Tesla “Autonomy Day” Takes Investors For Another Ride

Investors were not persuaded by Autonomy Day, but Tesla's foundering prospects & financial condition are very convincing.

Tesla Motors (TSLA US) "Autonomy Day" event yesterday started more than 40 minutes late and lasted more than four hours. Worse, we had heard most of it all before: wildly optimistic claims with dubious target dates projected by CEO Elon Musk. The difference is that these days most of this is received with considerable skepticism.

The only real news materialized when Musk finally made it clear he was announcing another major change in business strategy--the second in two months--and it will be so expensive that Tesla will not generate positive cash flow until after plans been fully implemented over the next 1-2 years.

That's called changing guidance on the fly, and it comes just ahead of Tesla's release of first-quarter results after the market closes tomorrow.

Was "Autonomy Day" yet another of Musk's splashy diversions? Probably. We already know the first quarter was a disaster (see my reports "Tesla’s Weak QTD Deliveries Signal March Expectation Madness" and "Quick Take on Tesla Q119 Deliveries: Yes, They Were Bad").

Chances are increasing that the rest of the year may not get much better—as I have warned.

Off We Go, Again

Musk has been promising since 2016 that Level 5 Self Driving Autopilot technology is already installed in every car Tesla makes and is ready for full activation via phased in software updates as soon as permissible by regulatory authorities.

“So we expect to reach feature parodies following field validation of hardware 2.0 probably in December (2016) so maybe two or three months from now. So for two or three months is actually hardware 1.0 car will be better than a hardware 2.0 car and then approximately every two or three months thereafter is when we expect to release significant improvement in autonomous capability.

I feel pretty good about this goal is that we will be able to demonstrate a demonstration drive of our full autonomy all the way from LA to New York. So basically from home in LA to let’s say dropping you off in Times Square, NY and then having the car parking itself by the end of next year (2017) without the need for a single touch including the charger."

Elon Musk, Autopilot 2.0 Conference Call, October 19, 2016

Of course, this hasn't happened, and while Tesla's Autopilot has improved measurably, it arguably has lost competitive and technological ground to more comprehensive systems from Google's Waymo (Alphabet Inc Cl C (GOOG US)) and Cruise by General Motors Co (GM US). In the meantime, some of Autopilot's worst flaws have been revealed through a number of tragic accidents which, ironically, the company has blamed on drivers who took their hands off the steering wheel when Autopilot was engaged.

Apparently, Musk believes this won't be a problem much longer because, as he said yesterday, "like, probably, two years from now, we will make a car that has no steering wheels or pedals." Just start Autopilot and go.

Musk expects fully autonomous Self-Driving will be available even sooner, saying:

There's three steps to self-driving, there's being feature complete then there's being future complete to agree that where we think that the person in the car does not need to pay attention. And then there's the reliability level where we also convince regulators that that is true. So there's kind of like three levels. We expect to be set feature complete in self-driving this year and we expect to be confident enough from our standpoint to say that we think people do not need to touch the wheel, look out of the window. Sometime probably around I don't know second quarter of next year, and then we start to expect to get regulatory approval at least in some jurisdictions for that towards the end of next year. That's roughly the timeline that I expect things to go on."

This is possible, according to Musk, because Autopilot now includes Tesla's new propriety Self-Driving chip, "the best chip in the world" versus Nvidia Corp (NVDA US) chips Tesla has been using, with better AI software versus offerings by Waymo and GM.

And with more than 1 million self-driving Tesla's on the road by next year functioning as "robotaxis," including lease returns (which likely will help bloat inventory values hurt by eroding new and used car prices, handy when backing bank debt) and privately owned Teslas the company will invite into its network, Musk plans to launch a better ride-hailing service than Uber Technologies (0084207D US).

Spoiler alert: Uber is not worried about this, not one bit. Neither are Nvidia or Waymo or GM, which all produce demonstrably superior offerings right now and probably for years to come compared with Tesla's pipeline through 2022.

And while unlikely any time soon, if at all, even if:

Tesla and its very limited pool of participating customers (at best) can resolve the extraordinary liability associated with having their driverless cars set out on their own to ferry passengers around town without hitting anything or anybody,

and it could create a business model modestly profitable (not the wildly ambitious financial model provided yesterday),

and it managed to carve out a viable niche competing against market leaders Uber and Lyft Inc (LYFT US),

and Tesla could somehow get permission to cover the country in driverless cars,

Truly autonomous self-driving cars are years if not decades away.

Never mind that Tesla has yet to achieve even average competence, much less profitability, as a sustainably efficient carmaker.

Here's what we already know about the first quarter, which is Tesla's third straight month of full production capability, as I explained in "Quick Take on Tesla Q119 Deliveries: Yes, They Were Bad":

It's obvious that Tesla's sales were foundering in the first two months of the quarter with Model 3 deliveries averaging just 2,200 per week--less than half the pace versus December--and Models S and X sinking to just 900 per week versus 1500-1600 per week the previous quarters. It's also clear the March surge involved only Model 3--Models S and X were little changed.

We can also surmise that the in-transit cars reported at 10,600 were likely Model 3s, and this represents just over two weeks of deliveries. This hardly indicates a "large number of vehicle deliveries" forced to "shift to the second quarter," as Tesla explained. Indeed, Tesla had more cars in transit in the September and December quarters when demand was clearly growing.

Now consider that Tesla's Model 3 production at 62,950 was just 4,840 per week--still trailing the 5,000 per week promised since the June quarter last year. This was little changed versus the fourth quarter and also short of average market estimates for 64,400. The Bloomberg Model 3 Production Tracker had projected more than 79,000 Model 3s produced for the quarter--6,087 per week--which is more than the 77,100 Tesla produced for all three models combined. Nevertheless, even with the late surge in deliveries overseas and assuming the in-transit cars were Model 3s, Model 3 excess inventory extended to 2.4 weeks versus 1.4 weeks in the fourth quarter and 0.4 weeks in the third quarter.

There are more red flags with Models S and X, where production was slashed by 43% y/y and sequentially and still generated substantial excess inventory. While Model's S & X had indicated 4-6 weeks of available inventory every quarter for more than a year, plunging sales in the quarter to just 930/week versus more than 2100/week the previous two quarters drove excess inventory to nearly 15 weeks.

Also in the past few months, Tesla has failed to successfully implement hastily and/or ill-conceived plans:

Tesla had difficulty getting local funding as promised for its Shanghai auto assembly factory, likely due to its rapidly increasing credit risk and inability to provide sufficient collateral to satisfy its Chinese lenders. It started construction anyway which further weakened its bargaining leverage. The result was far less funding than needed, available for only a year at a time, at more expensive and restrictive terms (Tesla - Now We Know The Y, But Not the How).

Tesla seemingly threw together a disappointing unveiling of the long-awaited Model Y, which turned out to look much like the increasingly troubled Model 3 with underwhelming features (like a nearly unusable third-row seat) and a much later than expected readiness. Deliveries are not projected until 2020-2021 when, I warned, Model Y could be so outdated it's competitively irrelevant. As I expected, Tesla was not flooded with early bird order cash as it hoped (Tesla - Now We Know The Y, But Not the How and Tesla Bonds Go Boom).

Tesla has been unable to wrap up its tender offer for its weirdly expensive acquisition of nearly bankrupt Maxwell Technologies (MXWL US), announced at the first of the year. Only a paltry few shareholders have tendered their shares, and the SEC still hasn't approved the associated S-4 registration of shares Tesla will need to fund the deal if they do. Also, while Tesla tells it differently, it looks like it has driven its long-suffering and singularly important battery supplier Panasonic Corp (6752 JP) to halt further spending into all their joint ventures--creating a new threat to needed expansion at their jointly run Nevada factory (where Model Y is to be produced) as well as production at the new Shanghai factory and, I suspect, Tesla's plans for Maxwell (look for my upcoming report on this troubling trifecta).

Alarming declines in January deliveries which persisted into February triggered panicky Tesla to lurch into a new online-only sales model, before considering, as I noted, it's also costly to close stores, fire employees and redistribute remaining staff, and sell off fairly new equipment at steep losses. Plus, leases are really tough and super expensive, if not impossible, to exit on a whim (see Tesla’s Plan B 2.0; Y Not). After chaos erupted for customers and buyers as well as employees, and after landlords rejected Tesla's overtures, as I expected, the company soon tried to reverse course but the damage was done.

Tesla announced the long overdue $35k base Model 3 with huge fanfare and then dropped it from online availability just six weeks later before a single car was delivered because it's still too expensive to produce amid faltering demand, even after slashing headcount and overhead expenses (Tesla - Now We Know The Y, But Not the How).

After additional waves of price cuts and discounts and curtailed product offerings in just the past three months failed to staunch stunning declines in deliveries, Tesla's insistent declarations of "insanely strong" demand for the Model 3 are less convincing than ever (see "Tesla’s Weak QTD Deliveries Signal March Expectation Madness" and "Quick Take on Tesla Q119 Deliveries: Yes, They Were Bad").

That's Not the Worst News

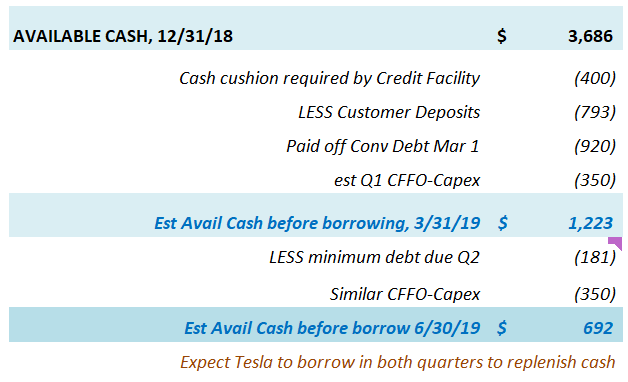

Tesla is well-aware that all its stakeholders--investors, employees, creditors, and suppliers--are seriously concerned with its accelerating liquidity pressure, especially in the calamitous first quarter which also included an expensive $920 million debt maturity and revelations that another $180 million that had been due at the end of December and then in January was pushed off again until April. With losses and cash consumption on the rise, I projected in March that Tesla's available cash could fall to less than $700 million without borrowing by the end of the second quarter.

By early April when Tesla announced dismal deliveries and production numbers for the first quarter, it had retreated from confidently projecting "sustainably positive net income and cash flow every quarter going forward" to "negatively impacted" first quarter income with "sufficient cash on hand"--which sounded disturbing enough.

Yesterday Musk revealed late in the presentation, and only after directly asked, that Tesla's Autopilot and robotaxi plans will be prohibitively expensive to implement over the next two years as planned: "It’s basically our entire expense structure."

“Between now and when the robotaxis are fully deployed throughout the world, the sensible thing for us is to maximize the number of autonomous units made and drive the company toward cash-flow neutral,” Musk said. “Once the robotaxi fleet is active, I would expect to be extremely cash-flow positive.”

Elon Musk, Autonomy Day, April 22, 2019

So while we consider how Tesla plans to drain the cupboards over the next year to fund autonomous Autopilot, robotaxis, and a new ride-hailing business, recall it also has projected for 2020 the launch of Model Y, the pickup, the Semi, and the Roadster, as well as the refresh of Models S & X, all while continuing to starve R&D spending which had dropped to roughly half of depreciation expense by the fourth quarter at just 3.6% of revenue (excluding stock-based comp).

Tesla already has fallen behind on expanding its Supercharger network, adding customer service stores, and obligated development at existing factories. Maxwell may require tens of millions in capex for several years before its contribution to Tesla is commercially viable, much less profitable.

There's also another $1 billion in debt due between now and the end of next year, and the Shanghai factory--which is projected to open late this year and ramp-up to full production next year--will need additional funding by the end of the year via additional loans from China-based banks.

Hopefully, Tesla will thoroughly explain tomorrow how it plans to juggle all these serious obligations with breakeven cash flow--at best--over the next couple of years, but I'm skeptical. I expect Tesla to stick with its overly ambitious delivery and production targets for the full year and hope to catch up to the dream sometime in the third and fourth quarters, which seems unlikely.

I also expect we will have to wait for the 10-Q filing to get a better, if not complete picture of actual core operating performance and financial condition in the first quarter, given Tesla's tendency to boost revenue and operating margins with unusual, nonoperating, nonrecurring items. I suspect the SEC may be waiting for this as well given Tesla's alarming deterioration, which may be part of the delay in approving the S-4 for shares to fund the Maxwell acquisition.

I continue to estimate first quarter auto segment revenue at $4.1 billion (up 60% y/y; down 32% sequentially) and consolidated revenue at $5.3 billion (up 56% y/y; down 26% sequentially), with $565 million in EBITDA (10.7% margin), a slightly larger net loss than previously estimated at $100-200 million versus $91 million net income in the fourth quarter and the $710 million loss last year, and potentially $200-400 million in cash consumed in operations.

Maintain “Underperform” on TSLA 5.3% Senior Notes due 2025, down 2 points since my last report to 85 (8.4% ytw; 605 bps). That’s just 110 bps of spread per turn of estimated leverage in 2019 on potentially increased borrowing to offset cash shortfalls—hardly adequate compensation for such a volatile issuer with such precarious prospects. Given Tesla's persistent uncertainty and escalating risks, we could see 3-5 points additional downside from here.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.