WeWork Board and SoftBank Battle CEO For Control

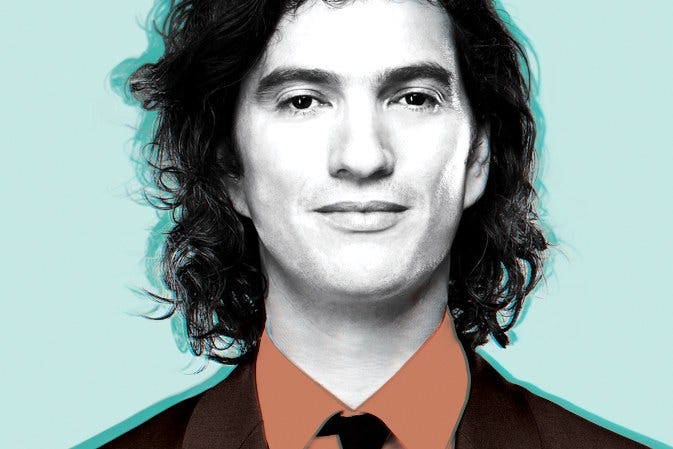

WeWork's notorious co-founder and CEO adam Neumann may be pushed out by its board and its largest investors. And that's a good thing.

The Wall Street Journal broke news on Sunday that key board members at The We Company (WeWork) (WE US) are working to remove the company’s notorious co-founder and CEO Adam Neumann.

Among them are Masayoshi Son, Chairman of WeWork’s largest investor SoftBank Group (9984 JP), which also is mostly responsible for its extravagant equity valuation of $47 billion.That estimate plunged to just $10 billion--which still seems too high--leading to the spectacular collapse of the company's pending IPO (see my report Gravity Works As WeWork Doesn’t; Now Plan B).

SoftBank wants more now than just getting the IPO stopped indefinitely--and perhaps not just because of staggering losses on its massive WeWork stake.

There’s even more at stake. This news also signals that WeWork still can't get the massive cash infusion it needs to ease its urgent and worsening liquidity pressure because banks sitting on $6 billion in unclosed credit facilities still refuse to oblige.

Which shows that WeWork's many roadblocks start, but don't end, with Adam Neumann.

Game On

Several board members, including SoftBank, are reported to be planning to replace Adam Neumann as CEO in a vote that could come this week.

It’s a bold move but far from guaranteed to succeed. WeWork’s board is inordinately small with just seven members, including Neuman and a few of his allies. Neumann also has so much equity control he literally can fire the entire board and then, presumably, replace it with toadies who will yield to his will.

This is a major part of WeWork’s problems, leaving the Board with few alternatives since Neumann himself is a significant reason WeWork’s pending IPO imploded spectacularly in a matter of weeks after it was announced (see my report Gravity Works As WeWork Doesn’t; Now Plan B.

And Neumann has shown he isn’t going to back down without a fight.

You're In My Chair

Neumann is not new to criticism; he just hasn’t been forced to care before now. Moreover, investors are right to be concerned about:

His still extraordinary and debilitating control over WeWork’s operations and prospects via his unusual super majority equity voting power,

His troubling self-dealing; e.g. borrowing from WeWork to buy buildings which he leased back to WeWork; selling WeWork rights to the word “We” for $6 million (which he had to return amid investor outrage); cashing out some $700 million in stock and loans backed by his WeWork stock just before the IPO was announced.

His dismal track record executing WeWork’s performance results as advertised versus his outrageous forecasts and the company’s inherent vulnerabilities which actually signal further deterioration—especially if business conditions weaken as I expect.

His irrational and even reckless behavior. We’ve already seen, for example, how an unrestrained, irresponsible, and ill-advisably overconfident autocrat can cost investors billions in evaporated market cap with Tesla’s (TSLA US) bombastic CEO Elon Musk--see Tesla Take-Private Plan: Shoot First, Answer Questions Later (If at All) and Tesla: Dave’s Not Here and Musk Won’t Leave and Tesla - Truth and Consequences.

So, Neumann’s leadership failings also drive his urgency to get WeWork’s IPO done: it really needs to raise several billion in cash, pronto, and that’s probably not going to happen now.

WeWork’s last official update had it tabling its IPO last week, albeit with the assurance that it still planned to close the deal before yearend.

I was immediately skeptical the IPO will close in the foreseeable future given WeWork’s deteriorating operating metrics, fading revenue growth, and dubious business prospects. I also detailed in my last report how WeWork’s available cash is dramatically lower than advertised, which explained why it needs as much as $9 billion in fresh cash as soon as possible—and how fast that cash is likely to be consumed.

I also have estimated that WeWork’s results for the rest of this year and likely next year will be disappointing. If so, this may further suppress WeWork’s equity valuation, already down more than 80% to $10-12 billion versus the $47 billion valuation floated since January, to $5-7.5 billion.

So delaying the IPO was a modest concession at best to worried stakeholders, including SoftBank which had urged Neumann to shelve the IPO some two weeks ago given the overwhelmingly negative reception it was be getting from investors as its extravagant equity valuation evaporated day by day.

No doubt Neumann still is irritated at this outcome since he’d agreed to whittle some of his extraordinary controlover the company to address persistent concerns raised by existing and potential investors.

However, the comparatively nominal changes in governance he allowed did little to assuage concerns. Deal insiders reported that investors still could not be persuaded to fill even $2 billion of the $3 billion minimum planned for the IPO, even with SoftBank agreeing to take as much as $1 billion of the offering.

WeWork’s failed IPO and its dramatic devaluation have created new financial pressure for Neumann. WeWork’s legacy bankers are also Neumann’s bankers, and they are rethinking terms on $500 million in loans they made to him which are backed by his now substantially devalued WeWork stock.

But Neumann is not the only one scrambling to deal with one of the biggest IPO flops ever.

When Push Comes to Shove, Bigger Can Shove Harder

It's not clear who's leading the charge to push Adam Neumann aside, but the biggest name in the posse undoubtedly is SoftBank’s CEO Masayoshi Son.

After years as one of Neumann’s biggest champions, Son and Neumann are now at loggerheads. Son not only seems to have become disenchanted with Neumann’s obstinance, but his infatuation with WeWork has also drawn perhaps his fiercest criticism yet—and deservedly so.

Son has himself long been heralded as a “visionary” investor in technology, which made his attraction to WeWork so surprising. WeWork is not a technology company or even a disruptor—it’s just an overhyped real estate company repacking a decades-old business model with flashy apps and slick marketing.

Yet, as I have observed, Son is the single person most responsible for WeWork’s $47 billion equity valuation fueled by more than $9 billion he directed SoftBank to invest in WeWork since 2017 in addition to at least $2.5 billion in loans—against internal objections.

Worse, all of SoftBank’s WeWork investments, from the first in mid-2017 when WeWork was valued at $16.9 billion to its last one in January this year at $47 billion, came in at prices substantially higher versus the $10 billion—or less—it seems to be worth now.

Compound this with sizable losses also accumulating in other foundering Son favorites like Uber and Slack Technologies, and we’re talking serious red ink in staggering amounts that probably won’t be recovered for years, if at all, just as SoftBank is trying to raise capital for its second Vision Fund.

Not so visionary.

So it’s not clear whether Son’s position and/or power at SoftBank might be in jeopardy, but his credibility with investors has clearly taken a hit. It’s easy to see why he’s no longer on Team Neumann.

And in a battle between a disaffected SoftBank, with its colossal market presence and capability, versus a petulant Neumann, I wouldn’t bet on Neumann.

Also troubling, WeWork is making its banks unhappy.

While WeWork's power struggle will dominate the headlines this week, liquidity pressure remains its most urgent concern.

Legacy banks which carry WeWork’s current $650 million credit facility also arranged its pending $6 billion in new credit facilities back in August.

Even then, as I warned in my last report, WeWork’s banks had demanded much higher interest costs and fees versus its existing loans, and committed loan terms for a much shorter period, to reflect WeWork’s sharply higher risk—long before the company’s $47 billion market value went poof.

As I always say, banks get far more comprehensive financial and other information about the company than other investors, and they get that data every month. WeWork’s banks also have superior claims to all of the company’s credible tangible asset value—which is meager at best—and knowing all this WeWork's banks are clearly worried.

When banks get spooked we all should be wary, and WeWork’s banks are undoubtedly more concerned now with the company’s prospects.

My concerns seem to be confirmed by the desperation implied in this latest news. WeWork’s ongoing turmoil signals that its banks continue to refuse to allow additional access to substantial new borrowing it needs until it can cobble together a stronger capital base.

So with the close of what likely will be another disappointing quarter coming in a week, WeWork’s directors have little time to fix what they can before it gets worse.

WeWork’s Board Could Vote This Week

Anything can happen this week, including bad news that nothing gets fixed and WeWork continues to founder as Neumann blusters and digs in. But I suspect SoftBank and WeWork’s other large investors and its bankers will prevail over the next week or so since the alternative is WeWork potentially sinking into serious financial instability and insolvency.

The best outcome at this point, which is far from guaranteed, is for the board to enact substantially more corporate governance and stronger management oversight, including bolstering the board’s strength with increased power and membership to sufficiently countermand Neumann’s overbearance. As such it would be appropriate to replace Neumann as CEO and/or install a credibly capable bench of top management to support a revamped management strategy.

If successful, this could help WeWork begin to restore its shredded credibility and pave the way for it to pull together stopgap cash financing, if not the full $6 billion in credit facilities waiting in the wings. This may include some combination of a smaller $3-4 billion credit line plus $1 billion or so in high yield debt and up to $1 billion in private equity financing (some or all potentially from SoftBank).

This is enough to get WeWork through yearend, but not enough to solve its burgeoning operating struggles and persistent cash burn—particularly if business conditions stall next year as I expect.

WeWork bonds may rally this week if the board prevails, but I wouldn’t fall for it. Next year looks like a dangerous blind curve for WeWork investors.

WeWork 7.875% senior notes are down more than 6 points to 96.9 since my last report. This still indicates insufficiently low 8.8% ytw/700 bps given its appalling credit metrics and dismal prospects. Upside potential remains limited at best versus downside risk which could be another 5-10 points from here. Maintain “Sell.”

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.