billion, most of its $42 billion target announced in March, from selling $14.7 billion of its prized Alibaba Group (9988 HK) stake plus $22.4 billion of its T Mobile Us Inc (TMUS US) shares and $2.9 billion in Softbank Corp (9434 JP).

Softbank reported buying back $12 billion (JPY 1.3 trillion) in debt after the quarter closed, but didn't mention this was less versus debt added in the second quarter so pro forma debt remained slightly higher versus fiscal year-end on March 31st. With EBITDA also down substantially core leverage jumped to near 10x at the end of June versus 7x at March end, assuming total debt/EBITDA.

This demonstrates just how far Softbank has fallen from investment grade credit quality metrics it lost amid the escalating WeWork debacle last fall (see my comprehensive reports in which I projected the sad outcome of the whole sorry affair for The We Company (WeWork) (WE US) and Softbank starting with Gravity Works As WeWork Doesn't; Now Plan B on 9/17/19 through to WeWork Bonds in Peril As Softbank Abandons Equity Tender on 4/1/20).

Using the standard credit metric of Total Debt/EBITDA reveals Softbank's substantially higher and increasing risk versus the reportedly improved 11% LTV (loan-to-value) it preferred to feature in the June quarter. LTV as Softbank defines it is critically flawed as a credible risk metric since, as I have demonstrated since last fall:

Softbank has persistently overstated asset value of its privately held holdings (by multiples of billions of dollars for WeWork, for example) in its now increasingly more volatile portfolio,

It cherry-picks which and how much debt to include,

And it masks actual obligation totals by reporting net debt which may include cash and equivalents as Softbank generously defines—like including cash expected but not actually received yet.

And remember, the bulk of Softbank's cash now has not been generated by performing brilliantly with profitable investments.

Softbank still really has only one of those: Alibaba, its legacy anchor investment that still comprises more than half of its portfolio.

Even Alibaba wasn't profitable enough on its own to offset stunning losses from Son's spectacularly expensive failures like WeWork and a string of others, many of which—like WeWork—are now bankrupt or close to it.

So cash flooding in now is cash Softbank was driven to raise via selling off the best of its portfolio after bloodying the balance sheet so badly its banks cut off its borrowing access and its credit quality ratings were slashed to junk less than six months ago.

It's hard to take seriously Softbank's proclaimed commitment to "conservative financial management" when it manipulates the ill-fitting LTV leverage metric and all the factors used to calculate it to dramatically understate its true financial risk.

Softbank also warned investors just weeks ago to expect a delay until potentially after March 2021 in executing its pledge to buy back stock and pay off more debt to bolster its balance sheet "in light of the uncertainty in market trends and other factors:"

Given the current concern for a second or third wave of the novel coronavirus (COVID-19), SBG believes that it needs to further enhance its cash reserves. SBG is investing the funds raised until such cash reserves are used for the planned share repurchases and debt reductions, together with other surplus funds, in high-quality, highly liquid marketable securities and other instruments, in addition to holding the funds in cash and deposits, while being firmly committed to its existing financial policies on LTV (loan-to-value, the ratio of liabilities to holding assets) and cash on hand.

SoftBank Group Corp. Consolidated Financial Report For the Three-Month Period Ended June 30, 2020; August 11, 2020

So how, exactly, does Softbank explain telling investors that market conditions are so potentially perilous it needs to squirrel away billions in cash for perhaps another year as a precaution in high-quality, highly liquid marketable securities and other instruments…

And then immediately go launch a multi-billion-dollar high risk option scheme so large it moved markets in stocks it just bought?

What Would Jesus Do?

This sounds more like the guy who lost more than $70 billion in the dot.com crash—highest financial investment loss for any single person in history. The same guy who compared himself to Jesus Christ a few months ago. Indeed, Son is personally running the new options strategy himself with a small staff, according to sources talking to Bloomberg.

It now seems clear that Son was well underway in mid-August with his high risk and potentially dubious investment strategy to raise quick cash via weaponizing options trades in the currently irrational environment, knowing it would help drive up prices on stocks Softbank just bought.

He just didn't admit it at the time to Softbank investors.

This fits with Son's typically freewheeling, shoot-from-the-hip investment strategy. As he once explained to investors "Feeling is more important than just looking at the numbers. You have to feel the force, like Star Wars."

And with a fresh $40 billion Son apparently feels free to shoot for the stars for potentially another year, or more, before he may feel compelled to make good on Softbank's pledge to clean up the balance sheet to strengthen its financial condition, which buying back stock clearly doesn't do. This while selling off more stock as needed in Softbank's more liquid winners to keep cash coming in—further eroding portfolio quality while increasing risk. This as the next year likely will be plagued with continued economic weakness globally, plus persistent COVID-19 concerns, which could negatively impact most every holding in Softbank's portfolio.

Gee, what could go wrong?

WeWho?

Softbank has gone silent about WeWork, in which it sunk some $15 billion, mostly for equity, and which I have pegged since last October as worth zero given its fatally flawed, money burning business model and nominal tangible assets versus $47 billion in long term debt and leases it can't afford (last detailed again in WeWork's Mounting Losses Send Softbank Scrambling For Alternative Financing on 4/1/20).

Not surprisingly, little has changed. In WeWork's latest quarter it burned through another $500 million in cash, according to Financial Times, despite laying off 8,000 workers, renegotiating some leases, and selling off mostly floundering assets worth little to nothing and likely netting even less cash. WeWork's reported cash has dropped to less than $4 billion but, as I have demonstrated over several quarters, most of WeWork's reported cash is not actually cash it has on hand because it also includes cash commitments it expects/hopes to receive at some point—mostly from Softbank (see WeWork Bonds in Peril As Softbank Abandons Equity Tender on 4/1/20).

But you won't see details or even any mention of such continuing large losses from Softbank's largest privately held investment—the same one that burned down the house less than one year ago. Softbank buries WeWork's losses in equity income, along with losses from numerous other failed companies in Softbank's portfolio which have filed bankruptcy since then (see WeWork Bonds in Peril As Softbank Abandons Equity Tender on 4/1/20).

Keep that in mind as Son invests however much he wants in new shiny objects, like Tik Tok. Or perhaps a multi-billion dollar play in short-dated, out-of-the-money calls. Wahoo.

Meanwhile, Softbank's banks remained steadfast in their refusal to fund its promised $3 billion purchase of WeWork's (worthless) equity, as I projected, causing Softbank to abandon its tender offer back in April as I expected—saying Softbank's credit access was tapped out. Son was required by his banks only six months ago to pledge 60% of his Softbank shares, up from 49%, to back his billions of dollars in personal margin loans.

This blurs the lines between Son's finances with the company he controls and entangles both in increasingly dangerous levels of market exposure.

And Vision Fund 2 still has seen comparatively little action for lack of funding, which will have to come mostly from Softbank and Son. That's because Softbank's legacy mega-investors—its own most vital whales who have plied it with billions of investment cash for years until backing out last fall—are not coming back in size anytime soon.

Good thing for them—Softbank investors have lost $10 billion in market cap in two business days as of this writing on Son's latest bright idea.

It could be awhile before we learn more about Son's schemes and prospects. Results from Softbank's current quarter ending September 30th won't be announced for months, but it was to be the first of several much easier comps because it laps the beginning of stunning losses from the spectacular collapse of WeWork—Son's personal treasure, now ghosted.

Son has even less emotional attachment to his obligations to Softbank's bankers, investors, and bondholders.

About Softbank's bonds: In today's crazy market it's no surprise that Softbank's most heavily traded bond is the 6% note due in 2049. Sheesh. We don't know what mood Son will be in tomorrow, or next quarter, or next year, just that he manages to remain mostly unrestrained in whatever strategy he chooses no matter the consequences.

Not a great recipe for bond investors given Softbank's excessively poor credit quality, it's increasingly volatile and dubiously aggressive financial strategies, and its notoriously deficient and misleading reporting.

Now we can add increased risk of investigations by regulators and lawsuits from investors because of Son's options scheme and others possibly related to Softbank's strange connection to investments in Wirecard AG (WDI GR)now that its years of fraud have been revealed.

Softbank's 6% notes recently traded at 97.3; 7% ytw, 565 bps. That's an appallingly meager 56 bps per turn of core leverage on a 29-year bond with weak "B2/B+" credit quality ratings. Initiate rating as “Underperform.”

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.