WeWork Board to CEO: YouOUT

Notorious CEO Adam Neumann Is Out, But WeWork's Troubles Are Far From Over

The We Company (WeWork) (WE US) board has pushed out CEO Adam Neumann, capping weeks of scrutiny which fizzled its egregiously bloated equity valuation and crated its storied IPO (see Gravity Works As WeWork Doesn’t; Now Plan B).

As I expected, WeWork's largest investor Softbank Group (9984 JP) figured as prominently in Neumann's ousting as it did in driving up WeWork's extravagant equity valuation since, as I noted again in WeWork Board and Softbank Battle CEO For Control, it had invested all of its massive stake when WeWork was valued at $16.9-47 billion versus current estimates near $5-10 billion.

Awkward.

WeWork's troubles are far from over. Ejecting Neumann is only the first step in a long list of pressing concerns plaguing the company which may or may not even be fixable.

But it might be enough to get WeWork's wary bankers back to the bargaining table since, as I have warned, the company's shrinking liquidity and precarious financial condition are its most urgent threats at the moment.

It's Not You; It's Us. No, It's You.

After just over a day since news surfaced that certain WeWork board members, Softbank, and other major investors were moving to push him aside (WeWork Board and Softbank Battle CEO For Control), the deed is done. The board released a formal statement at mid-day today, including:

"WeWork’s Board of Directors today announced the following leadership changes: Co-founder Adam Neumann has decided to step back from his role as CEO, and will continue on as non-executive chairman of the board. WeWork’s Artie Minson, formerly co-president and chief financial officer, and Sebastian Gunningham, formerly vice chairman, have been named co-CEOs of the company. These changes are effective immediately."

Neumann will serve as non-executive chairman, and his voting power will drop to three votes per share from 10 votes. He added in a memo to his staff:

When Miguel, Rebekah and I founded WeWork in 2010, we set out to create a world where people work to make a life and not just a living. Over the past 9 years our global team has built a community of over 500,000 members in 130 cities across 29 countries, and I could not be more inspired by everything we have achieved.

Our business has never been stronger, but since the announcement of our IPO, too much of the focus has been placed on me. Our priority has always been our mission and our community. Because of this, I have chosen to step back as CEO and will concentrate on my role as Chairman of the Board. It is you, our amazing team, that deserve the focus and your daily actions are the secret to what makes this company so special. We have an incredible opportunity to execute on our goals and be measured by our results.

To lead the company forward, Sebastian Gunningham and Artie Minson will serve as Co-CEOs. They are proven leaders that embody the ethos of our culture, with track records of scaling world-changing businesses.

The spotlight on us has never been greater than at this moment, and with this visibility we have an opportunity to expand our global business to more people than ever before.

I am profoundly grateful to each and every one of you for your dedication to this company and our mission. I have never believed in our business, our people, and our future more.

As we take this next step in our company’s journey, I am equally ready to listen, grow, and continue working relentlessly on my commitment to all of you.

-Adam Neumann

So, Who's In Charge Now?

Sebastian Gunningham and Artie Minson, two current WeWork executives, will act as joint chief executives.

CNBC reported, "Minson, a former chief financial officer of Time Warner Cable Enterprises LLC who joined We Company in 2015, will oversee its finance, legal, human resources, real estate and public communications. Gunningham, a former executive at Amazon.com Inc, Apple Inc and Oracle Corp who joined We Company last year, will take responsibility for product, design, development, sales, marketing, technology and regional teams."

Their jobs are little changed. The difference, according to reports, is that they haven't until now been able to run their operations as they were hired to do since autocratic Neumann micromanaged most decisions and kept staff in near-constant organizational turmoil.

Artie Minson joined WeWork as a President and Chief Operating Officer with the aim of “scaling WeWork’s operations and expanding the company’s presence globally.” He became Chief Financial Officer in June 2016.

His steady-handed style and seasoned management experience is counted as a key asset by WeWork executives and employees, especially compared to Neumann's volatility. Comments to Business Insider included, "Artie was always the adult in the room," and he has "a lot of business acumen" and even "seems a little too level-headed to be involved" with the company.

Minion's a particular fan of WeWork's strategy of bulking up via attracting large "enterprise clients," e.g. Fortune 500 companies, which now contribute 40% of total membership revenue, telling Business Insider:

"We're really just getting started on enterprise," he said. "We're now opening buildings at a much higher percentage filled than we used to, and that's because you're not building on speculation; you're building on you know what people want and when they want it."

The trouble with this idea, as I noted in Gravity Works As WeWork Doesn’t; Now Plan B, is "such space also can and likely will disappear in a business downturn as easily as it was added by companies that logically viewed this flexibility as a key advantage to help preserve their own resiliency."

Minion also told CNBC earlier this year that investors should view WeWork's losses as "investments" given the company "had tremendous growth opportunities in building out its co-working properties for an ever-expanding base of clients, or members."

“We really want to emphasize the difference between losing money and investing money,” Minson said Wednesday. “You can lose money or you can invest money. At the end of this quarter, we have these cash flow-generating assets.”

Artie Minion to CNBC, 5/15/19 following WeWork's first quarter results.

Hmm. I'm suspect the only ones buying that kind of logic are the "smart money" folks who kept investing in WeWork even as it missed Neumann's outrageous forecasts over and over for years until it reached that stunning $47 billion equity value back in January (see Gravity Works As WeWork Doesn’t; Now Plan B).

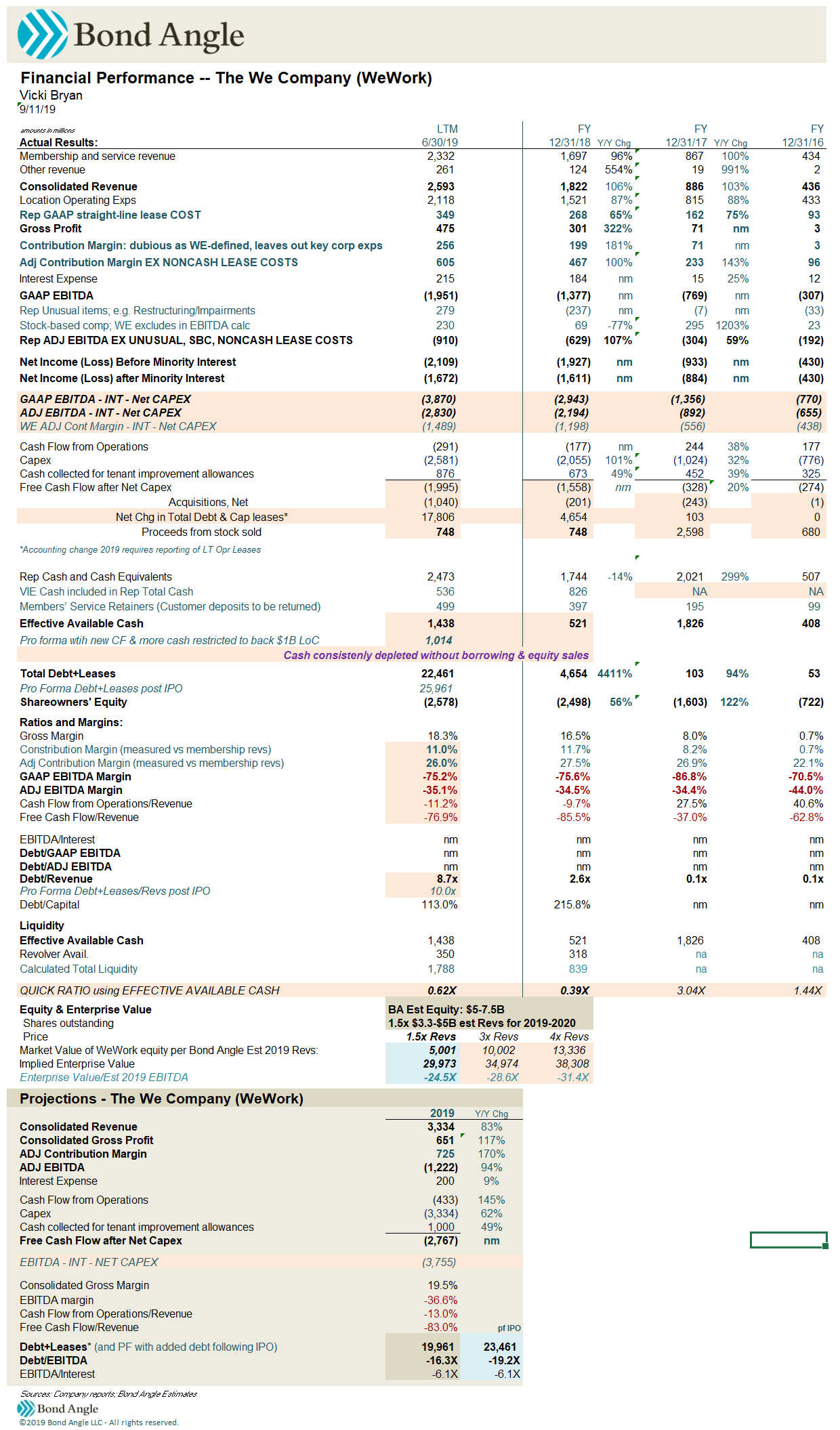

In reality, WeWork lost nearly $300 million in the first quarter of this year and more than $600 million in the second quarter. So far WeWork has proven only that it's expert at losing money, and that's why the company's equity value has plunged to $5-7.5 billion, by my estimate (see attached model).

Sebastian Gunningham joined WeWork last year as vice-chairman. Many at WeWork speculated even before the IPO that he might succeed Neumann at some point. One WeWork exec told Business Insider,

"There was a sigh of relief when Sebastian joined from Amazon because he comparatively exuded so much professionalism and people really trusted him and were like, 'Finally, someone's coming in who knows what's going on." ... "He was the first person to approach any process from the top down with logic instead of some crazy plan. He stuck out like a sore thumb."

No doubt he was significantly different coming from Amazon, where concise planning and execution is the point. He ran Amazon Marketplace as Senior Vice President from 2007-2018. CNBC said Gunningham was "one of CEO Jeff Bezos’s closest advisors, and was part of his elite group of top lieutenants, known as the S-team, for most of his time there. He oversaw more than 30,000 people" versus WeWork's total workforce of 15,000.

Gunningham came to WeWork with the plan of bringing order and balance to Neumann's freewheeling, unstructured management style. He became the "shadow CEO" who introduced structure and accountability through performance audits and company-wide performance targets.

However well suited they may seem to be for the challenges ahead, it remains to be seen how effective they actually will be and how well they work together riding two to one horse as they share CEO functions. I'm also generally wary of management teams left behind when an autocratic leader is ousted; e.g. executives that survive and even thrive in an environment so tightly controlled by an eccentric micromanager tend not to be the type of management capable of confidently fixing and building anew with fresh eyes while crafting a more collegially inspired culture.

At the very least Gunningham and Minson do seem to get they have inherited a dumpster fire. In a memo to staff on Tuesday, they wrote:

“While we anticipate difficult decisions ahead, each decision will be made with rigorous analysis, always bearing in mind the company’s long-term interests and health.”

Back to Business--and Bigger Problems

Diffusing the Adam bomb was a major step, but it doesn't fix WeWork which suffers from serious near-term liquidity pressure, unsettled governance issues and board deficiencies, uncertainty with its IPO, and fundamental flaws with its business model which it has exacerbated with a potentially unsustainable financial structure:

I challenged WeWork's board to replace Neumann with substantially more capable management who aren't there to say yes to an autocratic CEO. It may or may not have done that; we'll see. In any case, the board also is fully responsible for enabling Neumann's extraordinary control and rubber-stamping his every move and misstep. We need to see the board completely revamped with the addition of seasoned industry veterans also independent of undue influence from major shareholders.

The board also should be increased in size from a paltry seven directors to nine-twelve. Governance and management oversight deficiencies need to be addressed, and an independent audit committee created.

As I noted in WeWork Board and Softbank Battle CEO For Control, installing more capable senior management and a credibly responsible board could help WeWork begin to restore its shredded credibility and pave the way for it to pull together stopgap cash financing, if not the full $6 billion in credit facilities waiting in the wings which had been contingent upon closing the now failed IPO. As I said then, I don't expect the IPO to resurface any time soon. I suspect the new plan may include some combination of a smaller $3-4 billion credit line plus $1 billion or so in high yield debt and up to $1 billion in private equity financing (some or all potentially from Softbank).

Key to those bank discussions will be crafting a plan to address how WeWork can quickly curb its severe cash consumption which, as I detailed in Gravity Works As WeWork Doesn’t; Now Plan B, is on a pace that could burn through its effective available cash of $1.4 billion--far less versus $2.5 billion reported--in less than a quarter (see attached model). Given what I expect could be an ugly third quarter closing in five days, liquidity pressure could become acute.

If so, WeWork needs to implement significant cost-cutting now, and it will be painful. Suspending poorly performing noncore housing and educational businesses like WeLive and WeGrow seem obvious. I also wouldn't be surprised to see layoffs by as much as 25-30%--so harsh because, unfortunately, it easier to cut staff than renegotiate WeWork's long-term leases with terms up to 15 years. WeWork's lease costs are among its most expensive and where it also has the least flexibility.

Ironically, this demonstrates the inherent vulnerability I warned about in WeWork's business model: it collects revenue short term while servicing long-term leases, and when business conditions erode its revenue will too because its customers also will cut staff, particularly its enterprise customers which contribute 40% of revenue now. This is, as I noted in Gravity Works As WeWork Doesn’t; Now Plan B, one long term problem WeWork can't easily fix.

The next positive news for WeWork could be getting some interim credit facilities closed, which could ease liquidity pressure into next year, accompanied by an equity injection from private investors to keep the bankers happy. Even this probably won't be enough to offset negative impacts from two or more disappointing quarters ahead.

WeWork 7.875% senior notes are down roughly 3 points to 94.1 since my last report. This still indicates insufficiently low 9.2% ytw/769 bps given its appalling credit metrics and dismal prospects. Upside potential remains limited at best versus downside risk which could be another 5-10 points from here. Maintain “Sell.”

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.