Softbank May Blink First (WeWork Bondholders Hope)

Softbank is working on a plan to take control of WeWork vs the bank's $5 billion debt scheme said to include mountains of junky high yield notes.

The latest plan to emerge in now urgent discussions to bail out The We Company (WeWork) (WE US) is for its top investor Softbank Corp (9434 JP) to buy up a controlling interest in the equity, according to reports out Sunday by The Wall Street Journal and Financial Times.

Key to the plan will be settling on a reasonable value for WeWork's foundering equity which has plunged 80% by conservative estimates (down 94% by my estimate) versus the lofty $47 billion where Softbank last invested in January--which already has Softbank in trouble with its own investors.

WeWork's banks are said to be working on a $5 billion debt package, including a massive $3 billion high yield bond issue marketed by lead banker JPMorgan Chase & Co (JPM US), of course, which would greatly reduce their own exposure to the company's horrific and escalating risks while enveloping existing bonds in a mountain of unsecured debt.

While the Titan's clash, WeWork is failing. Insiders say it could run out of cash next month--tracking my projections (see The Tide Is Out and WeWork Bondholders Are Naked).

Watching from the kid's table are WeWork's bondholders who boxed themselves into their feckless position and so are stuck with accepting whatever the adults cook up.

Softbank has Few Options: All Ugly

One item that didn't appear in any of the WeWork brochures was that it was mere months from bankruptcy if it failed to raise $9-10 billion from its IPO and new credit facilities arranged back in August. But there were plenty of clues.

For one, WeWork's cash consumption is voracious and unrelenting--much like its mounting losses which continue to outrun even rapid revenue growth which now is threatened by the recent revelations of its dramatically inflated profitability, prospects, and value. As I noted again in The Tide Is Out and WeWork Bondholders Are Naked, WeWork burned through $6-8 billion in cash during 2018 through June 2019, including all the substantial cash raised from borrowing and equity infusions. This compared to revenue at just $1.8 billion for 2018 and $2.6 billion generated for the LTM ended June 30, 2019. It lost $1.9 billion and $2.1 billion, respectively, over those same periods.

I estimated that WeWork "was set to consume all the $9-10 billion it planned to raise in stock and debt in a year or less with still no convincing path to profits or positive free cash flow." I also noted that WeWork's effective available cash was much lower than reported at $1.4 billion as of June 30th, and this could be depleted by yearend.

My concerns seem to be confirmed by reports that deal insiders say WeWork could be out of cash and facing bankruptcy if it doesn't get a financing package by the end of November.

It's less clear that Softbank is willing to spend more than it's already offered to save WeWork.

Buying more of WeWork is a losing proposition for Softbank on top of $11 billion spent so far. In addition to netting astonishing losses on its stake, now as the largest holder with 29% of WeWork, Softbank already has caught significant flak from its own investors for its WeWork obsession which was driven by Chairman Masayoshi Son. Those investors finally balked at Son's plan in December last year to buy out the rest of WeWork for $16 billion when the company was valued at $45 billion versus $20 billion where the company first invested $4.4 billion a year earlier. Son settled for investing $2 billion the next month, which took WeWork's value to $47 billion. Good times.

Now Softbank's investors cite Son's freewheeling WeWork excesses as good reason not to invest in its new Vision II Fund.

Softbank has become considerably more restrained since August in further pledges of WeWork investment. Word was that Softbank would take on $750 million to $1 billion of the struggling IPO. Since the IPO's collapse, it still seems to be offering no more than $1 billion in addition to $1.5 billion it already had pledged for 2020.

Given the dramatic plunge in WeWork's equity value, it's possible that's all it will take for Softbank to get a controlling stake now:

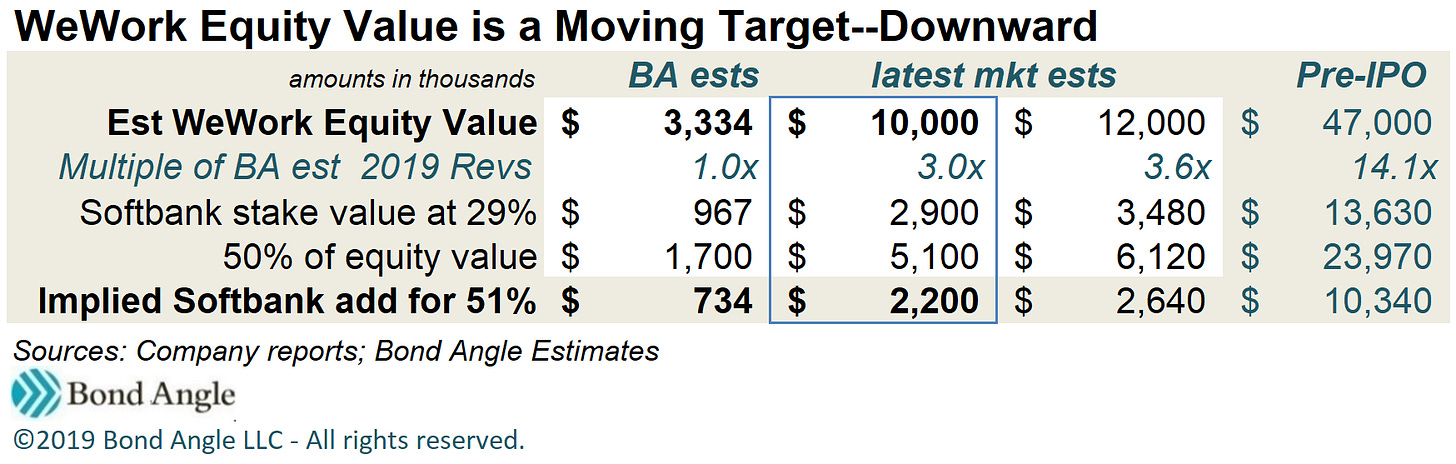

As I show in the chart above, WeWork was astonishingly overvalued at $47 billion which was more than 10x the value of IWG PLC (IWG LN), its much larger--and profitable--competitor, and more than 14x my estimate for 2019 revenue.

It's still expensive by this measure even at $10 billion, but $10-12 billion was the range rumored back in September as the adjusted target for the IPO before it was pulled. This also shows that Softbank could spend less than $2.5 billion to buy enough of WeWork to get a controlling stake.

This will formalize a sickening write-down of billions versus WeWork's inflated equity value--Softbank alone invested more than $11 billion mostly in equity--but that horse has already left the barn because it burned nearly to the ground.

So Why No Deals Yet?

The immovable measure of WeWork's peril has been its banks' steadfast refusal since August to close on any new financing in any amount unless its equity investors stepped up with significant additional cash.

That said, having Softbank as its parent company may solve some problems holding WeWork back by bolstering its shredded credibility. Much of WeWork's near-term risk stems from concerned counterparties afraid to sign new business, and existing landlords and customers who worry it can't execute agreements it's already made.

In the meantime, however, WeWork will continue to hemorrhage cash as it restructures its untenable business model--especially with rent as its highest and least flexible operating expense. Even with Softbank as its owner, WeWork still may elect to file bankruptcy to help renegotiate legally locked up long-term leases amounting to more than $47 billion.

And all of WeWork's creditors should remain wary of its troubling lack of tangible asset value, which likely is significantly below book value, versus its significant cash and lease and debt obligations. I expect the banks are keeping their risk exposure comfortably below TAV, leaving little if any left for unsecured debt claims in a liquidation scenario.

The Banks Have Been Worried For A While

I noted in Gravity Works As WeWork Doesn't; Now Plan B and in subsequent reports my concern that WeWork's legacy banks had played a major role in driving up its equity value, with JPMorgan Chase & Co (JPM US), Goldman Sachs Group (GS US), and Morgan Stanley (MS US) pitching it to investors last year at $50-100 billion and fighting over leading its IPO when it was valued at $47 billion.

But when it was time to bring the IPO to market, the $6 billion in credit facilities they arranged were priced with steep terms and shorter maturities and set to close only if the IPO closed. Some $2 billion of that total amount comprised a Letter of Credit facility which charged interest and required WeWork to provide 100% collateral in cash--a clear sign to me at the time of the banks' wary view of WeWork's disturbing credit risk. The only thing that has changed since August, despite likely two months or more of negotiations, is that the banks are willing to lend even less.

The plan now appears to be a $5 billion debt package, potentially including a whopping $3 billion in new unsecured high yield notes which will dramatically reduce the banks' exposure. I suspect the remaining $2 billion in credit facilities will be even more expensive versus previous terms and also divided between a credit line and another fully cash-backed letter of credit facility.

I had projected a similar bailout package in Gravity Works As WeWork Doesn't; Now Plan B--the difference in proposed terms now is the banks' obvious desire to create even more protection from WeWork's horrific and escalating risk.

I also suspect the banks and Softbank have been kicking around essentially the same terms for the past month or two. WeWork's other large investors don't appear to be stepping up, and WeWork is hardly in a position to stop the train. Why are they still worried about signing bailout deals?

Perhaps they were waiting for the close of what I expect was a terrible third quarter going into a worse fourth quarter.

Sell it To High Yield, They Buy Anything

I observed in The Tide Is Out and WeWork Bondholders Are Naked that WeWork marketed its last high yield bond deal, led also by JPMorgan, and also with a woefully inadequate prospectus, during a quarter when operating margins turned out to be shrinking with losses mounting alarmingly which wasn't revealed until long after the bonds were sold and trading below par.

There's no reason to think they won't sell another issue more than four times larger (and more than 1x trailing revenue) just because the company is in dramatically worse shape, especially now that WeWork bonds are rallying on news of a potential bailout so yields could fall back closer to 9% which, as before, falls well short in compensating for WeWork's severe credit risk. Willingly less-informed investors are easier to manage.

Rinse, repeat.

Looking forward, it could take 2-3 years to turn WeWork around, and the company that emerges, if it emerges, will have to be dramatically different versus what it is today, with different operating and credit metrics and vastly different prospects during what I expect also will be a softer business environment.

In the meantime, the company probably will not change its practice of providing bondholders inadequate information which then fails to reflect the company's true and accurate financial condition and prospects--because it's not required to. As I noted in The Tide Is Out and WeWork Bondholders Are Naked:

No IPO, no more public filings about financial performance going forward.

Otherwise, WeWork is only required by its bond indenture to provide financial reports to holders or "prospective holders" of its bonds. Reported financial information need only be "essentially" complete to the extent it was provided in the bond prospectus and does not have to be certified by WeWork senior officers as correct and true.

Prospective bond investors should have insisted before the deal closed--as I did many times during my years on the buy-side--that WeWork agree in writing in the indenture to provide management-certified financial other SEC-required reports to all "holders, prospective holders, and security analysts" to ensure broadly disseminated transparency of comprehensive information to benefit investors as well as facilitate accurate market pricing and trading.

It's obvious that providing information only to bondholders before and after the notes were issued in April last year has been woefully inadequate as a reliable measure of the company's financial health or operating prowess, little better versus news reports about exuberant private investors who drove WeWork's equity value to $47 billion or its banks that pitched it as high as $100 billion in pursued of hundreds of millions in fees.

So, the best outcome for bondholders is that Softbank buys up control of WeWork and triggers the change of control put to enable them to sell their bonds back to the company at 101% of par.

Otherwise, bondholders are stuck in perpetual semi-darkness with bonds that are hard to trade, with increasingly less market coverage, and issued by a company proven to provide inadequate information about its operating performance, financial condition, and prospects. Even the S-1, which provided a comparative wealth of public information, was critically flawed with missing, incomplete, and error-ridden information. Moreover, with the IPO pulled no one--not even bondholders--will see the SEC's substantial commentary on the S-1 which prompted the company to make significant changes in the amended version filed in September.

I suggest bondholders use any rally as an escape pod, while they can.

WeWork 7.875% senior notes have rallied 7 points to 90.5 (10.2% ytw/860 bps) since my last report. WeWork remains severely distressed and it's not yet clear whether the company can remain viable for the foreseeable future. Upside potential remains limited as a result given longer-term risks that continue to materialize versus downside risk which could be 5-10 points from here over the near term. Maintain “Sell.”

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.