Tesla's Car Business Finally Turned A Profit. Really. Time For A Big Bond Deal

What's next for Tesla bonds after it finally reports record revenue and (gasp) it's first ever legitimate profit could be big. Really big.

Tesla (TSLA) wowed investors last week by beating market estimates with record revenue and it’s first ever legitimate profit generated mostly from its actual operations for the second quarter.

Is this sustainable? Unclear. Tesla remained foggy about guidance and CEO Elon Musk warned that the critical chip shortage was a “serious problem” that could impair forward results. Musk also volunteered that Tesla’s pricey FSD option was not a “compelling value” until they “make it work” at some point, so he could justify its current $10,000 price or $199 monthly subscription.

In the meantime, however, Tesla’s credit metrics are better than ever now that it’s operations prove they actually can make money.

So Tesla may be planning a large bond deal to refinance its expensive 5.3% notes.

Finally, Numbers That Didn’t Have To Be Fudged

One of the biggest gripe from curmudgeons like me about Tesla’s financial performance is that it has persistently padded its numbers with unusual, noncore, and nonoperating items to mask chronically poor operating performance and dramatically weaker credit quality and financial condition (see more discussion on this in Tesla Goes To Record Extremes To Create Q1 "Profit" on 4/28/21.

Tesla has used these boosts to plump up revenue, margins, cash flow every single quarter for 18 years.

The biggest source by far of Tesla’s “profit” generation has come not from selling cars, its primary business, but from energy credits. Indeed, without the $2.72 billion in energy credit revenue reported for the two years ended June 30th Tesla would still be losing money instead of reporting $2.54 billion in net income.

This, as I have pointed out, has been the game changer. Tesla’s manufactured “profits” since Q2 2019 have created:

the basis for Tesla’s recent addition to the S&P 500 Index

and its mythological equity valuation

and its ability to sell stock at grossly inflated prices

and its artificially inflated credit rating which lets it borrow with impunity at cheap rates.

Tesla: So Long, Free Money on 5/6/21

But now this vital lifeline for Tesla finally is drying up since major automakers are able to produce enough EV vehicles to generate their own credits for emission standards compliance (see Tesla: So Long, Free Money on 5/6/21).

Sure enough, energy credit revenue in the second quarter dropped to $354 million, down 17% versus last year and down 32% versus the peak $518 million in the first quarter.

So it’s a very big deal that Tesla reported $1.14 billion in net income—nearly $800 million without energy credit revenue. This blew away the $104 million reported net income for the same quarter last year which actually was a $324 million loss without energy credit revenue.

Solidly profitable.

Selling Cars For A Living

Revenue was up 98% to $11.96 billion, and up 111% to $11.6 billion excluding energy credit revenue versus similarly adjusted results last year.

This came mostly from the 97% increase (117% ex energy credit revenue) in Auto segment revenue (97% of total revenue) thanks a 114% increase in total deliveries to a record 201,304.

Better quality revenue was matched with impressive cost reductions, including a 10% reduction in cost per vehicle delivered. Adjusted Auto segment gross margin (excluding energy credit revenue) jumped to 25.2% versus 15.2% last year. Operating expenses were up only 67% as SG&A, R&D, and Depreciation all dropped substantially as a percentage of revenue.

This resulted in impressive improvement in profitability, even when I excluded boosts which still notably padded results versus similarly adjusted results last year:

Reported operating profit jumped 300% as a result to $1.3 billion (11% margin), and nearly $960 million ex energy credit revenue versus -$202 million last year.

GAAP EBITDA was $1.99 billion (up 124%; 16.7% margin) and $1.64 billion (up 354%; 13.7% margin) ex energy credit revenue.

Reported EBITDA was $2.49 billion (up 106%; 20.8% margin) because Tesla adds back stock-based compensation (which I reject). This means It was $1.66 billion (up 400%; 14.3% margin) excluding energy credit revenue but keeping SBC in the calculation. SBC and energy credit revenue accounted for 33% of reported EBITDA—still high but better versus 73% last year.

Cash consumption was less clear, but also appears improved. Cash generated from operation excluding energy credit revenue was sufficient to cover $1.5 billion reported in CAPEX. That said, Tesla also funds part of capex in leases, which were up again this quarter to more than $1 billion. Reported debt was down $1.4 billion versus the first quarter to $8 billion, $11.1 billion including leases.

This slashed leverage to just 1.4x on reported EBITDA and to 3x on unvarnished GAAP EBITDA—both down by half versus the first of the year and Tesla’s best ever credit metrics (see attached model at the end of this report).

Reported cash was down just $900 million versus the first quarter to $16.2 billion, down $980 million to $15.4 billion excluding customer deposit cash Tesla can’t spend.

The bottom line is Tesla has low actual leverage on credible EBITDA, zero net debt, fat operating margins, actual profit, and actual free cash flow altogether for the first time in its 18-year history.

If Tesla can hold sales and margins at similar or better levels in the second half, which I expect, yearend leverage for 2021 on reported EBITDA could drop to 1.3x or better. More important, leverage on GAAP EBITDA excluding '“enhancements” could drop to 2x or better—legitimately investment-grade credit quality. Wow.

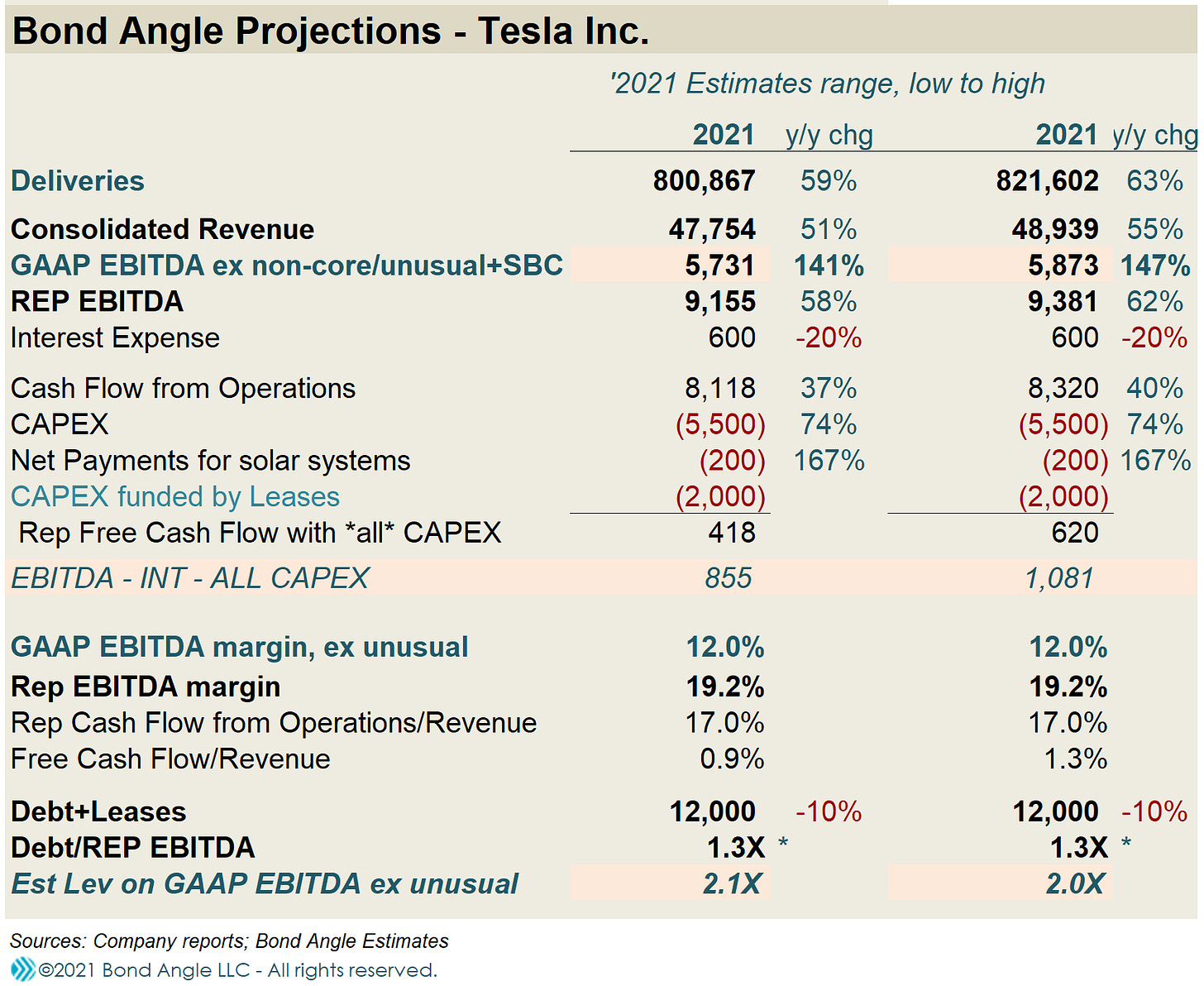

And that’s what I project:

Timing Is Everything

If I’m right, there’s a good chance Tesla is courting the rating agencies right now for a credit quality upgrade.

This would come in handy about now as Tesla prepares to call its expensive 5.3% notes as I have projected it should do for months even as the bonds continued to trade well above the call price (see Tesla About to Call It's 5.3% Bonds on 6/25/21).

Now I suspect Tesla may likely sell new bonds to refinance the old bonds. And why not, given how dirt cheap even high yield bond yields still are. Bank of America’s US High Yield Index closed at 4.16% ytw today; the BB High Yield Index was 3.21%. ytw.

Tesla’s bonds, by comparison, have persistently traded substantially tighter than even the BB index even though it is lower-rated even at its recent peak B1/BB.

The bonds have traded at 2% ytw and lower for most of this year, generally lower than average yields on investment grade bonds. Recently they even traded at negative ytw for more than a month as the bonds continued to trade above the August 2021 call price.

As I long have pointed out, Tesla’s credit quality metrics certainly haven’t supported such premiums. They didn’t even support it’s credit quality ratings—that is the “BB” rating awarded by Standard & Poor’s, which conveniently bumped its rating higher a couple of days before adding Tesla to its S&P 500 Index back in December as the most expensive new addition ever.

S&P’s lucrative decision was based on Tesla’s four quarters of dubious “profits” which had been entirely generated by selling energy credits that masked more than $1.1 billion actual losses (see Tesla: The Sky's The Limit...Until on 1/25/21).

Not only was Tesla far from unprofitable, reported EBITDA used in credit quality metrics remained substantially overstated. As I wrote then:

S&P got to its happy place by adding back lease expense of roughly $430 million to simple GAAP EBITDA to get $4.4 billion in lease-adjusted EBITDA and produce a low leverage calculation of 3.4x. While this doesn’t add back excessive stock-based compensation expense as Tesla does, and which I heartily oppose, it does include more than $1.6 billion in energy credits plus unusual and nonoperating items which otherwise indicate leverage on core lease-adjusted EBITDA closer to 6x and my much less generous calculation near 7x on unvarnished EBITDA.

Tesla: The Sky's The Limit...Until on 1/25/21

With Tesla now able to legitimately generate strong credit quality metrics approaching investment grade thanks to credible EBITDA and sharply lower debt I imagine S&P and likely even Moody’s will be amenable to boosting Tesla’s ratings higher.

If so, Tesla could come to market selling bonds at roughly 2% yields. At that price, there’s a good chance Tesla will raise much more than the $1.8 billion it needs to retire its 5.3% bonds. It would be crazy not to.

How much? It could actually increase debt by more than $2 billion, for example, and still keep yearend leverage at or lower than it is right now. This implies $4 billion in new bonds.

Money can’t buy happiness, so they say, but who wouldn’t want a few billion more in extra cash for a rainy day?

Tesla’s problems aren’t solved, after all. As I have been warning for than two years, Tesla is facing eroding market share in all its models in all its major markets. Most of its problems are self-inflicted thanks to Tesla’s false and misleading claims, the notoriously poor build quality and reliability of its cars, and its appalling customer service. Tesla is plagued by aggressive accounting with dubious disclosure, and it is run by an unscrupulous, autocratic, out-of-control CEO largely unchecked by board governance. It’s facing increasing legal pressure as a result from mounting lawsuits and intensified regulatory investigations in the US and in China. China, in particular, has come down hard on Tesla already this this year (see Nikola’s Ex CEO Trevor Milton Arrested for Lying to Investors. Some Ask, “What About Elon?” on 7/29/21 and Tesla Q2 "Complications" on 6/29/21).

Such headwinds will increasingly overshadow progress Tesla manages going forward, which will become even more tenuous next year as the competitive landscape intensifies. Hard won pricing gains and margin expansion will likely shrink.

This is bad news for Tesla’s stock which struggles to claw back to ground zero ytd and yet still trades at three-digit multiples of ambitious future earnings expectations. Welcome to working without a net.

Buyers of Tesla’s potential new bonds, by comparison, can bank on convincing EBITDA, likely sustainable if not improving margins, and ample cash to cover operations and debt service plus expensive legal settlements and regulatory fines. This offers credible downside support and the potential 2% or so yield I expect may offer up to 50 bps of tightening down the road.

Better than a stick in the eye.

Tesla's 5.3% senior notes due 2025 are lower since my last report and now trading near the call price at 102.7 (1.9% ytw; 190 bps). This offers no credible upside given that these bonds are being refinanced. Better to wait instead on new bonds I suspect Tesla will issue to refinance this issue, sweetened by a credit quality upgrade to at or near investment grade and yield near 2%. Maintain "Underperform."

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.