Tesla CEO Diverts Q1 Call With WTF Rant

Ignoring CEO trash talk vs gaping holes in inflated Q1 results, serious cash burn, & dire warnings for Q2 & beyond that even Elon dubbed "serious risk."

Tesla Motors (TSLA US) managed to top greatly reduced market estimates with a tiny profit generated for its first quarter, as announced Wednesday afternoon. This should have been good news CEO Elon Musk could build on in the company's eagerly awaited conference call.

Instead, "Hold My Beer" Musk decided to curse and spew disinformation about the "fascism" of sending people home in the US to shelter from the deadly and rapidly spreading COVID-19 pandemic:

“The extension of the shelter in place or frankly I would call it ‘forcibly imprisoning people in their homes against all their constitutional rights’ — that’s my opinion — and breaking people’s freedoms in ways that are horrible and wrong and not why people came to America or built this country. What the f***? Excuse me. Outrage. It’s an outrage.”...To say that they cannot leave their house, and they will be arrested if they do, this is fascist....This is not democratic. This is not freedom. Give people back their goddamn freedom.”

And, right on cue, Elon's latest meltdown became the main topic of conversation. Tesla's bloated stock price climbed another 9% in after-hours trading to $870 as of this writing on top of the 4% it rose as of Wednesday's close before the company's earnings were released.

For those keeping score at home, this indicates a $160 billion market cap for Tesla, higher than combined values of $21 billion for Ford Motor Co (F US), $32 billion for General Motors Co (GM US), and $75 billion for Volkswagen (VOW GR). Ridiculous.

Investors should look closer at gaping holes in Tesla's inflated first-quarter results, its substantial and escalating cash burn, and sobering warnings for the second quarter and beyond which even Musk dubbed as "a serious risk."

Red Lights Flashing

It's important to remember that Tesla's first quarter was under pressure to meet management's ambitious targets before the pandemic hit (see my report Clearing Up Tesla Q419 Results on 1/30/20) even compared with dismal results reported last year (see Quick Take on Tesla Q119 Deliveries: Yes, They Were Bad on 4/4/19 and Tesla: When a Spartan Diet + $2 Billion Isn't Enough on 5/17/19).

Revenue has steadily eroded from multiple rounds of severe price reductions starting Q318, in addition to the loss of energy emissions credits as buyer incentives which were fully expired by the end of 2019. As a result, Tesla continues to generate only incremental revenue growth and hasn't been able to sustain same period delivery strength or revenue quality.

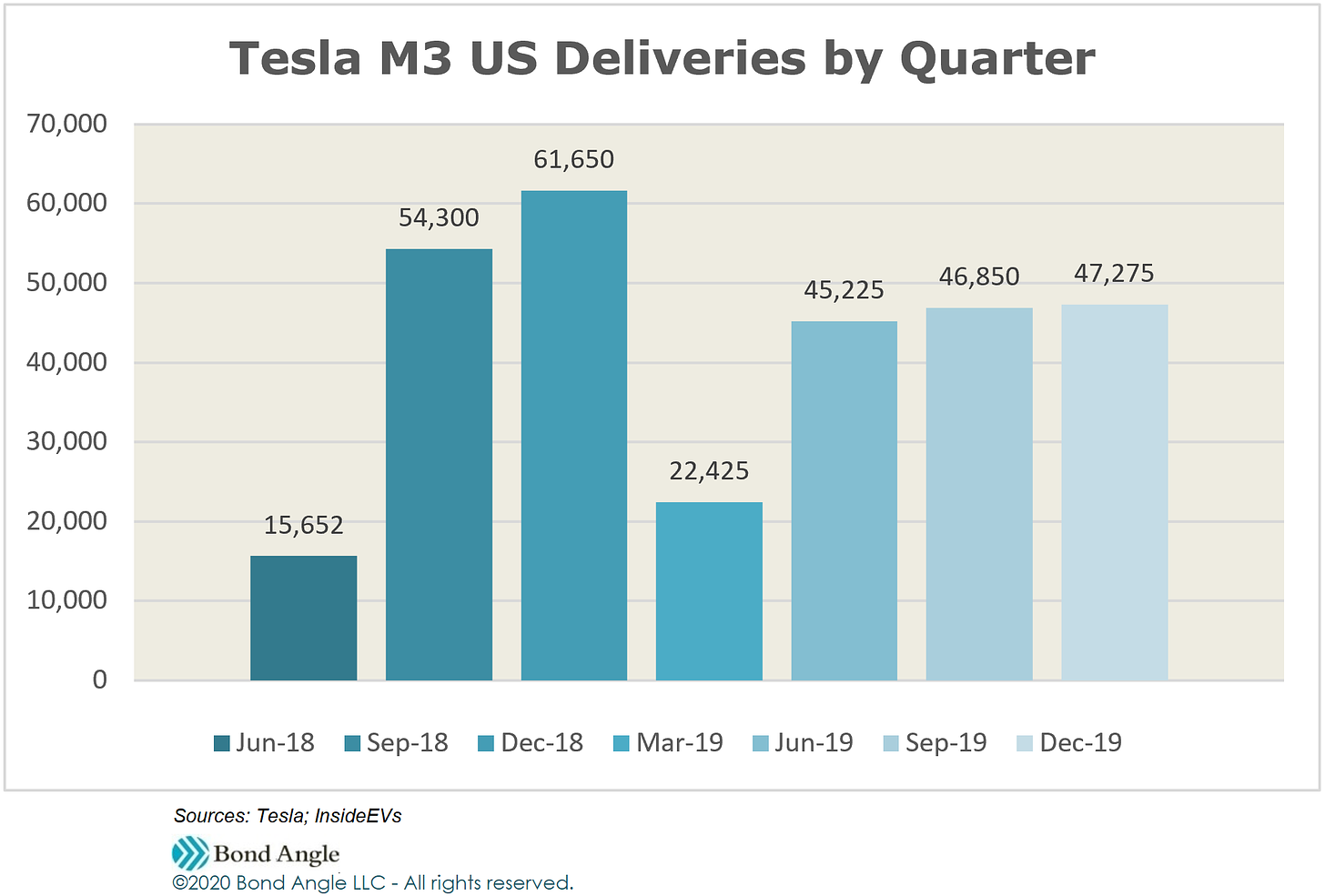

Same-store sales trends have been in a slump for more than a year. Models S&X deliveries have been in steep decline since the Model 3 was launched in June 2018. I started reporting early last year that Model 3 deliveries in the US were faltering within the first two quarters after its launch and were declining y/y by the second half of 2019.

The first quarter of this year marked the last easy comp versus poor results last year, when Tesla also bungled the launch of Model 3 into Europe and China.

This delayed its new market expansion until late in the quarter. If demand fails to hold this year, which seems likely, Tesla must rely on incremental growth from the new Model Y which launched in mid-March and its hurriedly built Shanghai plant which started its first deliveries this quarter (along with notable problems already materializing in quality and service, as I projected).

These are not fool-proof plans. I have projected that Model Y will cannibalize Model 3 sales (most recently discussed in Tesla: Into Thin Air, 1/16/20) which seems to be confirmed by Tesla's immediately oblique reporting which combined Models 3 and Y.

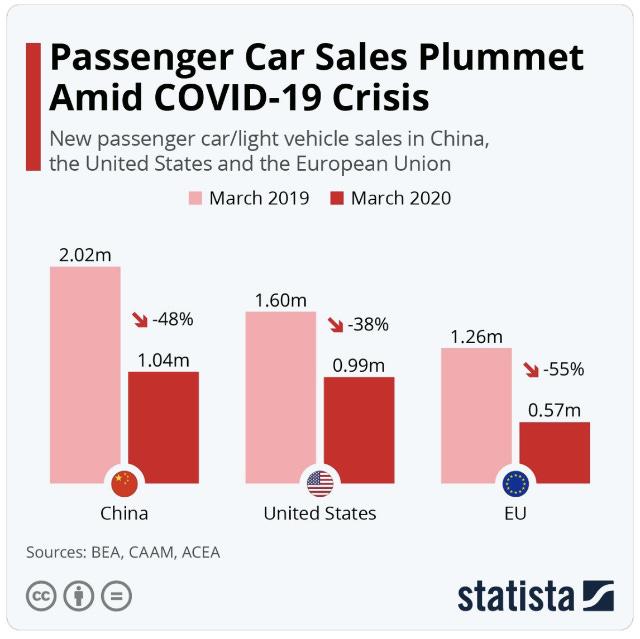

The global economic meltdown is well underway and the collateral damage will continue to escalate long after the COVID-19 pandemic subsides. Global auto sales are in free fall everywhere, including China. China decided to renew EV buyer subsidies to help stimulate demand, but Tesla has to slash prices for the second time this year on its China-made Model 3 to qualify.

So I wasn't surprised that Tesla reported only 88,400 deliveries, which trailed market expectations but met my estimate for 88,131. This was well below the 90,000-100,000 indicated by management, but still up 56% versus weak results last year mostly on a full quarter of Model 3 deliveries into Europe and China plus nearly 5,000 Shanghai-made Model 3s. Models S&X were essentially flat versus last year when deliveries plunged 45%.

While deliveries increased 56%, revenue per vehicle was down sharply as I projected. Consolidated revenue was up only 32% to less than $6 billion, which trailed reduced market estimates but beat my $5.8 billion estimate.

The difference versus my estimate was an unusually large boost from emissions credits which were up 64% to $354 million. It was enough to spike reported Auto Segment gross margin by 550 bps to a dubious 25.5% versus 20% excluding emissions credits.

Reported EBITDA was boosted by emissions credits and stock-based compensation, a calculated enhancement Tesla initiated in the fourth quarter. Together they comprised $565 million (59%) of the reported $951 million and accounted for most of the $797 million increase versus last year.

Such boosts were enough to dramatically understate leverage as near 4x on reported trailing EBITDA versus a disturbing 7.4x on unvarnished EBITDA.

Despite delivering 25,500 more cars versus last year which generated $6 billion in revenue, Tesla only managed a skinny net income of $16 million. Excluding emissions credits, Tesla produced a net loss of $338 million.

And by the way, Tesla noted that emissions credits will be increasing and that they mostly turn into accounts receivable instead of cash which are collected...some day.

This may explain some, though not all, of Tesla's mysterious and disturbingly bloated accounts receivable which has remained elevated and growing faster than revenue since the third quarter of 2018.

Similarly, reported cash consumed was $895 million versus $920 million burned last year, mostly on increased working capital and capex. Excluding emissions credits and including reported capex plus modest spending for solar energy systems (which was essentially unchanged), cash consumption on core operations edged higher at $1.28 billion versus $12.5 billion last year.

And this is before we can account for other likely contributions to gross profit, EBITDA, net income, and free cash flow via items that Tesla typically adds but doesn't report until the 10-Q filing; e.g. deferred revenue, convenient accounting changes, and favorable adjustments to warranty reserves and resale guarantees, etc.

By then Tesla fans will have forgotten, again, about potentially dicey numbers signaled in the earnings release, much less their total disconnect with the inflated stock price, or that Tesla just lost another General Counsel just before earnings were released.

Ending cash was $8.08 billion, up versus $6.27 billion at yearend on $524 million in additional borrowing plus $2.3 billion raised from the sale of stock in February, two weeks after Elon Musk told investors on the fourth-quarter conference call "it didn't make sense" to raise capital now with so much cash pouring in from operations.

Debt (including leases) also has increased in 10 of the past 12 quarters, ending up $1.2 billion versus last year to $13.94 billion.

It's Far From Over

Conditions look worse for the second quarter. While regions in states around the US are tentatively coming out of quarantine, 30 million people are out of work with many so financially distressed they may not recover for years—if at all.

Most businesses are under at least some stress with customers and supply chains and distribution critically disrupted. The global economy has sunk deeply into what's likely to be a protracted recession, if not depression, and conditions remain fluid as long as the pandemic remains active.

For the vast majority of people not benefiting from the now gaping wealth gap, it's not a buyers' market.

Tesla lost 10 days of production in the Shanghai plant in early February, but the disruptions and final closing of the Freemont plant in California have been the most damaging to Tesla's operations—hence Musk's nasty (and inexcusable) fit on the conference call.

The California plant makes all Tesla models plus parts and components that are shipped to the Shanghai plant which assembles but does not yet fully manufacture Model 3. California is also Tesla's largest US market by far.

By mid-April, just two weeks after Tesla closed the first quarter with $8 billion in the bank, it started seeking rent relief from its landlords, initiating pay cuts, and laying off workers. Tesla's US plants are expected to reopen May 4th, but I expect most of the quarter's revenue to be generated in June.

I don't expect Model Y sales will be enough to offset sagging demand with Models 3, S, and X in the US, but burgeoning strength in Europe and appeal in China for the Model 3 could help temper the damage. On Tuesday Tesla hosted a live web show on the Taobao shopping platform in China which attracted 4 million viewers to watch a livestream celebrity demonstrate features of different Tesla models and book test drives online.

Tesla told investors on Wednesday that "before the interruptions" it had been tracking a "record quarter of deliveries," which implies more than 110,000. The company did not withdraw its exuberant guidance for 500,000 deliveries for the year, which implies it now needs to average more than 133,000 in each of the next three quarters.

That seemed out of reach even before the pandemic hit.

I estimate second-quarter deliveries near 84,000, down 5% versus the first quarter and down 12% y/y. If so, this indicates reported revenue at $5.73 billion (down 10% y/y), EBITDA at $840 million (14.7% margin), and a net loss near $50-60 million versus the $408 million loss last year.

Tesla’s bonds have lagged the helium high in the stock but are still overvalued at 96 (6.2% ytw; 584 bps) which is down 5 points since my last report. This yield is 200 bps tighter versus the BoA High Yield general index and certainly leaves no margin for disappointing performance, much less Tela's considerably overstated EBITDA or complications that may show up in the 10-Q which likely will provide critical information, as is typical, that tends to confirm that operating performance and financial condition are weaker than earlier reports indicated. This has happened every quarter for several years now. Maintain "Underperform."

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.