Tesla Q2 Results: Diminishing Returns

Weak Revenue, Worsening Losses, Ambitious Guidance At Risk

Tesla (TSLA) tracked my below-market estimates for revenue and profit in second-quarter results announced after the market closed Wednesday—bad news for Tesla stock and bonds which dropped precipitously on the news.

It happened because drastic pricing cuts Tesla needed to shove sufficient cars out the door to make its ambitious delivery targets, along with plunging revenue quality from eroding mix as sales of premium Models S and X continue to founder, have decimated its ability to generate profits as I had warned again in "Tesla Q2 Deliveries Beat; Demand and Profit Trends Less Clear" and "The Trouble With Tesla's Arrested Development."

That's why even though Tesla affirmed—in a way—its ambitious guidance for record deliveries for the year, there's still a good chance it won't make its numbers or make money doing it.

Shaky start, then things got worse

Consolidated revenue tracked my estimate at $6.35 billion, which was up 59% but still down 12% versus the record $7.23 billion generated in the fourth quarter even though deliveries were 51% higher.

The problem was auto sales at just $5.17 billion, which was up 66% y/y but also down 12% versus the fourth quarter. Excluding the $111 million boost from energy credit sales to get pure auto sale revenue revealed that the average price per car delivered was $53,031. That's down 20% y/y and down 16% versus the fourth quarter, the consequence of multiple rounds of price cuts starting in the third quarter last year.

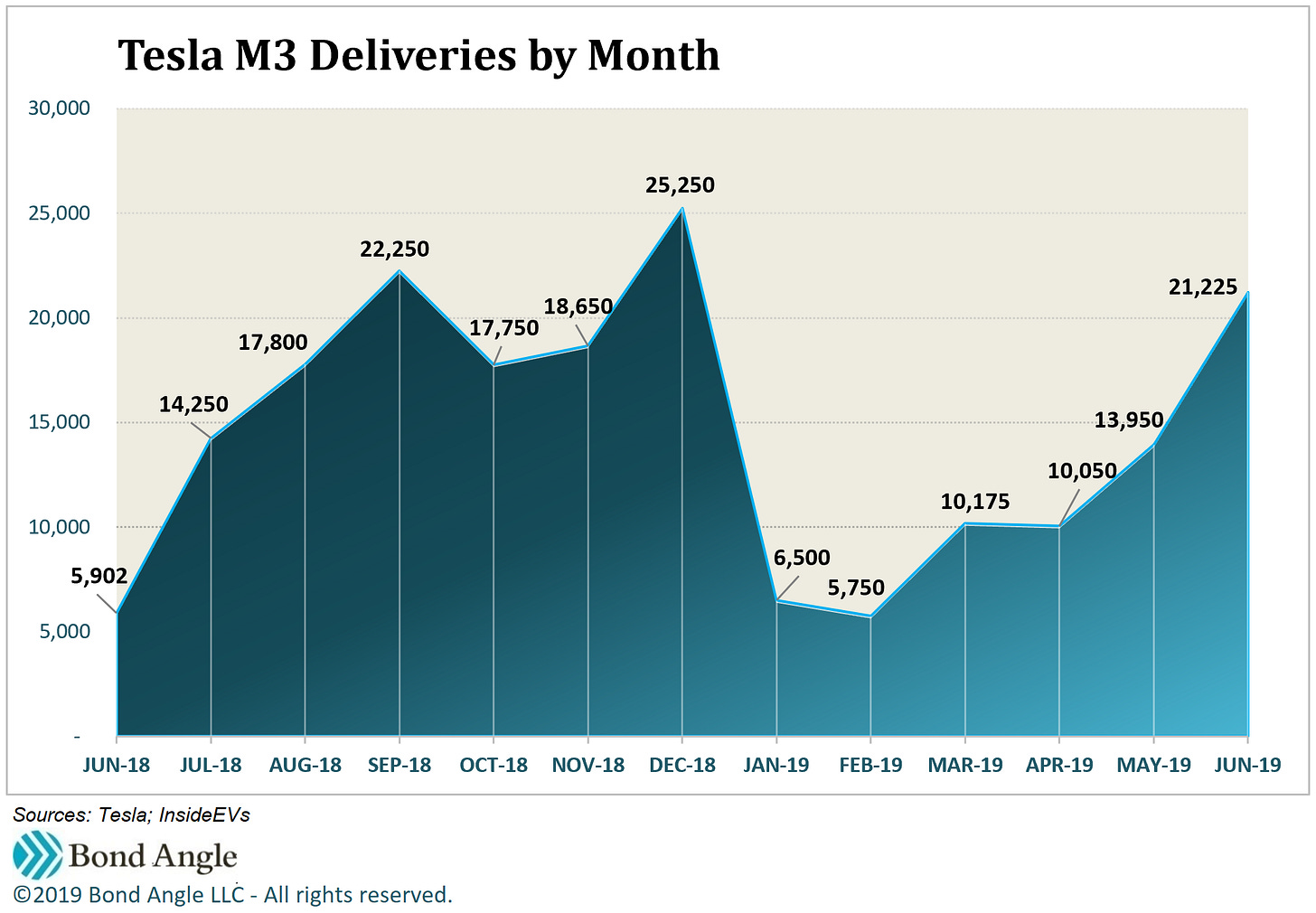

Tesla had little choice, however, because even drastic price reductions have failed to stabilize demand. As I noted in Tesla Q2 Deliveries Beat; Demand and Profit Trends Less Clear, US Sales of Model 3 already are sagging in 2019 versus the second half of 2018 when it was launched at scale:

Total M3 sales would be been down substantially this year versus the second half of last year if not for Tesla expanding M3 into Europe and China late in the first quarter.

However, overseas sales in the second quarter also showed signs of faltering appeal, with M3 overseas deliveries in May-June at 25,037 down 10% versus 27,726 for Feb-March (sources: Tesla, Bond Angle, EVSales.com).

If so, this may confirm my speculation back in March that "the second half of 2018 may have marked the peak in Tesla's commanding market strength."

Pricing pressure is not Tesla's only problem, as I also have warned. Eroding mix has become devastating to Tesla's profitability as sales slump in expensive Models S and X, hit hard by falling energy credit subsidies and increasing competition from newer, less pricey models—including Model 3—as well as self-inflicted damage from the same nagging quality and reliability problems which have also have tempered Model 3 demand (see The Trouble With Tesla's Arrested Development).

Lower mix was expected when the lower-priced M3 began to ramp up last year, but Tesla maintained "insane demand" could support healthy growth in sales for all its models.

In reality, poor management oversight, chaotic sales strategies, and shoddy manufacturing have sabotaged its once glowing potential.

Formerly healthy sales in Models S and X collapsed in the first quarter this year. Tesla maintained since the fourth quarter that M3 deliveries have averaged roughly $50,000 per car.

Assuming that, we can see that MS+X pricing cratered in the second quarter this year with a drop to $66,308—down 36% versus the first quarter and down 31% y/y.

With demand still at risk and revenue quality likely to continue eroding for the foreseeable future, Tesla has limited options other than juicing volumes.

This explains the company's rush to get the Shanghai plant up and running by yearend—even as China is becoming bloated with EV production capacity as it also grapples with slowing economic growth.

Guess we'll worry about that next year when Tesla also plans to build a production plant in Europe.

Assuming it can meet at least the low end of 2019 guidance which now is "aimed" at 360,000-400,000 deliveries—and the company seems willing to do almost anything short of skinning puppies to make its numbers—profitability will still remain under pressure for the foreseeable future.

Slashing costs hasn't worked, nor is it likely to any time soon

Tesla has been unable to offset its deteriorating revenue quality despite multiple rounds of layoffs (including firing its entire Quality Control department in its primary Freemont plant) and cutting essential costs like R&D to the bone.

It also has yet to accomplish long-promised synergies from improved manufacturing efficiency. Gross margin on adjusted auto sales, excluding boosts from energy credit sales, dropped another 130 bps in the second quarter to 15.9%—the lowest in a year when deliveries were less than 41,000 (57% lower versus the second quarter).

EBITDA was a bit better at $370 million (5.8% margin) versus my $300 million estimate, and $488 million (7.7% margin) excluding undefined restructuring charges. This wasn't enough to forestall a net loss of $408 million, near the worse end of my projected loss range of $250-450 million and much worse versus the market consensus estimate of a $260 million loss.

Far from the "profitable" quarter Tesla had projected, this followed the surprising $702 million loss in the first quarter which had wiped out Tesla's meager $450 million profit generated in the last half of last year—the first since the meager $22 million reported in the third quarter of 2016. Tesla has generated only four profitable quarters in its 16-year history.

Tesla preferred investors to focus on shiny objects like its lush $4.95 billion in cash on hand, but there's a catch. Most of the $2.75 billion increase versus the first quarter was netted when Tesla sold $848 million in stock and more than $2 billion in bonds in May (see Tesla: When a Spartan Diet + $2 Billion Isn’t Enough).

I warned clients then that Tesla selling stock and bonds at multiyear lows even as it projected record deliveries was a bad sign for second-quarter results. Tesla stock closed Thursday at $228.50—still down 6% versus the $243 price for the secondary offering.

Cash from operations was a surprising $864 million, but this was mostly from $965 million in noncash charges (depreciation, stock-based comp) and "other" line items offset by the large net loss. The nominal $287 million generated from working capital came mostly from a rare $450 million reduction in inventory—which should happen given record deliveries—and stretching payables again (which shouldn't happen given record deliveries. Sigh.)

Interestingly, accounts receivable was up another 10% versus the first quarter and up 101% versus last year—again outpacing the 59% y/y growth in consolidated revenue. Tesla's bloated accounts receivable remains a curious mystery for a company that operates by requiring cash upfront from customers before their cars are delivered.

Capex was down to $250 million versus $609 million spent last year, less than 3% of revenue and just 43% of depreciation expense. Indeed, Tesla cut capex guidance again to now $1.5-2 billion versus $2-2.5 billion.

This makes no sense for a so-called growth company with such a long and much-delayed to-do list unless Tesla remains concerned, as it should be, about its large and growing cash obligations versus its dubious cash-generating capability.

In addition $800 million in debt due over the next year, Tesla continues to expand its supercharger network. It's now back to expanding its customer service store count. (Projected waves of store closings back in February to support Tesla's ad-hoc new strategy of online-only sales to preserve cash was always a bad idea, so fuhgeddaboudit.)

Tesla also needs to expand capacity to support pending Model Y production next year, and supposedly the pickup at some point, plus build and operate plants in China and now Europe. Oh, and we shouldn't forget about the ninja battery lab in Freemont, not to mention Maxwell Technology-related battery making projects underway which are always a fun way to evaporate cash (I'll have more on this in an upcoming report I've been working on for a while).

Still plentiful signs of trouble ahead

Tesla dialed back its previous profit forecasts and now expects to be "about breakeven" for the third quarter and simply "profitable" in the fourth. Even this muted outlook seems like a stretch.

It doesn't help that Tesla is losing yet another critical senior executive and this exit will leave a mark. Co-founder and longtime Chief Technology Officer JB Straubel is leaving just as the company he helped shepherd to maturity over the past fifteen years is finally producing at full scale and supposedly on the brink of sustainable profitability—according to CEO Elon Musk.

He's also walking out on continued development of Tesla's notorious autopilot and autonomy systems and Musk's eccentric robotaxi endeavors, which Musk has boasted will make Tesla a $500 million company. Of more than 30 senior executives who have left Tesla over the past year,Straubel's exit may be the most disturbing.

Tesla has to break delivery records every quarter going forward. Even with record numbers this quarter, it's still tracking behind for the year and must average 101,000-121,000 deliveries in the next two quarters to meet guidance.

This explains Tesla's obvious urgency to get cars produced at the Shanghai plant by yearend, which may be enough for it to meet at least the low end of guidance for the full year—come hell or high water. We'll see.

But as we have seen, even record deliveries probably won't be enough for Tesla to turn a profit this year. Continuing pricing pressure and mix erosion through the second quarter already signaled auto sales revenue could be down 9-10% y/y (including emission credit sales) in each of the next two quarters, as indicated in my chart above. Tesla cut pricing again after the quarter closed, and this probably won't be the last time.

The delivery numbers I estimated above assume potentially 3,000-5,000 produced by yearend at the Shanghai plant. This contribution is in my best-case estimate for total deliveries which remains below 360,000 at 359,325 to potentially lower by 10,000-15,000.

At best this indicates third-quarter revenue at $6.65 billion (down 3% y/y) with adjusted EBITDA near $636 million (down 36%; 9.6% margin) and a $200 million net loss versus $312 million in profit generated last year. I estimate fourth-quarter revenue at $7.03 billion (down 3% y/y) and EBITDA near $700 million (down 21%; 10% margin), which indicates a $135 million net loss versus a $139 million profit last year.

As a result, my estimates for the year—shown below—are little changed versus my models published in March (Tesla: Now We Know the Y But Not the How) and May (Tesla: When a Spartan Diet + $2 Billion Isn’t Enough). Profitability is fading faster than revenue erodes, as is Tesla's credit quality as mounting debt overtakes tepid EBITDA growth.

With total debt and leases at more than $14.2 billion and climbing to potentially $14.8 billion by yearend, leverage could climb to 7.9x.

See full model attached below for Bond Angle's historical and projected results.

So much for the hope rally. TSLA 5.3% Senior Notes due 2025 are down more than 2 points since my last report to 87.4 (8% ytw; 612 bps). That’s a measly 78 bps of spread per turn of estimated leverage by yearend 2019, woefully inadequate compensation for such a volatile issuer with such precarious prospects. Given Tesla's persistent uncertainty and escalating risks, there's a good risk of 3-5 points of downside from here. Maintain “Underperform."

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.