Tesla to Sell Another $5 Billion in Stock—Might As Well

Tesla is selling another $5 billion in stock—because it can and, surprisingly, it probably still needs the cash. That’s just one of many reasons investors shouldn’t buy.

Tesla Motors (TSLA US) announced Tuesday morning that it plans to raise up to $5 billion in new sales of stock over time at prevailing market prices. As the third offering this year, including just three months ago, Tesla stands to raise more than $12 billion.

And why not, say Tesla fans. With the stock up 674% so far this year, it has become only the sixth company ever to hit $600 billion in market value. In two weeks it will added to the S&P 500 (SPX INDEX).

Such blind enthusiasm dismisses Tesla's problematic sales trends, its chronic lack of core unprofitability and free cash flow, it's increasingly threatened prospects, and more.

Or that Tesla needs to borrow every quarter and stretch its payables and sell record amounts of stock after reporting last January that it had “grown to the point of being self-funding.”

Not even close.

Yet investors remain unconcerned, and Tesla knows it.

Nothing Like Free Money

In many ways Tesla perfectly reflects gravity-defying markets this year which have charged to record highs despite a deadly pandemic raging unchecked or recession-level economic distress which will could persist over the next two years.

Tesla stock is up 650% since the brief dip in March when the pandemic took hold in the US. It is up 10-fold over the past year, as adjusted for the 5-1 split last August. It's trading at 141x estimated forward earnings and 1200x trailing reported earnings which have been dramatically inflated by accounting boosts and unusual items to mask chronically unprofitable core operations.

And, as I have observed over the past two years, such valuations can't be justified based on Tesla's fundamentals, its problematic prospects, or peer comps for any of its business segments—none of which have produced unvarnished core profits in more than 17 years (see my most recent discussion in Things People Believe: Flat Earth, Faked Moon Landings, and Tesla $2100 on 8/24/20).

This reality gap becomes more consequential when Tesla joins the S&P 500 Index as the sixth largest company, settling between Facebook Inc A (FB US) and Berkshire Hathaway Inc Cl A (BRK/A US). Tesla achieved this by finally reporting four consecutive profitable quarters. The trouble is those "profits" reported in every single quarter were traced entirely to energy credit sales plus non-cash accounting and unusual items—none of which are its core business.

The total boost was a whopping $1.6 billion over the four quarters ended September 30th, which worked out to 30% of reported EBITDA. This transformed nearly $1 billion in cumulative net losses to $556 million in reported "profits"—a paltry 2% of revenue. Hello, S&P 500.

Not surprisingly, this also means operations actually still burn substantial cash—not generate it as reported. Tesla reported free cash flow at $1.93 billion for the trailing four quarters as of September 30th, but this was boosted by the $1.6 billion noted above and ignored $100 million for solar equipment CAPEX and $1.1 billion in CAPEX funded by leases. With all considered operations actually consumed more than $800 million in cash.

Which is why Tesla borrows every quarter and stretches its payables even as it boasts about growing free cash flow. The entire $9.18 billion y/y increase in reported cash to $14.53 billion as of September 30th can be traced to net borrowing of $1.5 billion plus $7.7 billion raised from selling stock & equity equivalents.

Also, Tesla's actual spendable cash is far less than $14.53 billion as reported. Excluding more than $700 million in customer deposits plus $3.9 billion held overseas brings available cash down to less than $10 billion. Most of that overseas cash is held in China, and that cash is largely restricted and closely monitored by Tesla's Chinese bankers.

Keep this in mind as Tesla continues to juggle negative free cash flow despite growing revenue from incremental sales which mask falling same store revenue in every market.

Now consider substantial increases in CAPEX expected over the next 2-3 years. Tesla is building new plants in Texas and Germany plus ongoing plant expansions in Fremont and Shanghai plus a new commercial battery factory. Add this to a necessary redesign of the troubled Model Y already in progress plus the now two-year delay of the quirky CyberTruck plus severe and ongoing deficiencies in super charging networks and service store count as Tesla loses ground versus volumes of units outstanding.

This is not even Tesla's full pipeline or all its problems, but it's enough to suggest that the $4.5-6 billion Tesla projects for CAPEX over the next two years could prove too low.

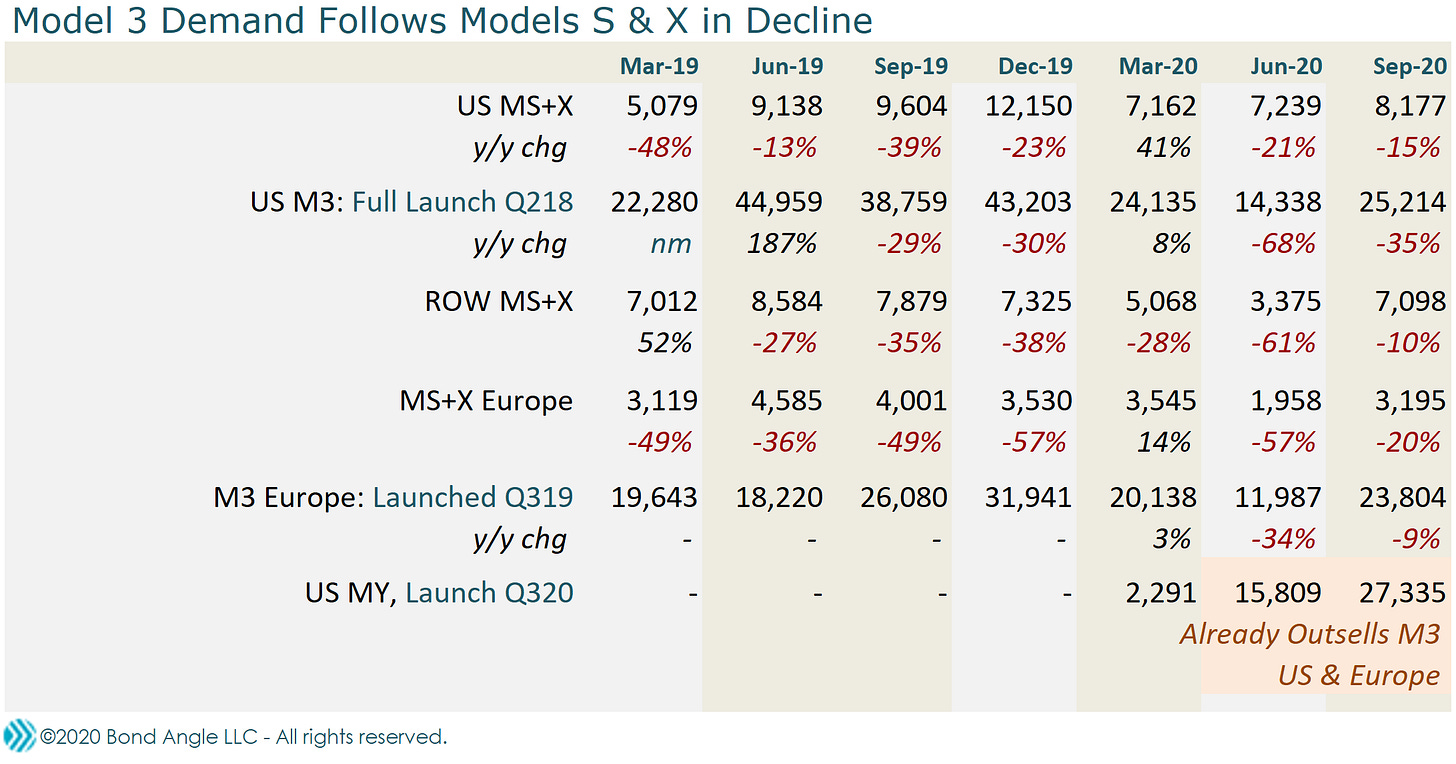

Tesla's cash and profitability pressures are compounded as it struggles to sustain same store demand in all its markets and waves of new competition gobble up market share, problems that I expect will escalate in 2021 and beyond. As I detailed again in my report What's Going On With Tesla's Demand? (10/27/20), Model 3 sales peaked within six months after its major launch in the US in 2018, joining Models S & X in freefall after only a year at full-scale production.

Model Y outsold sinking Model 3 in its second month after launch. I expect the same will happen in Europe and China, before Model Y also begins to fade after another 2-3 quarters.

Tesla is concerned about all this and more, pressure that I expect will intensify in 2021 and beyond. That's why it pads its operating results so liberally. Why it still borrows heavily every quarter and pays its bills late. Why it is now partially funding rapidly escalating CAPEX with leases. Why it must continue to slash prices several times every quarter in every market plus boost expensive incentives to ignite stalling sales even as it warns employees about disturbingly weak profit margins.

And why it continues to sell more stock than ever before to raise cash—while it can.

But For The Time Being

Fourth quarter trends so far indicate more of the same weakness in the US and Europe noted in the third quarter, but Tesla caught a break in China at the end of October when the government implemented new restrictions which effectively boosted sales of EVs.

So instead of scrambling to find sales for production out of its new Shanghai plant, including shipping 7,000 MIC Model 3s to Europe (where they apparently aren't selling any better) Tesla's China sales doubled versus estimates to nearly 22,000 in November. This was good news given Tesla's already tempered outlook for fourth quarter deliveries which projects a range of 159,000-196,000 (up 44-77%).

I've adjusted my fourth estimates accordingly to now 175,000 (up 56%) deliveries versus my previous 165,000 (up 48%) (see What To Expect in Tesla's Critical Q3 on 10/19/20), so now mid-range of Tesla's guidance. This indicates reported revenue at nearly $10 billion (up 35%) and reported EBITDA near $2 billion (20% margin), boosted by roughly $550 million in energy credit sales & accounting enhancements. This indicates year-end leverage much improved but still high at 5x unvarnished EBITDA.

Tesla's 5.3% senior notes due 2025 are little improved since my last report at 104.3 (2.8% ytw; 245 bps). The bonds remain excessively valued with yield tighter by 170 bps versus the BoA High Yield general index even though Tesla is a B3/BB- issuer. Pricing also indicates a meager 82 bps per turn of leverage on my estimated 2020 reported EBITDA and an appallingly low 35 bps per turn of leverage on core operating—unvarnished—EBITDA. Maintain "Underperform."

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.