Tesla: Into Thin Air

When and why Tesla’s euphoric rally might hit the wall; convertible bonds now in the money; china, model y, & other shiny objects.

Tesla Motors (TSLA US) benchmark 5.3% senior notes have traded above par since last week, which hasn't happened since they were issued in August 2017, while its stock hit $542 on Tuesday, another all-time high.

That nearly $98 billion market cap made Tesla substantially more expensive than its largest US-based competitors Ford Motor Co (F US), General Motors Co (GM US), and Fiat Chrysler Automobiles Nv (FCAU US)—indeed more expensive than Ford and GM combined.

Yet Tesla sells a fraction of the cars they do, has much weaker operations and financial condition by comparison for the foreseeable future, and has yet to turn in a profitable year or even generate positive free cash flow on core operations. Tesla's enterprise value swelled to 50x my estimate for 2019 EBITDA and 35x 2020 EBITDA while multiples for Ford, GM, and Fiat Chrysler are 2-3x.

The remarkable rally started on shaky ground in October when Tesla again reported dubious revenue quality, profit, and free cash flow for the third quarter (see Tesla's Q3 "Magic" Fades Quickly In Q4, 11/19/19).

It has been propelled higher ever since on record deliveries, euphoric expectations for fourth-quarter results and 2020 prospects, potential sales and production from the Shanghai plant, and shiny objects like Model Y and the CyberTruck—all of which look much different at sea level.

And with Tesla, it's important to remember there's often vital information the company doesn't disclose in a timely manner—or at all—which can reveal a very different view of reality versus the company's hype.

In the meantime, the updraft also has put all of Tesla's convertible bonds in the money, something new and interesting but not necessarily the path to meaningfully improved credit quality it may seem.

With the stock up 113% (at its latest peak) since October all of Tesla's convertible bonds are in the money.

Triggering the conversion option requires the stock to close at 130% of the conversion price for at least 20 of 30 consecutive trading days. The clock started running in mid-December, but it's not there yet:

Tesla has the option of delivering cash, stock, or whatever combination of the two it chooses to holders that elect to convert, transactions Tesla partially hedged by buying calls and selling warrants when the bonds were issued.

The warrants Tesla sold have strike prices ranging from $561-665, so those hurdles have to be met before Tesla can settle via cash or stock—potentially increasing already as much as 7% dilution expected upon conversion of the bonds.

Determining the ideal mix Tesla might use to settle the convertible bonds is more complicated given how fast the stock has escalated—and how volatile it is.

While the bonds outstanding total $4.3 billion, at $542 they can convert to 13.1 million shares of stock worth $7.1 billion.

I estimate Tesla could collect roughly $2.3 billion on the calls it bought at conversion prices, but it certainly doesn't have the cash to spare to buy out the rest.

Reported cash on hand as of September 30th was $5.3 billion, but available cash actually was no more than $4.7 billion excluding customer deposits that Tesla can't spend (see my report Tesla's Q3 "Magic" Fades Quickly In Q4, 11/19/19).

Tesla is not likely to make up the difference any time soon with free cash flow. Despite the hype over third-quarter results, it still hasn't generated unvarnished profits or free cash flow from core operations even with record deliveries.

Instead, as I detailed again in my last report, Tesla has consistently relied on accounting maneuvers and unusual items to juice reported revenue and profits, with increases to reported cash traced to adding debt and leases, extraneous equity transactions, stretching payables, and gutting capex despite its growing pipeline of long-delayed new models and promised expansions.

Such trends likely continued through the fourth quarter, but investors seem to be ignoring the possibility of disappointing fourth-quarter results in favor of high hopes for 2020—which may also fall short of enraptured expectations that have boosted stock price targets to more than $600.

Another "Record Quarter" May Fall Short, But Who Cares?

We've seen this movie. Even with record deliveries in the third quarter, reported net income fell 54% versus last year on revenue down 8%, gross profit was down 22%, and EBITDA down 7%. Free cash flow plummeted 58%.

Tesla delivered 112,000 cars (up 23% y/y) during the fourth quarter, which topped market consensus and my own estimate for 102,700.

What we don't know, because Tesla stopped reporting it after the second quarter, is how many of these were deliveries in-transit at the start of the quarter (see Tesla Q2 Deliveries Beat; Demand and Profit Trends Less Clear, 7/17/19).

Cars in-transit have been paid for but not handed over to buyers, becoming a boost to reported deliveries and revenue in the subsequent quarter. The number has been large, historically, contributing an average of 12% of deliveries reported for the subsequent quarter for the previous eight quarters ended June 30th.

For the fourth quarter, this implies 13,400 of deliveries for the quarter en route at the end of the third quarter and comprising most of the paltry 16,600 logged for October when deliveries fell 27% y/y overall because of a 44% plunge in the US.

Most of the surge in deliveries came very late in the quarter, as is typical for Tesla, but this time they undoubtedly were boosted by the imminent elimination of subsidies after yearend, including in the US where deliveries still fell 2%.

This also accounts for the late jump in the Netherlands where deliveries spiked by at least 11,600 in December. That's more than 10% of total deliveries for the quarter and a whopping 21% of global deliveries outside the US. It's a surge also not likely to be sustained.

Also notable is that the increase in deliveries was completely incremental, again, via expansion of Model 3 into new markets across Europe and China while US deliveries were substantially lower as I have projected.

I've been tracking this since early last year (see Tesla - Now We Know The Y, But Not the How, (3/14/19) when I noticed that Model 3 demand started faltering within the first six months of its June 2018 launch.

Indeed, US deliveries accelerated the 20% y/y decline in the third quarter, when US revenue fell 39%, with a 27% drop in the fourth quarter when Model 3 fell 23% and Models S&X plunged 42%.

Moreover, with lower prices overall plus weaker mix as cheaper Model 3s increased to 83% of total deliveries versus expensive Models S&X, core revenue and operating margins likely shrunk further versus the third quarter and the fourth quarter last year when Tesla reported a modest—and similarly boosted—profit of $140 million (see Tesla - Truth and Consequences, 2/28/19).

Limited fourth-quarter results are expected to be released at the end of January. We won't know until at least mid-February when Tesla files its 10-K report of audited annual financials how much of Tesla's revenue and profits for the fourth quarter can again be traced to substantial boosts from energy credits, accounting maneuvers, further tinkering with warranty reserves and resale guarantees, and other unusual/one-off items.

This is how Tesla transformed an unadorned net loss of $227 million in the third quarter into the "surprise profit" of $143 million Tesla reported which triggered the phenomenal rally in its stock ever since (see Tesla's Q3 "Magic" Fades Quickly In Q4, 11/19/20).

As I noted in that report, such boosts comprised more than $1.1 billion (54%) of reported LTM EBITDA as of September 30th, with leverage "improved" as a result to a still high 6.3x versus 11.6x on unenhanced core operating EBITDA.

We also will have no explanation until February to back up Tesla's reported free cash flow.

I've warned every quarter that what Tesla reports as free cash flow has been mostly and usually entirely generated from the noncore boosts noted above plus stretched payables and capex slashed alarmingly despite a growing and long overdue pipeline of new models, network expansions of customer service stores and superchargers, and expansions underway at now all its existing plants plus the newly announced (and as yet unfunded) plant coming in Germany.

The lack of organically generated free cash flow even as deliveries have swelled to record levels explains why Tesla has raised cash every single quarter from increased borrowing and leases, which continue to rise by double-digit rates y/y, plus extraneous equity transactions.

It also has resisted paying off even seemingly small pieces of debt; e.g. the $160 million SolarCity term loan that was due December 2018 was extended for a year, and counting.

It also didn't pay off the comparatively nominal $43 million in debt inherited with the stock-funded acquisition of Maxwell Technologies in the second quarter even though Maxwell also came with $32 million in cash (see Tesla Q219 10-Q Notes and Big Red Flags, 7/31/19).

Late in the third quarter, Tesla took out yet another credit facility with its China-based bankers in Shanghai, this time for RMB 5 billion (over $700 million) "to finance vehicles in-transit to China"—which it does not disclose.

I noted then that the new facility was nearly twice the size of the RMB 3.5 billion ($521 million) bridge loan Tesla arranged back in March to fund the initial construction of the $2 billion auto assembly plant, and it was arranged just as the plant was ramping up for local production which was expected to ultimately supply most local demand. Just three months later as the fourth quarter closed in December, Tesla took out an even larger $1.6 billion facility secured by the Shanghai plant—an unrestricted subsidiary—and then only paid off and terminated the smaller bridge loan.

This signals higher leverage on increased debt at yearend versus the third quarter, as I projected, just as even reported EBITDA is expected to decline y/y. I now expect fourth-quarter reported revenue at nearly $7 billion (down 4%) with $882 million in EBITDA (down 2%; 12.7% margin) and $85-100 million in net income (down 28-39%)—all including Tesla's typical boosts and unusual items similar in amounts seen in the third quarter.

My guess is that Tesla's drive to meet the low end of guidance for deliveries was costly and likely hard to continue going forward, so my revised estimates are only modestly higher—and well below market consensus:

Never Mind! Party Like It's 2020

Tesla's ecstatic investors seem little bothered but such concerns. The stock did retreat to a still lofty $518.50 as of Wednesday's close but was back up to $522 in after-hours trading.

The 5.3% benchmark bond closed at a peak 100.8, a meager 5% ytw and 344 bps spread which implies a paltry 60 bps per turn of 2020 leverage.

And why not! 2020 is going to be marvelous, right?

As the story now goes, demand is strong, Tesla is profitable, and it's flush with positive cash flow and a fat bag of cash. China production is off and running and Model Y is on its way by summertime, sooner than expected. Even better, CyberTRUCK!

What can go wrong?

Demand has hardly been proven to be sustainable. US trends offer the most important indicator of the sustainability of Tesla's future demand after the surge from new market launches. What we've seen is unrelenting demand erosion for Model 3 even after a year of multiple rounds of price cuts plus expensive incentives. This helps explain why Tesla is so anxious to accelerate the launch of Model Y, and signals that Model Y sales will likely cannibalize Model 3, as I have projected, rather than augment growth.

Model 3 has wrestled with demand erosion despite strong prevailing business and economic conditions, and given how similar Model Y is to Model 3 it may fare little better.

The pressure will intensify if global EV sales sink as I expect this year—even in China—as favorable conditions fade as we've already observed with traditional auto sales. Tesla hasn't managed to build strong, solidly profitable operations or financial stability after 16 years, including the last decade during the longest economic recovery on record. It could struggle mightily in a weakening environment and while facing ever more formidable competition from its stronger, better-capitalized rivals. Faltering demand for EV batteries in the US and China signal weakening sales trends well into 2020, and potentially longer.

Tesla already seems concerned about China, arguably its most important market now. The promised price increase on imported Model 3s apparently has been tabled, and Tesla instead has been talking about reducing prices by as much as 20% on China-made Model 3s. A 9% price cut was implemented just before the first local deliveries began a week ago. This followed the 12-26% price cut announced in November on long-struggling Models S&X.

Tesla is already giving up margin. Tesla still can't make a dime of profit on its low-end Model 3 made in the US. Why would it proactively sacrifice precious margin in China, potentially its biggest market and where it claims much lower and rapidly falling production costs, if it believes demand is as strong as promised?

Tesla already has stumbled with Chinese buyers. Model 3 had a rocky launch in China, with lower than expected demand not helped by Tesla's volatile sales strategies. Price-conscious customers also got irritated by Tesla's frequent price reductions, and angry buyers even protested Tesla's stores when prices were lowered significantly after their purchases. Prospective buyers will likely hold out for even lower prices already signaled.

A significant chunk of potential buyers in all Model 3 markets probably will decide to hold out for Model Y now that its launch is imminent. It's a crossover, it's a little bigger than Model 3 (ignoring the ridiculously cramped third-row seating), and it's likely to come at much lower prices than currently projected—mitigating its promoted increased profitability.

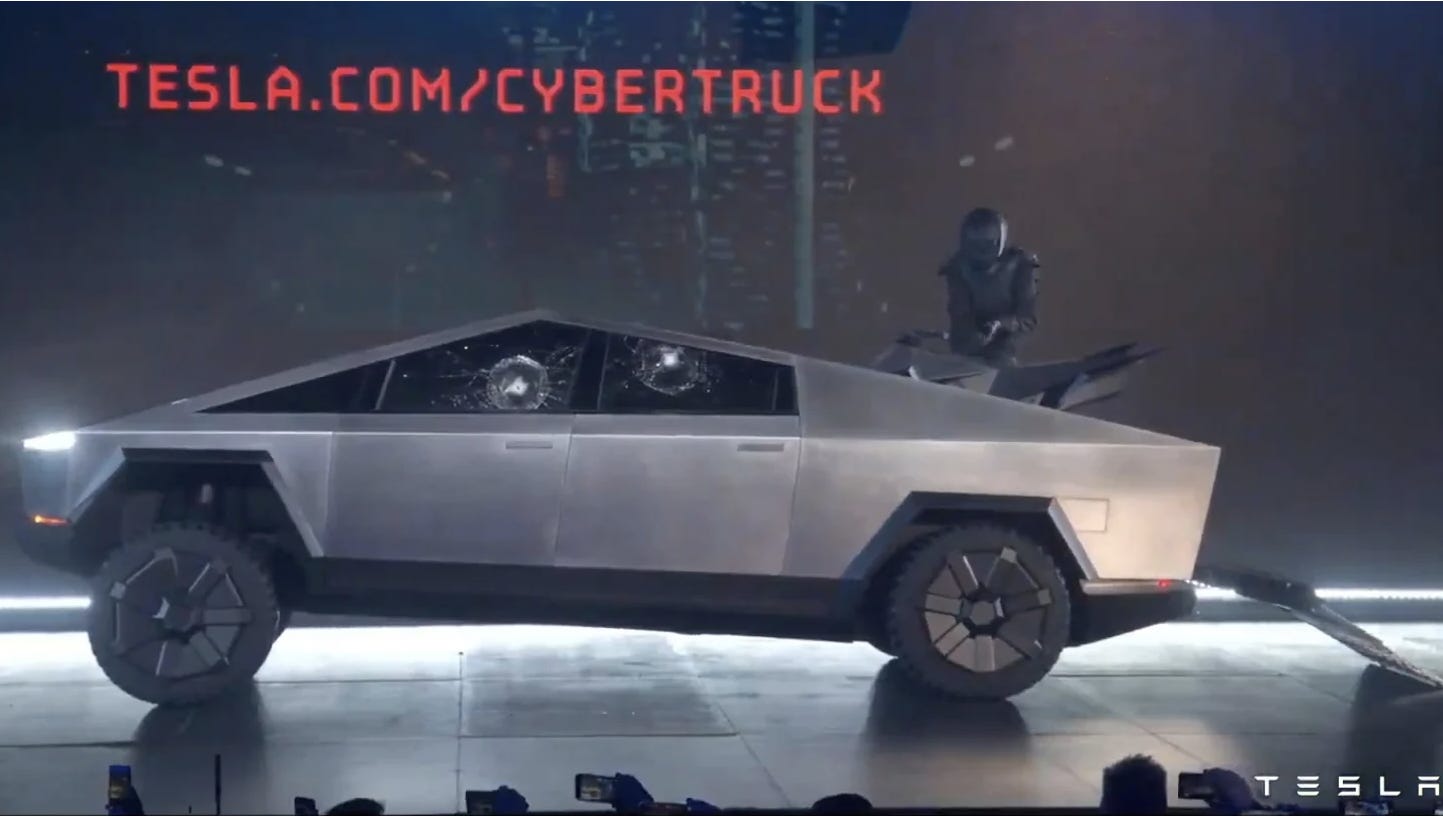

CyberTruck is little more than a party favor. I have another report in progress detailing practical problems I see with the CyberTruck, but there's no rush since it probably won't arrive for another 2-3 years, or more. We really have no idea what it will be by then or how much it will cost. Tesla can't even guarantee the price on Model 3 a month from now. And if its botched big reveal is any indication, much less Tesla's long track record of bombastic promises that don't materialize (robotaxis? ride-hailing?), CyberTruck probably won't live up to its hype.

For example, so much for bullet-proof glass and 3,500-pound payload capacity:

Tick Tock, Tesla

It's anyone's guess how long the market frenzy will continue. Limited and potentially problematic fourth-quarter results released in a couple of weeks may be quickly dismissed. Audited results won't be filed until halfway through the first quarter when holes in the pinata may become more clear. Or maybe not. We'll see. Tesla's biggest fans have short memories and infinite enthusiasm.

That's what Tesla will count on upon the conversion of the convertible notes, which could happen during the heyday window over the next month or two. If so, I expect Tesla will settle largely if not entirely with cash, funded by new convertible notes likely priced low, say 1%, with a conversion price at least 40% higher versus the prevailing stock price. At the recent high that implies at least $760. Settling mostly with cash will minimize dilution that will come if Tesla elects later to deliver mostly stock, as I expect, to satisfy the warrants which sport much higher strike prices.

If this happens, I expect the force will be strong for the new notes even if Tesla elects to raise more than the $4.3 billion currently outstanding in existing bonds given the cheap coupon, keeping leverage high.

All this can be wrapped up with a pretty bow before the end of the first quarter, long before the hangover takes hold if Tesla's prospects deteriorate as much as I expect.

TSLA 5.3% Senior Notes due 2025 are up 5 points since my last report to 100.8 (5% ytw; 344 bps). This offers a skinny 60 bps of spread per turn of estimated 2020 leverage, more suitable for investment-grade credits versus volatile Tesla with its "Caa1/B-" badging from Moody's and Standard & Poor's. Maintain “Underperform."

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.