Elon Suddenly Admits Massive Tesla Losses (Because Other News Out Soon Is Even Worse)

Elon Musk admitted Tesla is burning billions at Austin & Berlin plants—just as he saw Q2 becoming "super bad" as I warned cuz plunging China sales mean it can't mask big losses as usual.

Tesla (TSLA) CEO Elon Musk made the stunning admission in a recent interview with Tesla Owners of Silicon Valley that the carmaker is losing billions on "money furnaces" Austin & Berlin plants, Bloomberg reported.

I’m not surprised, but if Elon is willing to suddenly admit something this bad I suspect what’s really spooking him is even more troubling.

By the end of May, when Elon did the interview, he no doubt could see that Q2 results were becoming "super bad" and had decided to cut Tesla’s workforce by 10%.

Elon immediately walked back that projection to squelch the backlash from investors by clarifying only salaried workers would be cut while hourly employee count would rise. Then Tesla proceeded to slash its total workforce anyway while also withdrawing recent job offers—a much stronger reaction given what Elon and Tesla have indicated as near-term problems it will surmount.

This alarmed analysts who have again slashed their second quarter estimates for deliveries to now 250,000-295,000. This approaches my 251,458 estimate, which I had reduced from my original 273,189 figure to account for extended Covid-related shutdowns in China (Tesla China Deliveries: Weaker And More Important Than You Think, 3/14/22).

Either way, the expected drop is sizable versus first quarter results of 310,048, marking Tesla’s first down quarter since Q120 (see Tesla Q1 Deliveries Come In Under The Wire, 4/2/22).

Elon told the world he was worried about the general economy and continuing supply disruptions, reasonable concerns shared by the market for a while now. But we should also expect a sizable hit in the quarter related to the drop in Tesla’s stake in Bitcoin, down now 59% since the end of March and down 46% y/y, which could generate an impairment charge to earnings of near $800 million.

That Bitcoin impairment charge may provide superficial cover for much of a likely significant Tesla’s earnings decline as an unusual, one-time item that tends to be downplayed by market observers cheered as Tesla’s production came “roaring back” in recent weeks as China’s severe lockdowns eased.

They miss the part where Tesla’s more robust competitors, which were subject to the same difficult business conditions, have lost less ground versus Tesla and have bounced back faster. China-based BYD Co, which went fully EV in the first quarter, has become the largest EV seller in the world with more than 500,000 EVs sold in January-May of this year. Tesla took more than 16 years to hit its long promised 500,000 target in 2020—missing guidance by several years.

Even with severe business disruption through the China lockdowns, BYD sales have topped 100,000 every month since March and reports backlogged orders at 600,000 and growing. This trounces Tesla’s best quarter ever in China: 116,060 for Q421. First quarter China deliveries dropped 7% to 108,300 and second quarter results are tracking 75,000—down 31% versus the first quarter and down 36% versus Q421.

The biggest reason was lack of available inventory as China production was shut down. However, as I long have warned, Tesla’s market share has suffered, likely irreversibly, with the sharp increase in outperforming China-based competitors plus accelerating imports into Europe (and other key Tesla markets) from strong competitors in China, including BYD, on top of stiff competition from aggressive global rivals like Volkswagen (see Tesla's China Syndrome Will Spread, 1/13/22).

Europe seems little better for Tesla with second quarter deliveries down 73% y/y through May, and tracking just 25,000 (down 32% y/y) through June. China and Europe together contributed 55% of Tesla’s total deliveries the past two quarters.

This supports my speculation that Tesla has good reason for a while now to be worried about much more than weak second quarter issues. Indeed, recent pressures have only accelerated Tesla’s long standing problem: it has struggled for years to sustain same-store momentum in every market with every model in its aging and severely limited fleet.

As I have warned about for years now, Tesla’s troubles in China—indeed its persistent struggles to sustain same store sales in all its markets—existed long before the troubled second quarter and they’re not going away, as I warned again in Tesla China Deliveries: Weaker And More Important Than You Think, 3/14/22:

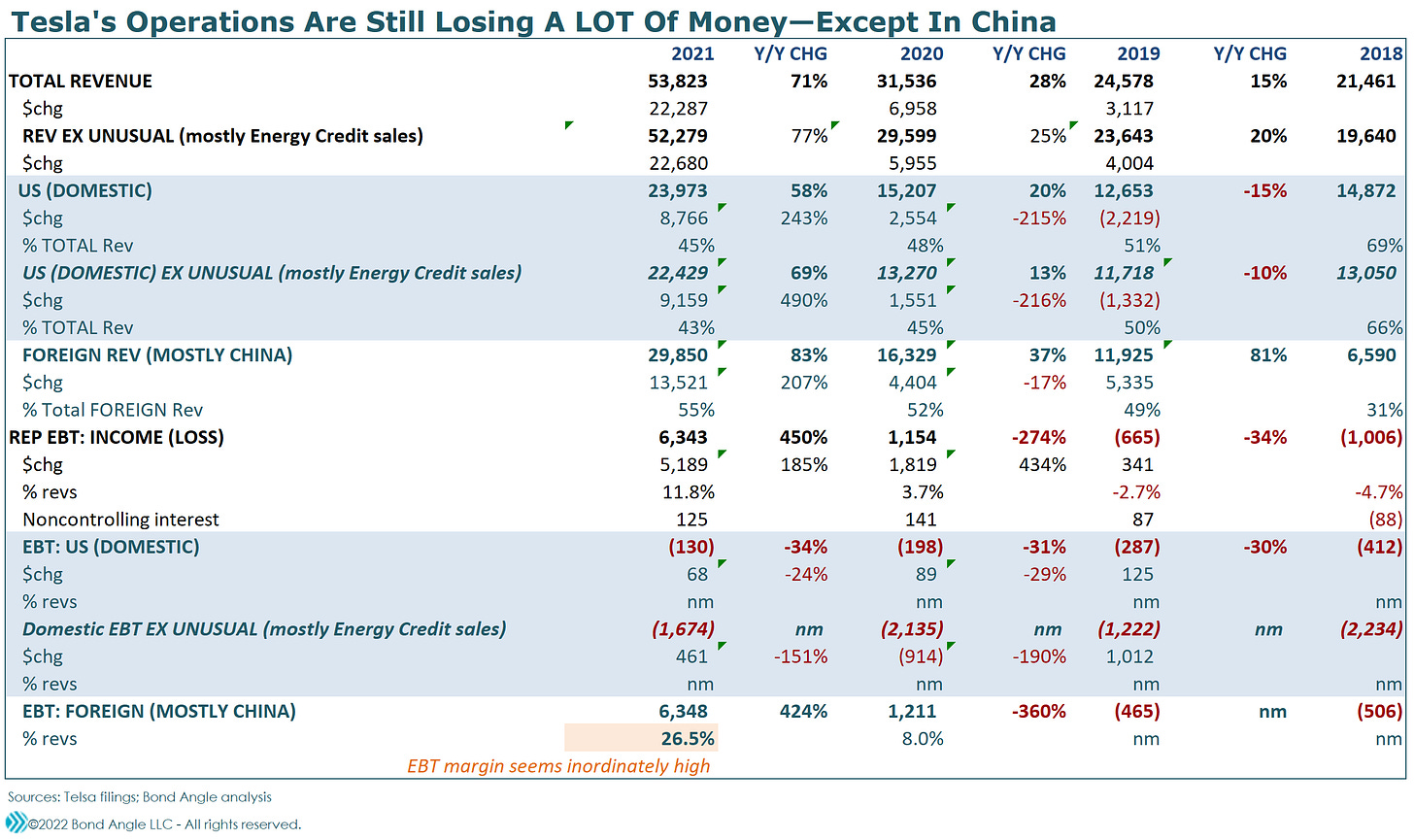

China is vital to Tesla as its richest market with now 26% of revenue and most all of its pretax profits versus its still money losing US operations (see my report Will Tesla Get Good News This Week?). Tesla generated 38% of its total deliveries in China in the fourth quarter.

It’s momentum Tesla can ill afford to lose, but that is what happened again in February. Recall Tesla has only one model still growing incremental sales: Model Y which launched for local sales in China in January 2021 and started exporting to Europe in July 2021. And as I expected, this immediately decimated local sales of Model 3—a persistent pattern I have tracked for years:

Sales in Tesla’s legacy models have faded almost immediately when faced with its new models, and now Tesla is facing stiff new competition from strong rivals in all its markets—especially China. Its new models have also struggled to sustain sales after initial new launch and/or new market expansions even before the first anniversary of said events (I last discussed this at length in Tesla: Don’t Drive Angry, 2/8/21).

Tesla Model 3 Sales Crashed in China in October, 11/10/21

If China operations go south, Tesla's chronically money-losing operations may be exposed

It doesn’t help that investors can only guess how such a sizable decline in China operations hurts Tesla’s profitability and cash flow. That’s because Tesla refuses to break out this vital business into a clearly defined segment—one that generates virtually all the company’s profit and cash flow and more than half of consolidated revenue.

Forget Elon's Twitter Spatter. Tesla's Got Trouble In China, 4/19/22, was my latest discussion detailing this acute vulnerability, a report that also inspired my discussion with Linette Lopez at Business Insider:

The reality is that Tesla's profitability is still full of caveats, according to Vicki Bryan, the founder of the research firm Bond Angle. Based on her reading of the company's financial filings, its American business is in ugly shape. Without a hand from electric-vehicle credits paid by combustion-engine carmakers, and without income from Tesla's China operations, Bryan calculates that the company's US operations would've lost $2.4 billion last year. On paper, its cash position is also helped along by a massive $2.1 billion add back to its profit from paying its employees (especially Musk) in stock.

Wonder why Elon Musk is lashing out about recession risks and work from home? Just look under the hood at Tesla, Business Insider, June 9, 2022.

Here, again, are key highlights from Forget Elon's Twitter Spatter. Tesla's Got Trouble In China, 4/19/22:

Tesla generated the majority of its revenue growth outside the US, mostly China, in 2020 and 2021, which also offset falling US revenue in 2019—before the Covid pandemic.

Foreign operations, mostly China, generated a 424% increase in pretax income to $6.35 billion in 2021—again more than accounting for all of Tesla’s reported profit.

US operations remain deeply in the red. When I excluded foreign pretax income and US energy credit sales from reported consolidated income, US operations lost another $2.4 billion in 2021—barely improved versus 2020.

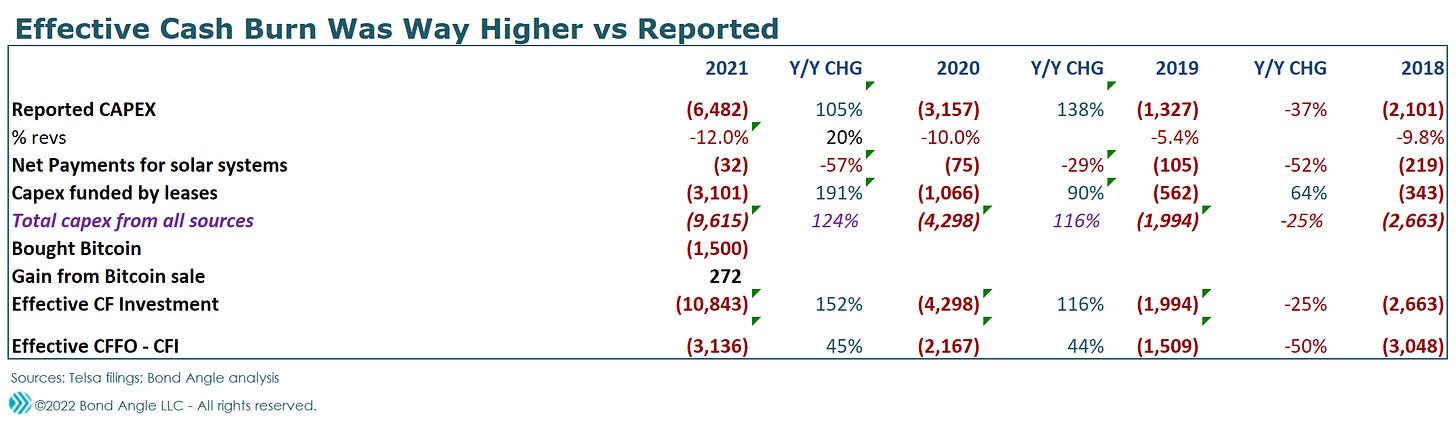

Tesla’s liberal use of accounting stock-based comp, mostly for Elon, substantially understates operating expenses and overstates profit. So I add stock-based comp back in to calculate Tesla’s effective operating expenses, income, and cash flow.

As a result, effective cash from operations was closer to $7.7 billion versus $11.5 billion as reported, when I excluded energy credit sales and stock based comp. And without $6.35 billion in foreign operating income—mostly China—US operations generated less than $1.4 billion:

Cash flow from foreign operations—mostly China—plus $3 billion in funding by leases was crucial in covering what actually was much higher effective capex at $9.6 billion versus $6.5 billion reported.

What happens when Tesla’s cash machine in China shuts down?

Assuming my estimate for 251,458, second quarter consolidated revenue is indicated at $16.4 billion, down $2.4 billion versus the first quarter when Tesla reported net profit of $2.1 billion.

If so, revenue was up 37% y/y but down 13% versus the first quarter and the lowest since the third quarter last year. This assumes Auto Segment revenue dropped $2.6 billion versus the first quarter at $14.25 billion. That's up 40% y/y but down 15% versus the first quarter and the lowest since the third quarter last year.

I also have projected that Tesla’s dubiously bloated margins will shrink significantly as rising costs (hit also by the end of advantageous supply contracts) outpace higher pricing plus diminishing benefits from energy credits and slick accounting maneuvers. Tesla’s excessive stock-based comp maneuver—the biggest boost to reported EBITDA—will be hit by the 38% drop in its stock price since the first quarter to $673.42. That’s down 37% ytd, down 41% y/y, and down 46% versus its November peak at $1,243.49.

I estimate second quarter reported EBITDA at $3.2 billion, up 28.5% y/y. That's also down $1.8 billion versus the first quarter, wiping out combined sequential gains for the past two quarters. This pegs EBITDA margin at 19.5%, down 130 bps y/y and substantially lower versus the dubious 26.8% for the first quarter (when stock-based comp and energy credits accounted for more than $1 billion of the reported $5 billion).

As a result, I estimate $300-500 million of Tesla’s likely earnings shortfall this quarter may be traced to floundering foreign operations—mostly China. If so, this plus estimated impairment charges on Bitcoin could reduce earnings by roughly $1.3 billion for the quarter compared with reported net profit at $2.1 billion in the first quarter and $1.1 billion for the second quarter last year.

We now know, thanks to Elon’s latest bombshell, most of Tesla’s cash is being consumed by the Austin and Berlin plants. But given persistent pressure still obvious in existing US operations, it’s likely excess cash is being consumed there as well.

We’re about to find out. Tesla is due to report second quarter deliveries over the next few days and full results after the market closes on July 22nd.

Tesla repurchased its 5.3% senior notes in the third quarter of 2021 as I projected, though I doubt we’ve seen the last of Tesla as a bond issuer. Until then, I have Tesla: Not Rated.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.