Tesla: Down to the Wire

Tesla boasts for months about "insane demand," why then are thousands of cars still parked in inventory at quarter-end?

With the fourth quarter just a few hours from closing, CEO Elon Musk said he is keeping Tesla (TSLA) stores open until midnight so buyers can still get the coveted $7,500 tax credit on a new car before it gets cut in half January 1st.

This is interesting since Tesla started warning months ago that buyers need to order by October to be guaranteed delivery by December 31st since demand was purportedly so hot the company couldn't make its cars fast enough.

It remains to be seen how many early birds rushed in, because as time passed that deadline has been extended through November and then December.

The takeaway here is that despite months of extraordinary sales efforts, price erosion, and declining production, Tesla's inventory remains troublingly bloated, conditions I warned about in the third quarter as accelerating threats for the fourth quarter and likely through 2019 (see my report "Great Magic Trick Tesla; Now Do It Again," 11/29/18).

Monthly sales trends for October and November also signaled that Tesla needs strong December performance if it still hopes to meet ambitious guidance for profits and free cash flow the company desperately needs to generate sufficiently sustainable cash flow to support operations plus hefty near-term debt maturities (much less its burgeoning R&D and capex obligations where it's already fallen behind).

Otherwise Tesla is likely to get really creative, again, with accounting and cash management strategies to keep up the illusion of progress and stability.

Gettum While They're Hot

We know Tesla expected dramatically higher sales by now based on its persistently ambitious production targets.

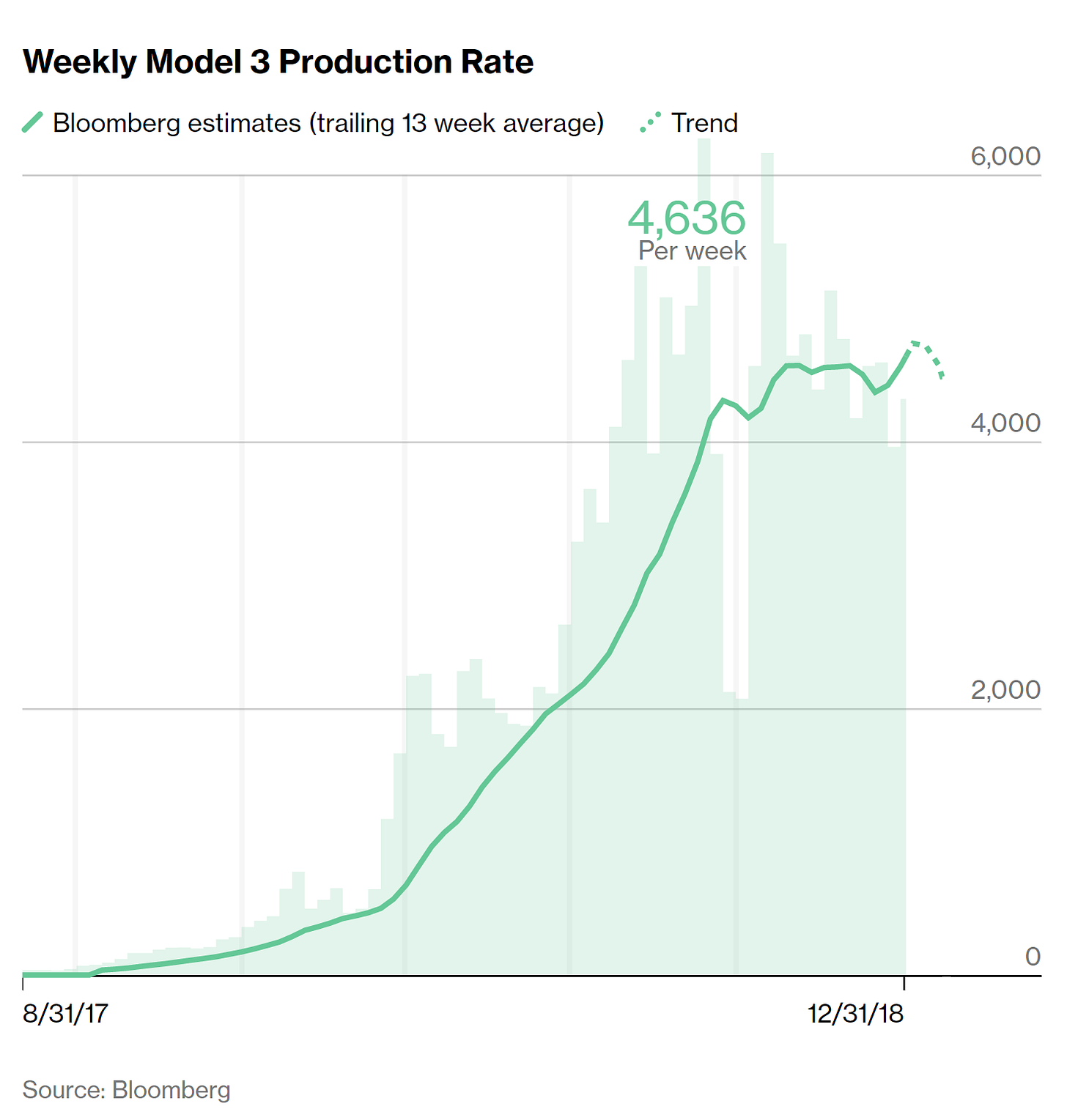

By this time the company had expected to be reliably producing 7,000 Model 3s per week, a goal it still is far from achieving. It has yet to sustain even 5,000 per week, the target that had been set for the second quarter. By the third quarter Model 3 production averaged just 4,400 per week.

Tesla maintained that its difficult ramp-up with the Model 3 suppressed its output as it struggled with numerous problems that drained efficiency, which Musk called "production hell." His celebrated triumph then was to close out the last week of the second quarter by finally producing 5,000 Model 3s, thanks to a dramatic 24-7 effort with all hands on deck feverishly assembling cars under a newly erected production tent.

And yet, mysteriously, being forced subsequently to rework 4,300 of those cars due to substantial defects, about 8% of total Model 3s sold in the third quarter, didn't seem to drive up Tesla's manufacturing costs accordingly as would be expected. Tesla even slashed warranty reserves in the third quarter which helped to boost its reported gross margin.

This made even less sense to me given signs of quality controls curtailed and flawed cars increasingly delivered to customers which logically would pressure margins.

Then, despites sales purportedly impaired by lower production levels versus targets, in addition to presumably higher than planned costs related to "production hell," Tesla still reported a surprisingly strong (albeit dubious) profit for the third quarter.

This included record adjusted auto segment gross margin at 25.8% (up 750 bps y/y), and at 25.5% (up 680 bps y/y) excluding meaningful boosts from sales of Zero Emission Vehicle Credits (ZEV) and stock-based compensation expense (SBC).

Such results will be hard for Tesla to maintain. I logged numerous boosts Tesla used to juice revenue as well as reported gross margin--nonoperating and/or unusual or nonrecurring amounts so significant they accounted for all EBITDA and net income Tesla reported for the quarter.

Fading demand, as I've suggested in previous reports, may explain Tesla's need for such tortured accounting strategies to boost results and why persistently lower than targeted production hasn't actually hurt sales. Tesla has transformed from having storied multi-year backlogs to having sufficient available inventory to support offering all models with immediate delivery since the middle of the third quarter. Even then third quarter inventory still ended slightly higher versus the second quarter (excluding unusual non-sales related adjustments as I noted above).

Increased availability of all cars, Models 3 as well as Models S and X, has continued throughout the fourth quarter even though production has mostly averaged near or below third quarter levels--only nudging higher over the past week.

Since Tesla apparently doesn't need to produce any faster to satisfy what seems to be fading demand, it has plenty of cars available right now to serve customers all over the country through midnight tonight. Electrek reported today that Tesla still has more than 3,300 Model 3s in inventory despite Musk's goal to sell out the company's entire stock by the end of this month.

As one example, my local Houston stores have barely moved any inventory the past couple of weeks. Most notably, this includes a comparatively large inventory of new and used Models S and X.

Indeed it seems likely that Tesla may have pulled demand forward, as I expected, by enticing customers to buy earlier to ensure delivery by the end of December before the tax credit is reduced by half.

That's a problem--Tesla needs impressively strong December sales to meet guidance

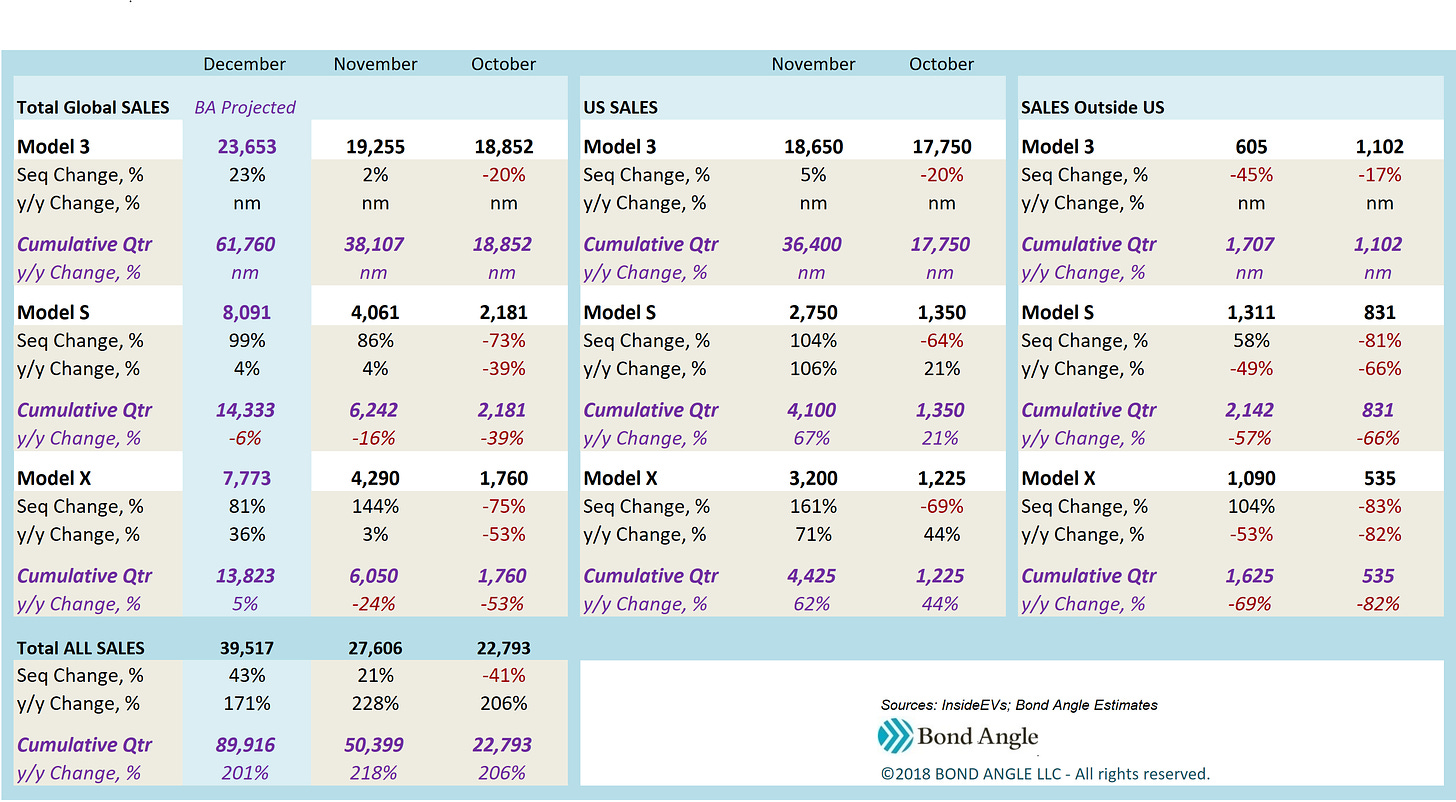

Healthy increases in November sales, as reported by InsideEVs.com, were not enough to overcome weak performance in October, especially for sales outside the US which continued to trail performance last year.

As shown in the chart below, Model 3 sales growth has tempered considerably. After double- and even triple-digit sequential growth most every month over the past year since it was launched, Model 3US sales were down sharply in October and barely higher in November. More troubling is Tesla’s slump in Models S and X sales outside the US, especially with plunging sales in China.

Overseas sales were hindered also by Tesla's failure to get the Model 3 approved for sale in Europe as planned for this quarter. Count this as another opportunity squandered while sexy rivals like the Jaguar I-Pace are leaping up the charts.

Even more at risk are sales of the aging Models S and X which require meaningful growth in December just to meet Tesla's guidance of 100,000 in combined sales for both for the year—flat to potentially slightly lower versus last year.

In addition to potentially lower unit sales, Tesla is experiencing increasing pricing pressure, including additional price cuts in China where Trump tariffs have made Tesla's cars even less competitive versus aggressive rivals.

Tesla also has introduced lower priced versions of US models, and Musk said Tesla would cover the extra cost of the tax incentive lost if a buyer's car is not delivered by December 31st as promised. Over the past couple of weeks reports also have surfaced that Tesla is offering to buy out remaining leases of existing owners to induce them to trade-in early. This translates into savings of several thousands of dollars for interested buyers--and thousands of dollars per car in lower profits for Tesla just as margins already are squeezed with lower pricing.

Actions Have Consequences

Tesla has good reason to be concerned if sales are as pressured as they seem to be, especially if, as I suspect, Tesla faces even more serious competitive challenges with tougher market conditions in 2019 amid stalling economic growth in the US and abroad.

Auto sales have been troubled all year, but sales of electric cars continue to buck the trend. That said, Tesla will begin to encounter serious competition from major contenders, including seasoned carmakers which already have invested in prototypes and extensive testing, steps which Tesla skips, so they can ramp-up in force in 2020 with new models being introduced starting in 2019.

Tesla, in the meantime, has been starving R&D as well as capex, which has delayed development of Model Y, the Roadster, the pickup, the semi-truck, and other ventures, much less be ready to open a new plant in China in 2020 capable of producing 250,000 vehicles a year as advertised.

In any case, Tesla already has pledged to generate “sustainably positive” GAAP income and free cash flow every quarter from now on, a tall order considering my work shows its core operations did not really produce the numbers reported for the third quarter.

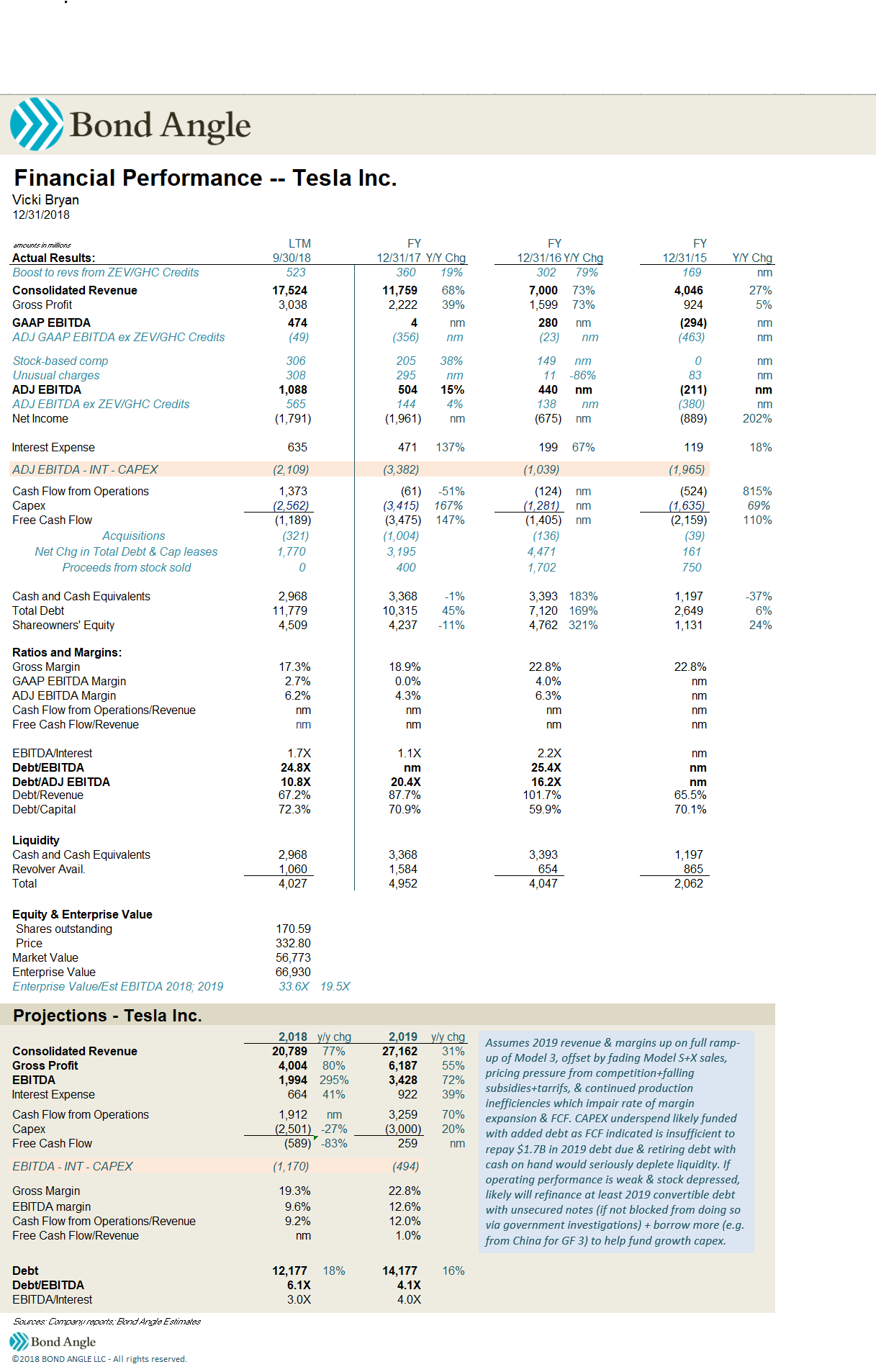

As I noted in my November report, I have projected fourth quarter deliveries up roughly 7% versus the third quarter to nearly 90,000, including 62,000 Model 3s, with lower average pricing near $65,500.

This indicates auto sales revenue at $5.7 billion (down 4% sequentially, up 135% y/y) with reported GAAP gross margin at 24.6% versus 25.8% sequentially and 18.9% y/y. I estimate consolidated revenue at $6.55 billion (down 4% sequentially, up 99% y/y), $945 million in adjusted EBITDA (14.4% margin versus 1.1% last year), and near $180-240 million in reported net income. That indicated leverage improved to 5.7x versus 24.8x sequentially on $11.34 billion in debt, which assumes $440 million in debt retired during the quarter.

Since then Tesla has repaid debt maturing during the quarter, but it also issued new debt to replenish the cash outlay. In mid-December Tesla sold roughly $840 million in trust certificates backed by auto leases, a much larger but similar transaction it completed in February.

So instead of reducing debt by $440 million, debt is tracking a $400 million increase--which has happened for six straight quarters. If so debt at yearend could be up $1.86 billion (up 18%) versus last year to $12.18 billion. That puts yearend leverage at a still uncomfortable 6.1x (see attached model).

I suspect Tesla increased borrowing--and likely will do it again--to ensure it can fund the repayment of $1.7 billion in debt due in 2019, including $920 million in senior convertible notes due March 1st as well as rising capex for its troubling list of underfunded and underdeveloped projects.

In early December, Tesla notified investors it plans to retire that March maturity with a 50/50 mix of stock and cash.

The announcement came just after the stock closed at $363, above the critical $360 price threshold it needed to hold through Feb 28th in order to be able to pay off the debt with stock.

I was skeptical.

As I wrote at the time, Tesla stock still hasn't recovered ground lost since early August when Musk tweeted his bogus scheme to take the company private at $420 per share.

That stunt got Musk convicted of securities fraud by the SEC and cost him the Chairman's seat (see my reports (see my reports Tesla Take-Private Plan: Shoot First, Answer Questions Later (If at All), and Tesla’s Take-Private Plan: Never Mind and Tesla: Musk Fought the Law, the Law Won, So What?.

I had little confidence that Tesla could avoid further controversy or generate enough good news between December and March to keep the stock price consistently above $360.

For one thing, Tesla seems likely to miss market consensus estimates for fourth quarter revenue and profit when it reports results in early February.

We didn't have to wait long. Tesla stock is down sharply since mid-December, hitting $295 on Christmas eve before closing the year at $332.

As usual, it also doesn't help that Elon Musk can't seem to stop stirring up trouble.

"Do You Feel Safe?"

CBS’s Lesley Stahl asked Elon Musk as he was driving with no hands on the wheel with Autopilot engaged

Musk told 60 Minutes in his interview on December 9th that he does not respect the Securities and Exchange Commission, that Tesla's board has zero control over him no matter what he does, and that his forecasts shouldn't be trusted because he's really "dumb at predicting" when things will happen. In the next scene he ignored safety protocols in the Tesla owner’s manual, and presumably concerns from the National Highway Transportation Safety Administration, when he drove hands-free and even changed lanes while in Autopilot mode as he chauffeured Lesley Stahl on the freeway in his Model 3. (It looked like he may have cut off that guy behind him, too.)

It has not been overlooked that Tesla has blamed victims of crashes of its cars who didn't keep their hands on the wheel when Autopilot was engaged.

That's not all. Musk continues to fight the lawsuit against him filed by the Thailand cave rescue diver he vindictively insulted last summer (even calling him "pedo"). He petulantly dared and prodded this regular-guy-turned-hero into suing him, a billionaire, and then argued to the court this week through his lawyers that "no one could reasonably believe his comments were truthful."

Investors can't reasonably believe Musk will be reined in or ever struck with a pang of conscious over any of his actions, especially now that he has hand-picked his successor Robyn Denholm as Chairman, a Tesla director who long has joined the board in rubber-stamping his every move for years. This included his actions which the SEC labeled as securities fraud related to his buyout stunt. This is not likely to change with the addition of Kathleen Wilson-Thompson and Larry Ellison as two new "independent" directors also added this week to satisfy the SEC's mandate for increased board oversight of Musk. Both were notable cheerleaders for another incorrigible CEO: Elizabeth Holmes. She and her company Theranos conducted a stunning multi-year, multi-million-dollar fraud which could eventually land her in jail. Mr. Ellison actually was fined $100 million by the SEC for insider trading when he was CEO of Oracle and sold $900 million in Oracle stock just before the company reported a disappointing quarter.

Just what Musk needs, more blindly adoring, like-minded fans.

For he is Musk, The Unrestrained, so investors beware.

Maintain “Underperform” on TSLA 5.3% Senior Notes due 2025, virtually unchanged over the past month at 87 (7.8% ytw; 515 bps). That’s a paltry 84 bps per turn of leverage—hardly adequate compensation for such a volatile issuer. Given Tesla's persistently uncertainty we could see 3-5 points additional downside from here.

See attached model:

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.