What’s Going On With Tesla’s Demand?

Tesla still struggles to sustain sales strength in its largest markets, even as it plans extraordinary increases in capacity. What’s really going on with Tesla’s demand?

Tesla Motors (TSLA US) has shipped 7,000 Made-In-China Model 3s to Europe, with expected distribution upon arrival next month to Germany, France, Italy, the Netherlands, Portugal, Switzerland, and Sweden.

Interestingly, this news comes after Tesla managed to top reduced market consensus estimates for revenue and profits reported for its third quarter, released after the market closed Wednesday and projected full year deliveries up 30-40%.

However, as I projected, Tesla again needed a sizable boost from energy credits and accounting maneuvers to increase operating revenue and profits sufficiently to mask yet another loss because its car business, its energy generation & storage business, and its parts & service business are still losing money after 17 years (see What To Expect in Tesla's Critical Q3 on 10/19/20).

This didn't seem to worry Tesla's fans who initially boosted the stock up by 5% the following Thursday, though it should.

Because Tesla has failed to overcome persistent weakness in core demand that I have been tracking for two years persist despite multiple rounds of price cuts and expensive discounting to boost sales. It has happened with every Tesla model in every key market.

And now Tesla is trying to find new markets for excess inventory out of its new Shanghai plant versus the existing China market which CEO Elon Musk had projected last year would be so strong for Tesla it would need several China plants to supply it.

So what's really going on with Tesla's demand?

Tesla's Increasing Struggle To Keep The Carousel Going

In 2017, Tesla sold a record 103,000 cars, mostly thanks to 101,600 deliveries of Models S & X while Model 3 was barely off the ground since its July launch due to severe production constraints.

Tesla maintained that Model S & X orders and pricing remained strong, and projected at least 100,000 deliveries for 2018 even with increasing Model 3 sales.

There had initially been concerns about whether Model 3 would cannibalize Model S and Model X. It seems the opposite is true. In stores where Model 3 is on display, customer foot traffic has increased considerably and orders for Model S and Model X have in fact increased.

Tesla Fourth Quarter & Full Year 2017 Update, 2/7/2018

The main obstacle slowing deliveries was not demand, Tesla would complain to investors for the next year or so, but failure by Panasonic Corp (6752 JP), its long-suffering supplier, to make batteries fast enough to meet its production needs.

Except that's not what happened, as I detailed in The Trouble With Tesla's Arrested Development on 7/17/19. I had noted late in 2018 that Tesla began to develop excess inventory in Models S & X even after it was forced to slash production as sales plunged following the full ramp up of Model 3 by the end of the second quarter. So 2017 proved to be a sales peak that Models S & X never approached again.

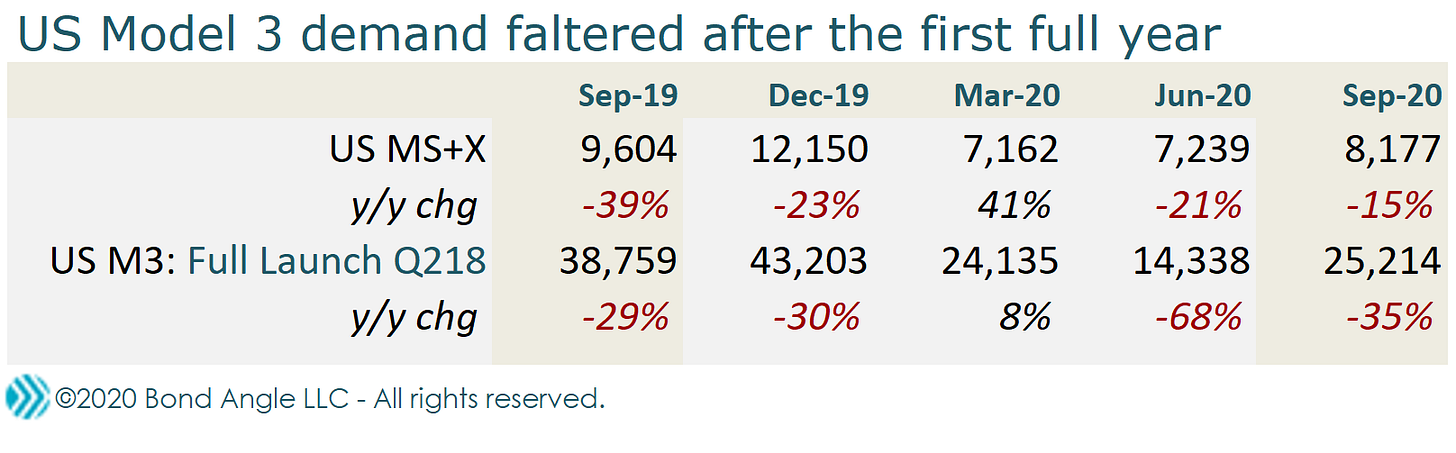

Instead, the June 2018 quarter marked the first year/year decline in Model S & X sales—and by double-digits at that. Plunging sales have continued in subsequent quarters to this day in every market where Models S & X are sold.

So the warning proved true: Model 3 decimated sales for Models S & X.

Notice, however, all the red ink in the chart above that soon punctuated Model 3 sales. The impact to Tesla's revenue quality and profitability grew even more painful given the severe erosion in mix plus multiple rounds of substantial price cuts and expensive discounting that keep Tesla's auto segment deeply unprofitable.

This explains Tesla's increasing reliance on energy credit sales, unusual & nonoperating items, & accounting maneuvers to boost reported revenue and manufacture reported "profit" even as deliveries increase 5-fold since 2017.

Let's break it down.

Tesla finally managed to achieve commercial-scale production capability approaching 5,000 cars per week by the end of June 2018. Model 3 sales took off, jumping to a record 61,650 deliveries by the fourth quarter, 2018, as shown in the chart above. This was expected given Tesla's claims that Model 3 had built a 450,000 order backlog and nearly $1 billion in customer deposits mostly for Model 3 by the end of the first quarter, 2018. Musk complained that struggles to meet Model 3's "insane demand" had created "production hell" and "delivery hell" for poor Tesla.

But I was troubled by increasing inconsistencies. As I wrote after third quarter 2018 results, just one quarter out from Model 3's storied launch:

Expected average price erosion on mix as Model 3 sales continue to dominate overall revenue seemed to be exacerbated by indications of additional pricing pressure and perhaps even fading demand—indicating that sales stability remains elusive.

What happened to the backlog? After more than a year of steady updates on Tesla’s swelling Model 3 order backlog when it couldn’t make cars fast enough to meet demand, management suddenly dropped the conversation. There was no update on the current status of more than 420 thousand reservations as of the second quarter for the Model 3, much less how many are now orders versus cancellations. Given Tesla’s persisting problems meeting its production targets, we would expect the company to continue to boast about a strong order backlog if it exists.

Instead, significant shortfalls in production targets apparently didn’t hurt sales—there were plenty of cars left over. Indeed Tesla actually had sufficient available inventory to hold an increasing number of flash sales, some even on a first-come, first-served basis which offered almost immediate delivery. Quick delivery was further encouraged by increasing sales discounts. Fire sales can move inventory, but only if the price discounts are fat enough—pricing power that’s much harder to claw back.

Great Magic Trick Tesla; Now Do It Again on 11/29/18.

These trends continued into the fourth quarter, 2018, when I began to suspect that Tesla was pulling demand forward with even more aggressive price cuts and discounting in a frantic late attempt to meet its guidance and still coming up short of its ambitious guidance.

Which is exactly what happened.

The takeaway here is that despite months of extraordinary sales efforts, price erosion, and declining production, Tesla's inventory remains troublingly bloated, conditions I warned about in the third quarter as accelerating threats for the fourth quarter and likely through 2019 (see my report "Great Magic Trick Tesla; Now Do It Again," 11/29/18).

Tesla: Down to the Wire, 12/31/18

Deliveries in the first quarter of 2019 then plummeted as I expected, with Models S & X down 48% y/y and Model 3 down a shocking 64% versus the fourth quarter.

Deliveries recovered somewhat in the second quarter, but that proved to be the last positive y/y comp for US Model 3 sales before they dropped sharply just one year after its full launch.

To ignite sales, Tesla announced waves of new price reductions and even the long awaited $35,000 Model 3—which it promptly withdrew from the market before the first one was delivered.

It wasn't enough. I warned that Tesla's demand problem was increasingly exacerbated by its escalating failures in quality control and customer service.

Consumer Reports withdrew its recommendation on the flagship Model 3 due to serious quality and reliability concerns—not actually surprising given increasing risks I have tracked with Tesla quality controls curtailed and flawed cars increasingly delivered to customers (see "Musk and Weird Q3 Developments Are Driving Investors to Telsa's Rivals" and "Tesla: Dave’s Not Here and Musk Won’t Leave" and "Tesla: Down to the Wire").

Tesla - Truth and Consequences, 2/28/19

Tesla chose this time to get rid of its entire quality control group as part of massive layoffs to slash costs. Bad idea, as I observed:

Continuing layoffs could make such problems worse since Tesla has targeted for reduction its more expensive—and more seasoned—employees which included the elimination of its quality control department at its primary factory in Fremont. Insufficient staffing, weak quality control, and notoriously poor management oversight could aggravate Tesla's atrocious manufacturing safety record, already dramatically worse versus all other US automakers combined:

Tesla's Plan B 2.0; Y Not, 3/10/19

Even multiple rounds of price cuts were not enough to offset faltering demand in the US, then Tesla’s largest and most important market. Tesla's blundering and ill-conceived quick-fix measures didn't help, nor did its shoddily produced cars.

So, as I projected (Tesla - Now We Know The Y, But Not the How, 3/14/19, US Model 3 sales peaked within six months after its major launch, joining Models S & X in freefall after only a year at full-scale production.

It seems doubtful Tesla can restore its former strength in its US market—it hasn't been able to even stabilize US sales. Tesla's solution to hurry the Model Y to market in March 2020 has slowed the overall decline, but the new model also cannibalized Model 3 sales as I projected. Indeed, deliveries in the recently announced third quarter dropped 13% in California, Tesla's largest US market. That included a 60% drop in Model 3, which more than offset growing Model Y sales.

Model Y outsold Model 3 in both of its first two full quarters.

Model Y's continued success in the US remains uncertain, however, especially since the market has become cluttered with attractive competitors from more credibly reliable rivals with far better track records for quality and customer service. If past trends hold, US Model Y deliveries may start to fade after another 2-3 quarters.

And while Tesla struggles to sustain even modest growth in run-rate US sales, it's planning another significant increase in capacity with a massive new plant already under construction in Texas. There it plans to build a significantly "improved" version of Model Y—not invented yet—plus the Cybertruck—also now subject to extreme redesign so the 2021-2022 production dates for one or both models could prove to be "fluid."

Bear in mind, Tesla was operating at just 56% of capacity utilization with is US and China plants, before another increase in capacity in the third quarter dropped utilization to less than 52%.

Foreign Intervention

With US sales in accelerating decline, Tesla has launched major expansions overseas. These incremental increases in deliveries have comprised the only unit growth Tesla has reported in four of the past five quarters.

Model 3 was exported into Europe and China near the end of the first quarter, 2019. Tesla also started delivering Made-In-China (MIC) Model 3s from its Shanghai plant in the first quarter of this year.

Things haven't gone smoothly.

Model 3 demand in Europe, a much larger EV market versus the US, nevertheless has lagged the US in every quarter. And, as in the US, sales slumped after just one year of its launch. Third quarter deliveries in Norway and The Netherlands, formerly Tesla's strongest markets in Europe, fell by 55% and 77%, respectively, and are down ytd by 77% and 67%, respectively.

Indeed, US Model Y sales outsold Model 3 in Europe as well as the US in its first two full quarters.

Not surprisingly, Tesla now plans to start shipping Model Y to Europe by year-end this year or early 2021. Cue an even more dramatic fall in sales for Model 3 in Europe as a result.

There's also a good chance the honeymoon period for Model Y proves to be shorter in Europe, where government subsidies are robust and the high quality competition is even stronger, as I noted:

Meanwhile Tesla is losing ground in Europe to fierce competitors like Renault SA (RNO FP) Zoe, the new Volkswagen (VOW GR) ID.3, and Hyundai Motor Co (005380 KS) Kona. That's why Tesla has accelerated expansion of Model Y into Europe in early 2021 and will open the Berlin plant not long after—to create growth from incremental deliveries as same-store deliveries sag.

What To Expect in Tesla's Critical Q3, 10/19/20.

It's far from certain that Model Y can gain and hold commanding market share versus these and other preferred and more credibly reliable EV brands in Europe. This plus floundering demand in Europe for Model 3 presents complications for Tesla's sizable new Berlin plant, already under construction where Model 3 and a new, dramatically redesigned Model Y will be produced.

I expect this model design to be incorporated into the Texas-made Model Y, which is likely to replace the deeply flawed US-made model from the Fremont plant where it shares 75% of parts and components with the problematic Model 3.

But Tesla remains characteristically vague about what improvements in design and performance it plans to make.

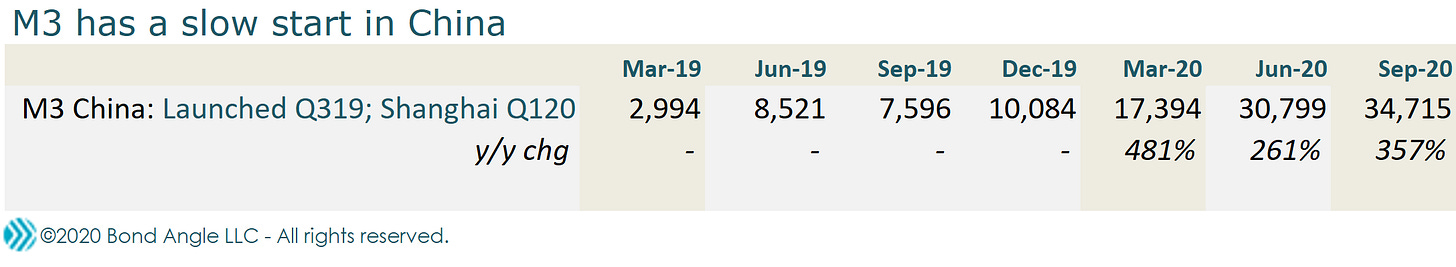

Tesla's launch into China, the largest EV market in the world, has been fraught with missteps and disappointing execution.

As I noted in Tesla: Into Thin Air, 1/16/20:

Tesla already has stumbled with Chinese buyers.Model 3 had a rocky launch in China, with lower than expected demand not helped by Tesla's volatile sales strategies. Price-conscious customers also got irritated by Tesla's frequent price reductions, and angry buyers even protested Tesla's stores when prices were lowered significantly after their purchases. Prospective buyers will likely hold out for even lower prices already signaled.

This wasn't helped by a general slump in EV sales in China later in 2019 following cuts in government subsidies that weren't restored until this year.

Buyer concerns were not been assuaged this year when the Shanghai plant ramped up in January. Not only has Tesla dropped prices seven times so far year, following multiple rounds last year, buyers also complained that build quality and technology in MIC Model 3 lagged US-made versions.

This was not surprising given Tesla's dismal track record for poor quality and customer service in the US, which I had warned could be even worse when it manufactures in China:

Moreover, overseas trends indicate that growth from Model 3 expansion into China and Europe may already be slowing. Some indications are surfacing the Chinese customers may be showing a preference for imported Model 3s over concerns about quality issues with locally made cars out of the new Shanghai plant—concerns I’ve also raised:

"So we should expect little if any improvement, if not worsening conditions, in Tesla's manufacturing plants in the US, and similar, if not worse, manufacturing issues cropping up when it opens its hastily built factory later this year in Shanghai, where management and regulatory oversight are substantially less intensive.”

The Trouble With Tesla's Arrested Development, 7/17/19, and Tesla's Q3 "Magic" Fades Quickly In Q4, 11/19/19.

And Tesla doesn’t need any more obstacles than it already has created.

Sales seem to gain traction in the second quarter of this year. However, the apparent strength in the third quarter is misleading as monthly sales revealed troubling weakness. Tesla's sales have always been heaviest in the final month of any quarter—until now.

As I noted in What To Expect in Tesla's Critical Q3, 10/19/20:

China deliveries are up substantially with the ramp-up of the Shanghai base, as expected. However, Made-In-China (MIC) Model 3 deliveries slipped to 11,329 in September versus 11,811 in August and 11,575 in July—all lower versus the peak of 15,023 in June.

Reports suggest monthly deliveries could decline to 10,000 or less as Chinese buyers are increasingly irritated with Tesla's multiple rounds of price cuts, poor quality and reliability of the cars, and that technology in MIC Model 3s lag US-made cars—as I warned in Tesla Q219 10-Q Notes and Big Red Flags on 7/31/19.

So it won't help that Tesla recently cut prices again, including on MIC Model 3, the 7th time this year for MIC Model 3s, at the same time it also dropped its generous 7-day return policy in all markets—including China. Which is why Tesla is accelerating Model Y production and delivery in China by the end of the fourth quarter as MIC Model 3 sales fade.

Given what already has happened in two other major markets to existing Model 3 sales when Model Y appears, MIC Model 3's prospects seem likely to fade in China as well.

Tesla seemed to confirm these concerns in September, when its internal reports of weakening sales trends out of Shanghai likely became obvious. That's when the company apparently decided to start shipping MIC Model 3s to Europe and other Asian markets.

This suggests that Tesla started scrambling to find other markets for excess Shanghai plant inventory from a market Musk had projected would be so strong for Tesla it would need several China plants to supply it.

Today, Tesla shipped 7,000 MIC Model 3sto Belgium where, when they arrive next month, they will be distributed for sale in "dozens of countries including Germany, France, Italy, the Netherlands, Portugal, Switzerland, and Sweden" according to China's state-backed The Paper.

Less clear is what Tesla expects to happen next.

Remember, Chinese buyers consider the cheaper MIC Model 3 as inferior in quality and technology to the problematic US-made versions on sale now and floundering in Europe versus strong, high quality rivals which are rapidly growing market share. Sending MIC Model 3s to Europe is a recipe for confusion for buyers there who may worry about identifying which is the "best" Tesla—and decide it's easier to just avoid Model 3 altogether in favor of so many reliably high quality alternatives.

Which is why this seemingly disparate action may actually damage prospects for German-made Model 3, when it comes online next year, which Tesla can't afford.

And if so, this means Tesla may be left to supplement flagging Model 3 demand in China with MIC Model 3 sales elsewhere in Asia next year, like India—where Tesla's also is planning to build a plant.

And remember, there's a good chance Model Y demand may start to fade in another 2-3 quarters, given the track record we've seen with Models 3, S, and X.

At the very least, 2021 looks increasingly challenging for Tesla with fading sales in its largest markets for most all its models just as it brings extraordinary increases in capacity online.

I'll be adjusting my 2021 estimates as the fourth quarter develops when we hopefully get a better idea of timing for new capacity that may or may not develop. In the meantime, I'll stick with my estimate of 165,000 deliveries (up 48%) in the fourth quarter (see What To Expect in Tesla's Critical Q3 on 10/19/20), near the low end of Tesla's tempered outlook which projects a range of 159,000-196,000 (up 44-77%). This indicates reported revenue at $9.5 billion (up 29%) and reported EBITDA at $1.9 billion (20% margin), boosted by roughly $550 million in energy credit sales & accounting enhancements.

Tesla's bonds are unchanged since my last report a couple of weeks ago at 103.8 (3.7% ytw; 333 bps). Compare that to the volatile stock price, which is down 2% to $420 but still an EV multiple of 76x my estimated 2020 reported EBITDA. Still, the bonds remain excessively valued with yield tighter by 200 bps versus the BoA High Yield general index even though Tesla is a Caa1/B- issuer. Pricing also indicates a 101 bps per turn of leverage on my estimated 2020 reported EBITDA and an appallingly low 55 bps per turn of leverage on core operating—unvarnished—EBITDA. Such levels offer nominal upside reward at best and zero margin for disappointment. Maintain "Underperform."

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.