Tesla’s New Plan: Buy Before You Try

Tesla's Long Awaited Launch Of The "Every Man" Model 3 Is Hurried; Its Thrown-Together Online Sales Model Seems Desperate

Tesla Motors (TSLA US) revealed that's its big news teased since Wednesday night was the long-promised launch of the "Everyman" version of its flagship Model 3 priced at $35k, give or take depending on new options for range and interior selections.

Buried in the lede is that Tesla also is initiating additional price cuts across the board, including for Models S and X. It's moving to an online-only sales strategy and closing hundreds of stores which will trigger additional layoffs.

Oh, and the first quarter will not be profitable after all, according to CEO Elon Musk on the conference call today to discuss Tesla's announcements.

So is Telsa pursuing a new, evolving strategy for the future or is it being pushed to retrench?

What's New?

It was nothing if not dramatic, starting with CEO Elon Musk's cryptic tweet Wednesday night that news was coming on Thursday. In the hours before the announcement, Tesla halted order-taking on its website and replaced the screen with a black page saying "The wait is almost over. Good things are launching shortly."

Promptly at 2pm PST Tesla posted the news on its blog, including:

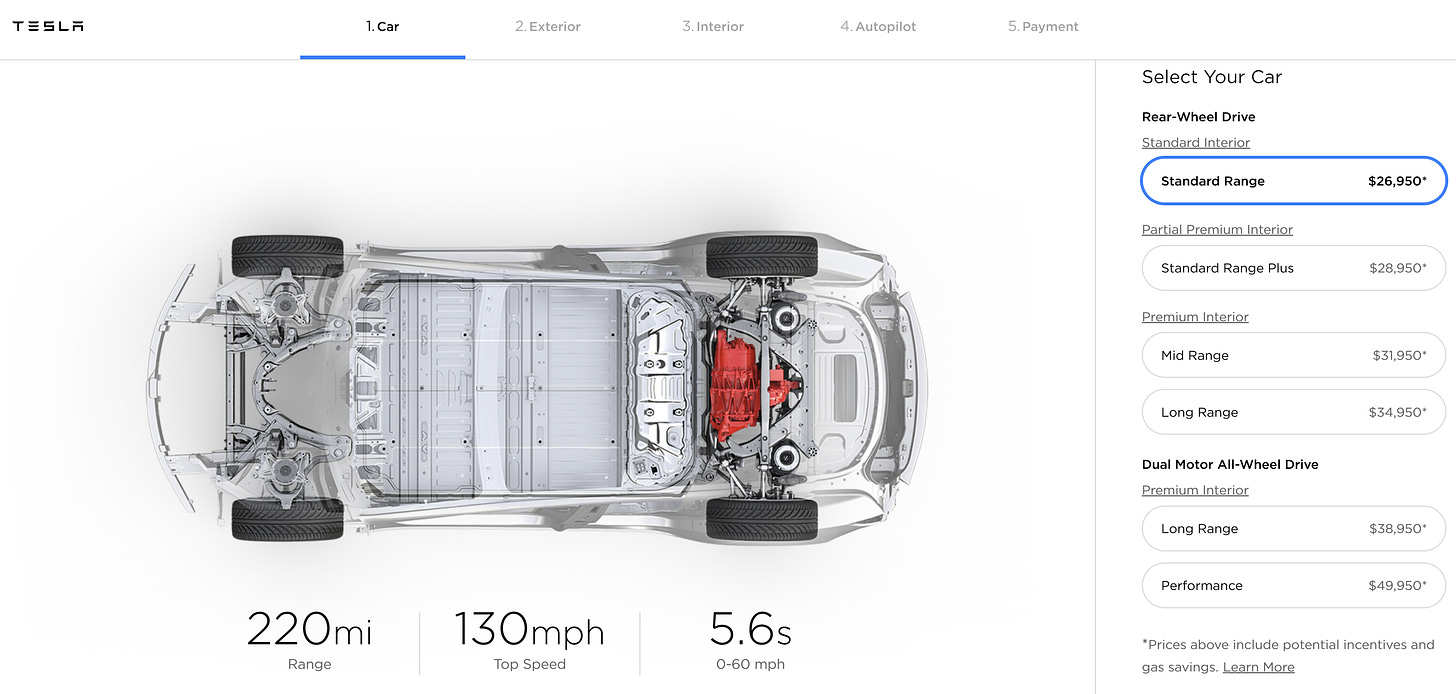

“We are incredibly excited to announce that the standard Model 3, with 220 miles of range, a top speed of 130 mph and 0-60 mph acceleration of 5.6 seconds is now available at $35,000! Although lower in cost, it is built to achieve the same perfect 5-star safety rating as the longer-ranged version, which has the lowest probability of injury of any car ever tested by the U.S. Government.

In addition, we are introducing the Model 3 Standard Range Plus, which offers 240 miles of range, a top speed of 140 mph, 0-60 mph acceleration of just 5.3 seconds and most premium interior features at $37,000 before incentives. For 6% more money, you get 9% more range, more power, and an upgraded interior.

...We’re also excited to announce that we’re implementing a number of firmware upgrades for both new and existing customers. These upgrades will increase the range of the Long Range Rear-Wheel Drive Model 3 to 325 miles, increase the top speed of Model 3 Performance to 162 mph, and add an average of approximately 5% peak power to all Model 3 vehicles.”

The website was updated accordingly:

Then Came the Bill

The blog posted continued with:

“To achieve these prices while remaining financially sustainable, Tesla is shifting sales worldwide to online only. You can now buy a Tesla in North America via your phone in about 1 minute, and that capability will soon be extended worldwide. We are also making it much easier to try out and return a Tesla, so that a test drive prior to purchase isn’t needed. You can now return a car within 7 days or 1,000 miles for a full refund. Quite literally, you could buy a Tesla, drive several hundred miles for a weekend road trip with friends and then return it for free. With the highest consumer satisfaction score of any car on the road, we are confident you will want to keep your Model 3.

Shifting all sales online, combined with other ongoing cost efficiencies, will enable us to lower all vehicle prices by about 6% on average, allowing us to achieve the $35,000 Model 3 price point earlier than we expected. Over the next few months, we will be winding down many of our stores, with a small number of stores in high-traffic locations remaining as galleries, showcases and Tesla information centers. The important thing for customers in the United States to understand is that, with online sales, anyone in any state can quickly and easily buy a Tesla.

At the same time, we will be increasing our investment in the Tesla service system, with the goal of same-day, if not same-hour service, and with most service done by us coming to you, rather than you coming to us. Moreover, we guarantee service availability anywhere in any countries in which we operate.”

Key Takeaways:

First, it's obviously good news that Tesla is finally offering the lower priced Model 3 it's been promising for three years. However, Musk clarified on the conference call discussing the news that this price is only available for the base model in black. Changing the color ($1500) and adding basic Autopilot ($3000) boosts that price to $39.5K. This is still more affordable versus the previous price but you're also still getting a pretty basic look.

There was a curious lack of enthusiasm for this potential boost in sales by Musk, given just last month on the fourth quarter conference call he had volunteered that "demand for Model 3 is insanely high" if Tesla could just get the price down.

Also, just last month Musk and the CFO had refused to clarify where the reservation book stood versus the previous reading last summer of 420,000, or even that they tracked this anymore.

Instead, remarkably, Musk and Co. told investors that "reservations are not relevant for us" presumably just weeks away from being able to finally open the floodgates on sales of more affordable models.

And when Tesla implemented another round of lay-offs in January, it explained this was necessary to cut costs while it ramped up production to support increased shipments to new markets in Europe and China—but this didn't seem to start until a couple of weeks ago.

Even more strange is that among the hardest hit in the layoffs was the customer delivery department, where Tesla slashed more than half the workers who are responsible for getting new cars to customers across North American.

“There are not enough deliveries,' one of the former employees told Reuters. 'You don’t need a team because there are not that many cars coming through.”

How did Tesla plan to handle spiking deliveries from an apparent boost in sales starting in a matter of weeks with its introduction of the new, lower-priced Model 3 just as it also transitions into an online-only sales model and starts closing stores?

Recall Musk's complaint about “delivery hell,” at the end of the third quarter last year, when 1) Tesla pulled out extra employees and even Tesla owners to help get cars delivered and 2) Musk reported buying extra carriers to handle the rush to deliver cars—a claim quickly disputed by trucking industry execs. Tesla expects to deliver nearly twice the volume of cars this year versus 2018, with more than half to be sold in North America.

Also, Tesla said it opened 27 new sales centers in the fourth quarter, and as of the 2018 10k filing just over a week ago, Tesla still projected "ongoing expansion of our retail locations." Why does it suddenly need to start closing sales centers?

It's not that the online-only sales model is a bad idea.Sexy startup Carvana Co (CVNA US) is growing voraciously by reinventing the used car market with its sleek online sales model and its novel pick-up/delivery door-to-door strategy. It even has actual car "vending machines" where buyers can go pick up a car they just bought online. How cool is that!

Carvana's buyers love it—and it sports a consistently high customer satisfaction rating as a result.

The model, when well-executed, makes intuitive sense. Most buyers don't like to haggle on price, and younger buyers, in particular, do virtually everything online these days so buying a car online makes perfect sense.

The used car market is much more treacherous versus the new car market, where Tesla already has substantial leadership in its niche. Tesla should be able to accomplish this evolution to online sales—except for now it appears to be rapidly running out of cash.

The Sound of Air Escaping

I suspect Tesla's is facing substantial and increasing liquidity pressure from pervasive margin squeeze coupled with escalating cash pressure. For example, Tesla will be paying off the $920 million convertible bond maturing tomorrow with cash because its stock substantially trailed the conversion price as I expected. There goes Tesla's cash cushion.

Here's how this happened:

Tesla's yearend cash balance looked nicely plump at $3.67 billion. However, available cash was only $2.89 billion excluding customer deposits.

Just like in Tesla's "miracle" third quarter, core operations actually were not profitable and did not generate cash (see "Great Magic Trick Tesla; Now Do It Again") and the cash shortfall was offset by borrowing.

Tesla boosted cash with $844 million issued in asset-backed notes in the fourth quarter. Even more troubling, Tesla did not repay $180 million due in December for a SolarCitterm loan. Instead, the loan was extended first to January and then to April, information that only appeared in Tesla's 10-K. Yes, the term loan is nonrecourse to SolarCity and Tesla, but it's still debt contractually due for repayment.

Without the extra borrowing plus the extension of debt due, available cash would have been $1.87 billion. Subtract from that the $400 million cushion required by Tesla's credit facility leaves $1.47 billion in cash available to retire the $920 million in bonds due March 1st.

So Tesla borrowed in the fourth quarter and pushed out the $180 million SolarCity Term loan repayment until the second quarter, indicating available cash at $2.89 billion at yearend—$2.49 billion minus the required CF cash cushion. As of tomorrow that drops to $1.97 billion available cash versus $1.33 billion in debt still due for 2019—that's uncomfortably tight and it's not clear when operations will actually start generating unvarnished free cash flow.

Consider now that Tesla's cash consumption also has substantially increased. Not only are core operations still not sustainably profitable or actually generating cash, first-quarter performance is sputtering. Sales nosedived on weak demand in January versus December, and there's little indication that February sales—US results expected tomorrow—may have rebounded by much, even assuming the step up in sales expected in Europe and China.

Margins remain under pressure. Revenue mix is eroding with now three price cuts this year plus the precipitous declines in sales of the aging Models S and X. This comes as operating costs have been rising with increased production plus increasing repair costs—especially with the problematic Model 3. And yet to preserve cash Tesla has slashed warranty reserves for two straight quarters.

So it's not surprising that Consumer Reports withdrew its recommendation on the flagship Model 3 due to serious quality and reliability concerns. I have warned about increasing problems for months with Tesla quality controls curtailed and flawed cars increasingly delivered to customers (see "Musk and Weird Q3 Developments Are Driving Investors to Telsa's Rivals" and "Tesla: Dave’s Not Here and Musk Won’t Leave" and "Tesla: Down to the Wire"). And Tesla's already has been struggling to keep customers happy.

Tesla also is falling behind with such critical capex projects as refreshing its aging Models S and X and introducing the long overdue Model Y, the Roadster, the Semi, and the Pickup. Adding to this are vital expansions required with its Supercharger stations, customer service stores, and obligated development at existing factories.

Tesla admitted today it will not generate a profit for the first quarter, as I expected, but it projects a return to profitability in the second quarter. We'll see, but it's likely that Tesla's serious liquidity pressure may drive it to raise cash in the near term.

It the meantime, I expect debt to continue to creep higher every quarter to fund continuing cash shortfalls—plus the potential refinancing of existing debt outstanding. If so, leverage is not likely to improve in 2019 even with higher EBITDA.

Speaking of rushing, and burning cash...

What's Up With Tesla Shanghai? Anyone?

Apparently Musk's tease with his mysterious change to "Elon Tusk" for a twitter handle was a slight of hand so we puzzle fans might be fooled by the Chinese reference (Tusk => Elephant => Chinese symbol for "sign of good things to come") to guess that Tesla's news would be some positive development with Tesla Shanghai Gigafactory 3.

Once the confetti settled, however, Elon was back to Musk on Twitter and we are back to wondering why it's taking so long for Tesla to secure funding for the factory.

As I noted back in January when Musk materialized in Shanghai with a surprise groundbreaking ceremony for the site, it's very unusual and disconcerting for a project of this size to get underway without "funding secured."

Indeed the longer construction goes on the less leverage Tesla has to negotiate terms of the funding and the more investors have to worry about what might be keeping the deal from coming together. After all, there has been substantial funding available for electric car production facilities, and China personally welcomed Tesla as the first foreign carmaker invited to build and operate a factory in the country without the requirement of sharing ownership (and profits) with a Chinese partner.

We've been hearing for weeks about pending assimilations of bank groups ready to put the deal together, most recently by Smartkarma colleague JL Warren Capital, but until a deal is announced there is no deal. As I explained in "Tesla: Shanghai Surprise," even Tesla's US banks have good reason to be concerned about this project as well as Musk's overseas funding plans.

So until the funding comes through, Tesla is paying the initial $500 million in construction costs, which it clearly can't afford (see Tesla - Truth and Consequences").

Considering all these issues, I can't help but feel like Tesla's announcements today, while mixed with good news, were the result of hurried necessity, much like I felt about the abrupt launch of construction with Tesla Shanghai Gigafactory 3 back in January (see "Tesla: Shanghai Surprise").

Maintain “Underperform” on TSLA 5.3% Senior Notes due 2025, seen at 89.3 (7.4% ytw; 491 bps) on the hope of improving credit quality following the retirement of the March 1st notes. That’s a meager 92 bps per turn of estimated leverage, more likely little improved in 2019 on potentially increased borrowing to offset cash shortfalls—hardly adequate compensation for such a volatile issuer. Given Tesla's persistent uncertainty and escalating risks we could see 3-5 points additional downside from here.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.