Tesla: So Long, Free Money

Stellantis says it will stop buying billions of dollars in energy credits from Tesla, leaving a giant hole in Tesla's "profit" potential and threatening its significantly overstated credit quality

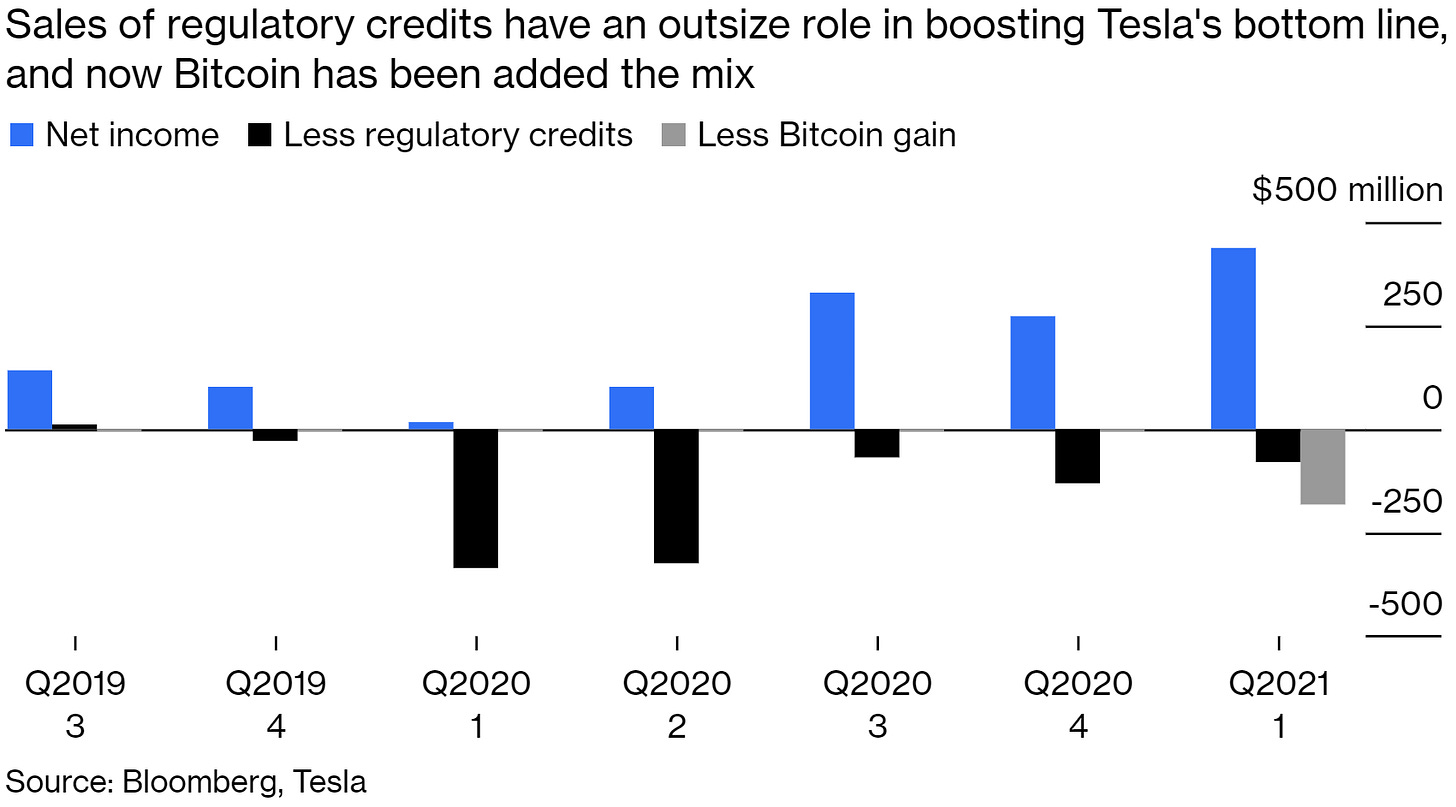

For years now, Tesla (TSLA) and its ardent fans haven’t worried that none of its businesses are profitable because it has sold billions of dollars in energy emissions credits to offset its rivers of red ink (see my latest report on this, Tesla Goes To Record Extremes To Create Q1 "Profits" on 4/28/21).

They dismissed concerns that every penny of cash it has ever banked came from selling said energy credits on top of selling billions in stock to said fans and borrowing even more in debt.

Pull these pesky threads and everything can unravel quickly, as I long have warned (for example, in Tesla: The Sky's The Limit...Until on 1/28/21).

Sure enough, Stellantis NV (STLA) told reporters this week that it expects to meet European emissions standards on its own this year without buying any more credits from Tesla.

That creates a big problem for Tesla because lucrative energy credit sales to Stellantis have been the primary source of all of Tesla’s manufactured “profits” since Q2 2019, which created:

the basis for Tesla’s recent addition to the S&P 500 Index

and its mythological equity valuation

and its ability to sell stock at grossly inflated prices

and its artificially inflated credit rating which lets it borrow with impunity at cheap rates.

It Was Good While It Lasted

Stellantis is the product of the $50 billion merger of Fiat Chrysler Automobiles NV and PSA Group which closed in January to create the fourth largest automaker in the world.

Fiat Chrysler had struck the deal with Tesla in May 2019 to buy roughly $2 billion in energy credits going forward to help it meet tightening European standards for carbon dioxide emissions.

The timing was perfect for Tesla which, at that time, had just reported a disastrous first quarter and was quickly burning through its cash (see Quick Take on Tesla Q119 Deliveries: Yes, They Were Bad on 4/4/19).

Tesla managed to sell only $327 million in energy credits combined for the first and second quarters of 2019. This was enough to create most all of the increase reported in total gross profit and nearly half of total reported EBITDA for the first half of the year. The combined $1.44 billion net loss for both quarters was whittled to the $1.1 billion loss reported, but Tesla still was solidly unprofitable and draining cash to multiyear lows.

Early in the second quarter of 2019 Tesla needed to quickly market surprise offerings to raise more than $3.5 billion in cash selling bonds, stock, and warrants (see Tesla: When a Spartan Diet + $2 Billion Isn’t Enough on 5/17/19). The deals came to market May 2nd and were priced the next day.

CEO Elon Musk did not, as I noted at the time, disclose Tesla’s urgent liquidity distress to investors in the first quarter call just a week earlier.

Instead, even as Tesla’s bankers obviously were at that moment finishing up work to announce and market both deals in a matter of days Musk had the gall to tell investors:

"I don't think raising capital should be a substitute for making the company

operate more effectively," Musk said. "It's healthy to be on a Spartan diet for a while." He added, "there is some merit to raising capital. But this is sort of probably about the right timing."

(Tesla: When a Spartan Diet + $2 Billion Isn’t Enough, 5/17/19).

Only after those deals closed did Musk admit, and only to employees, that this massive cash infusion was only enough to cover operations for 10 months.

Enter Fiat Chrysler with its $2 billion deal, signed at roughly the same time, to buy energy credits from Tesla. Yet Tesla also failed to disclose any details about this vital lifeline to investors, even when specifically asked about such deals on the second quarter conference call in July 2019.

Instead, Musk told investors on that same call that selling regulatory credits was a “relatively small part of the equation for Tesla.”

Oh, Really?

That was plainly not true then or now, and there’s little doubt in my mind that Musk and Tesla knew they were misleading investors.

CEO Carlos Tavares said this week that Stellantis (formerly Fiat Chrysler) has paid Tesla 2 billion euros—$2.4 billion—for energy credits in 2019-2020 and through the first quarter of this year.

This corresponds with $2.4 billion Tesla has reported in revenue from energy credits since then: $267 million in the second half of 2019 after the deal closed plus $1.6 billion for 2020 plus $518 million in the first quarter, suggesting Stellantis supplied most if not virtually all energy credit sales Tesla generated during those periods.

At the same time, total deliveries have escalated to impressive levels, with 368,000 (up 50%) in 2019 and 503,000 up 37%) in 2020. However the pace of growth began to slow markedly from the previous triple-digit pace as new launches of Model 3 in Europe and Shanghai lapped and failed to sustain early momentum in the face of fierce and escalating competition which is shrinking Tesla’s dominance in every key market. I noted similar trends in the US following the full launch at scale of Model 3 in Q2 2018.

The pace of revenue growth has slowed faster than deliveries, hurt by multiple rounds of severe price cuts Tesla needs every quarter to boost sales versus tempering demand and escalating competition. Sales of pricey Models S & X have plunged, eroding mix. Average revenue per car has fallen every quarter at a double-digit pace y/y.

Improving production efficiencies helped offset eroding revenue quality to boost gross profit, but not by enough to cover rising overhead costs and other expenses sufficiently to make Tesla profitable.

For that Tesla still needs help every quarter, and by rapidly increasing amounts, despite increasing annual revenue by $15 billion since 2018.

That help has come almost entirely from energy credit sales. Tesla started reporting net profit as of the third quarter of 2019, the very next quarter after the Fiat Chrysler deal was signed and every quarter since.

By the second quarter of 2020 Tesla had generated the required four consecutive quarters of “reported” profit it needed to be added to the S&P 500 Index, which happened in November. Tesla stock spiked to atmospheric levels and Elon Musk became the richest man on the planet.

As a result, Tesla was able to sell a stunning $12.3 billion in stock in 2020 alone. That cash plus cash from energy credit sales accounted for all of the increase in cash for the year plus a comparatively modest, but first ever net decrease in debt.

S&P also seized on this to boost its credit quality rating on Tesla bonds, conveniently just one day before it slotted Tesla into its S&P 500 Index in sixth place as the most expensive company ever added. S&P anointed Tesla with an incredible “BB” rating—near investment grade, saying Tesla’s “mounting liquidity has substantially reduced its financial risk.”

Well yes, a boat load of cash can solve a lot of problems. However, as I pointed out, Tesla’s operations don’t generate profits or cash (Tesla: The Sky's The Limit...Until, 1/28/21). Its fortunes have come from selling billions of dollars in energy credits—mostly to Stellantis.

This wasn’t a “relatively small part of the equation for Tesla.” It was a game changer.

What happens when the Stellantis deal goes away? And soon?

That’s a Deep Hole

Given the comparatively muted reaction to the news as reflected in barely changed Tesla stock and bond pricing, investors seem to be saying “Who cares?”

That’s not surprising since so many, particularly stock investors, have shown little if any concern about where and how Tesla gets its profits or cash.

Finding a bag of money on the side of the road can sure solve a lot of problems, but it’s not the same as reliably generating bags of money in your own elf tree. Tesla doesn’t do that.

Tesla can and probably will find new buyers for its energy credits, but the market for them is shrinking fast as most major automakers are scaling up their own EV volumes.

Volkswagen, for example, recently agreed to buy energy credits from Tesla in China. While terms were undisclosed, I doubt this deal will match the duration or the $2.4 billion generated from Fiat Chrysler. Volkswagen has begun to launch what will become an extensive stable of its own EV cars which have been well received, particularly in Europe where its new models quickly trounced Tesla every month until it was hit hard by global chip shortages Tesla has managed to avoid. Volkswagen also is building additional EV factories in China and in Europe so it seems likely to scale up commensurately.

So the real point is, as it should be, what will happen if Tesla has to rely mostly if not entirely on the fruit from its own operations?

Profit Could Fall—By a lot

Tesla already failed this test in the recently reported first quarter (see Tesla Goes To Record Extremes To Create Q1 "Profits" on 4/28/21). Despite record deliveries, Tesla still generated lower revenue and essentially flat to weaker EBITDA, profit, and cash flow versus the fourth quarter, excluding a record $518 million (up 46%) in energy credit sales plus $101 million in Bitcoin gains. Chalk it up to eroding revenue quality and spiking costs—which is only going to get worse as the year progresses and Tesla comes under greater competitive pressure than it expects in the second half of the year, as I expect.

It looks like Tesla won’t have the Stellantis energy credit sales going forward. If so, Tesla will have to generate new profit contributions to make up for the $428 million (up 285%), $397 million (up 396%), and $401 million (up 202%), respectively, from energy credit revenue reported in each of the second, third, and fourth quarters of 2020—$1.23 billion (up 223%) in total. And the record $518 million in the first quarter this year, perhaps the last energy credit revenue from Stellantis, has become the tough comp to beat in the first quarter of 2021.

These are big numbers to conjure, and it won’t look good if Tesla has to keep selling Bitcoin—it’s latest and most ridiculous shiny object—to plug the gap.

Cash Burn Could Accelerate

Energy credit revenue accounted for roughly a third of the $5.9 billion of cash generated from operations reported in 2020. The $4.36 billion in CFFO excluding energy credits was virtually consumed by $4.3 billion reported in capex from all sources: primary capex, solar system spend, and $1 billion in capex Tesla funded with leases instead to preserve cash.

In the first quarter Tesla actually consumed $543 million in operations excluding energy credit revenue and considering capex from all sources, instead of generating $293 million in cash as reported—a negative gap of $836 million (Tesla Goes To Record Extremes To Create Q1 "Profits" on 4/28/21).

That negative gap can be traced also to sharply higher primary capex, which increased $900 million y/y to $1.35 billion. It’s going to get worse over the next three quarters. Primary capex is projected at $4.5-6 billion versus $3.16 billion in 2020. This will intensify pressure on cash flow as Tesla also struggles to fill the $1.23 billion gap noted above versus energy credit revenue generated through yearend last year.

It doesn’t help that a sizable chunk of Tesla’s reported $17.1 billion in cash isn’t cash it can freely spend, as I detailed again in Tesla Goes To Record Extremes To Create Q1 "Profits". Excluding $745 million in customer deposits plus sharply higher $7.8 billion in cash held overseas, mostly in China and heavily restricted by Tesla’s China bank agreements, leaves roughly $8.6 billion in freely spendable cash versus $11.9 billion as similarly adjusted as of December 31st.

Given Tesla’s withering revenue quality and rising costs, I expect Tesla will struggle to improve profitability going forward. If so, and assuming trends continue and that Tesla can’t replace most or all the $1.23 billion lost from energy credits noted above, it could consume more than $3 billion in cash by yearend without contributions from other sources: borrowing, stock/option sales, and sales of Bitcoin.

This would leave effectively spendable cash at just $5.3 billion, down 55% for the year.

Growth Plans Could Be Scaled Back

Another major consequence of acute and increasing pressure on profits and cash flow is that Tesla could scale back its ambitious expansion plans and further delay already long overdue new model launches and the controversial redesigns of the stalled Models S & X (discussed in Tesla Reports Solid Beat With Strong Q121 Deliveries, But… on 4/4/21).

If so, this could slash already ambitious targets from Tesla and market consensus for revenue and profits for 2020 and beyond, throwing ice water on Tesla's falling but still exorbitant market cap of $640 billion as of today.

Some of this already is happening. Tesla had promised the refreshed Models S&X would be out in January, but a check on the web site indicates they won’t appear until before the second half of 2021 to 2022. This is hardly surprising. As I noted again in a recent report:

Tesla’s early announcements about the redesigned Models S & X revealed dubious gimmicks like a yoke steering wheel which may be unsafe, letting the car “guess” at gear shifting and direction using Tesla’s problematic Autopilot sensors, and moving key driver controls into Tesla’s touchscreen which recently was recalled for going dark while driving, among other issues.

We're Not Surprised Tesla has Quietly Delayed Deliveries of "Refreshed" Models S & X, 4/7/21

Tesla’s chronically troubled Germany plant expansion (labor clashes, environmental concerns, delayed government approvals, unpaid bills) has just been delayed again, pushing the latest July 2021 target for opening by another six months.

Credit Risk Could Spike

I’ve long warned that Tesla’s reported EBITDA dramatically overstates its core profitability, which also masks substantially higher credit risk.

Energy credit revenue accounted for roughly a third of the $5.8 billion in reported EBITDA for 2020, a result further bloated by another third by Tesla’s add-back of spiking stock-based compensation at $1.73 billion (up 93%).

First quarter results were even more aggressive, as I recently noted:

Stripping out $518 million in energy credits + $101 million in Bitcoin investment gains + $614 million added back in stock-based compensation (a disingenuous practice designed to embellish income) reveals core EBITDA at just $608 million (6.8% margin on adjusted revenue), which was more than accounted for by $621 million in depreciation & amortization. EBITDA last year as similarly adjusted was just $307 million (5.5% margin).

Tesla’s maneuvers inflated EBITDA by 203% this year and 209% last year. And trailing unvarnished revenue was $33.9 billion with $2.5 billion in EBITDA—both well short of targets prescribed in Elon Musk’s compensation package.

Leverage was substantially understated at 1.9x on reported EBITDA as a result, versus the still uncomfortably high 5.1x on core EBITDA.

Tesla Goes To Record Extremes To Create Q1 "Profits," 4/28/21

Just stripping out energy credits could slash EBITDA margin by 500 bps. Leverage could increase by a full turn or more as EBITDA drops, worse if Tesla resumes borrowing to bolster cash as I expect—as it has done every quarter in its history.

The downside risk to Tesla’s already overvalued bonds could be significant, especially if its deterioration materializes after the company refinances its 5.3% notes over the next few months, as I expect. And it's reasonable to assume that Tesla may want to head off paying significantly a higher interest rate by refinancing sooner, before its operations may come under pressure versus the profoundly cheap yields it can snag now while it enjoys market adoration.

The bonds are callable now at 103.98, which drops to 102.98 in August, and I suspect Tesla could refinance them for another 10 years at inordinately low 4% or so—yields roughly 300-400 bps lower versus yields associated with credit quality metrics closer to "CCC" ratings Tesla’s core operations actually produce.

Either way, increasing pressure on profitability, cash flow, and liquidity on top of potentially increasing debt could trigger credit rating downgrades on Tesla’s debt and possibly significant downside risk on Tesla bonds.

Tesla's 5.3% senior notes due 2025 are little changed since my last report at 103.9 (1.6% ytw; 69 bps). This offers no credible upside, particularly given good odds that the bonds get refinanced soon, and perhaps 5 points or more in downside risk if that doesn’t happen and Tesla’s operations & financial condition deteriorate as I expect. The bonds remain excessively valued versus, for example, the BoA High Yield general index yield of 4.19% even though Tesla is a weak B3/BB- issuer with “CCC” quality metrics on its underlying core profitability and leverage. Maintain "Underperform."

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.