Tesla's China Syndrome Will Spread

Tesla sold more cars in China in Q4 2021 than anywhere in the world. Model Y ramp-up continues, until it doesn't, while Model 3 struggles even harder to keep up. Also true: It's losing market share.

Investors have been so elated about Tesla (TSLA) reporting record deliveries for the fourth quarter that they have barely noticed the stick in the spokes coming next: the composition of those sales.

That’s because, as I recently warned, again, Tesla’s total reported numbers usually mask troublingly persistent weakness in continuing sales trends that I have been tracking since mid-2018:

Sales in Tesla’s legacy models have faded almost immediately when faced with its new models, and now Tesla is facing stiff new competition from strong rivals in all its markets—especially China. Its new models have also struggled to sustain sales after initial new launch and/or new market expansions, sometimes even before the first anniversary of said events.

Look Away From Elon Musk To Gauge Tesla's Prospects—and Looming Risks, 12/31/21

I projected again last week this would be critically obvious in Tesla’s fourth quarter deliveries in China, the largest EV market in the world and now Tesla’s largest market.

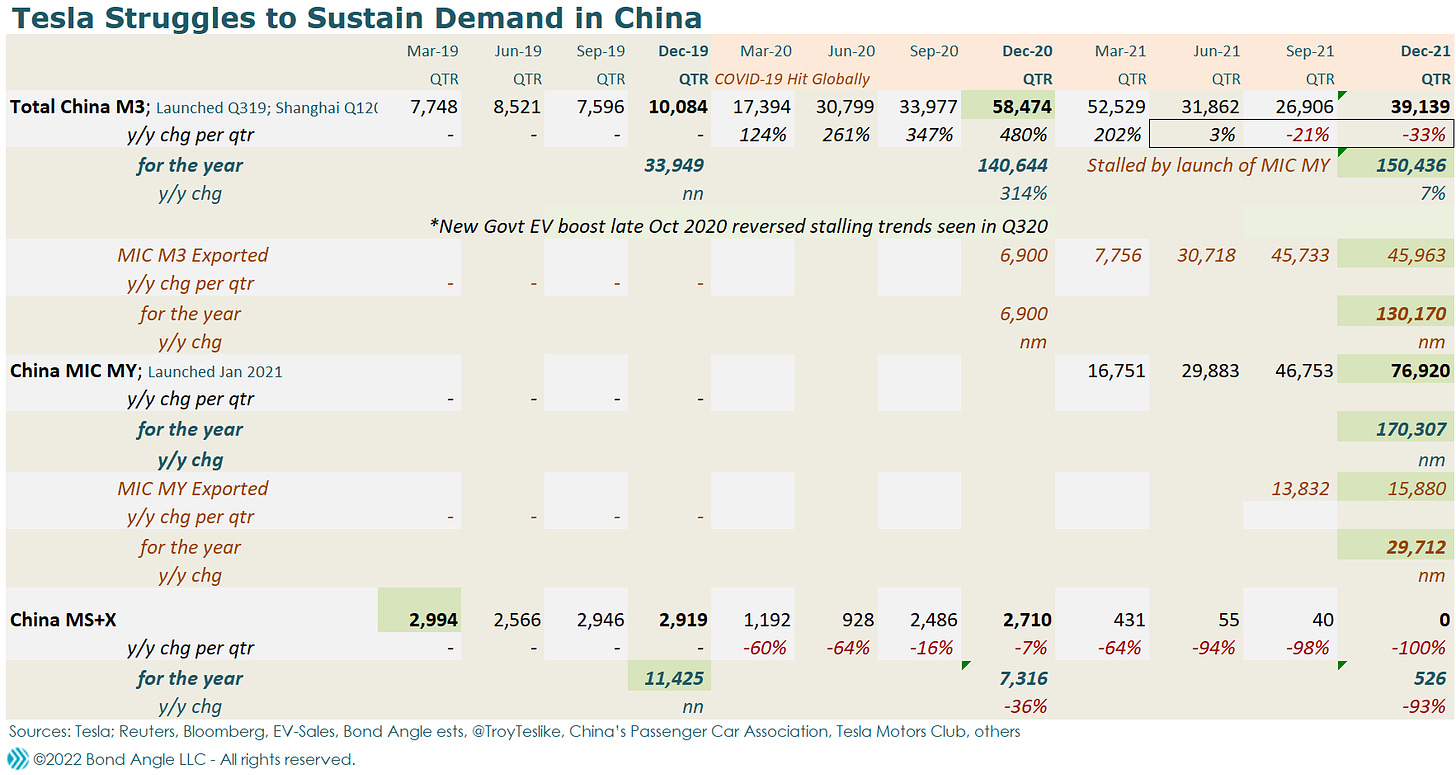

December sales were boosted by the late rush to buy before subsidies were slashed. China will reduced NEV subsidies by 30% as of January 1st, and plans to end the subsidies altogether by December 31st. However, I doubted that Made-In-China (MIC) Model 3 sales would rebound enough in a December surge to salvage the accelerating erosion triggered earlier in the year with the launch of MIC Model Y.

The Model 3 sales deficit was sizable, with deliveries were down a record 74% y/y for the first two months of the quarter, even worse versus the 67% y/y decline for the same period in the third quarter.

Sure enough, it was too much to overcome. Monthly Model 3 deliveries managed to

hit 30,102 in December, its best month yet and up 26% versus tepid results last year (source: China Passenger Car Association (CPCA)). That put deliveries for the fourth quarter at just 39,139, down 33% y/y.

By comparison, Model Y came in at 40,500, its best month yet since its launch in January. Moreover, Model Y has outsold Model 3 the past five months and six months. It topped Model 3’s record month back in September with 33,033.

Models S&X? Apparently 0, or near enough, since total deliveries for the December were reported at 70,602, the total for Models 3 & Y. That was up 197% y/y, thanks entirely to incremental deliveries of Model Y.

It was enough to push deliveries for the quarter to 116,059, up 90% y/y and topping indicated US deliveries at 112,210 (up 56%). Again, thanks entirely to incremental Model Y deliveries.

This made China Tesla’s biggest market. Where, as I have warned, it also continued to lose share to robust local rivals as it has for most of the year, led again by Chinese giant BYD (1211 HK) which delivered 92,7775 in December, up 232%, the latest in string of triple-digit growth months.

Let’s Review

I observed in Look Away From Elon Musk To Gauge Tesla's Prospects—and Looming Risks how Tesla caught a lot of lucky breaks that helped it avoid the worst of the supply disruptions in 2021 which held back production and sales for most of its top competitors.

Tesla’s luck hasn’t gone as far in China, mostly because it has continued to bungle its advantage by delivering poor quality cars and arrogant service which angered customers and the Chinese government, as I have observed before:

Meanwhile, China has cracked down hard on Tesla this year after serious complaints about locally made cars’ poor quality, reliability, customer service, and safety. Tesla has been summoned more than once before China regulators and multiple government agencies as a result. Tesla has been forced to execute several major recalls and provide formal public apologies for the trouble it has caused (see Tesla Q2 "Complications" on 6/29/21).

Nikola's ex CEO Trevor Milton arrested for lying to investors. Some ask, "What About Elon?", 7/21/21

It’s easy to track how this plus the rapidly increasing flood of better alternatives hurt Tesla sales by driving buyers to competitors, as shown in the chart below:

China deliveries in 2019 faltered until the fourth quarter, when buyers rushed to buy the last American-made Model 3s versus the locally made cars which started rolling out late in December 2019, confirming my concerns:

Some indications are surfacing the Chinese customers may be showing a preference for imported Model 3s over concerns about quality issues with locally made cars out of the new Shanghai plant—concerns I’ve also raised:

“So we should expect little if any improvement, if not worsening conditions, in Tesla's manufacturing plants in the US, and similar, if not worse, manufacturing issues cropping up when it opens its hastily built factory later this year in Shanghai, where management and regulatory oversight are substantially less intensive” (The Trouble With Tesla's Arrested Development, 7/17/19).

Sure enough, newly launched MIC Model 3 deliveries struggled to catch on and ultimately stalled late in Q3 2020 despite multiple price cuts, hurt by expiring subsidies and the pending launch of MIC Model Y which I had projected would cannibalize sales—as I projected.

Q4 2020 was salvaged Chinese government boosted local EV demand late in October by renewing subsidies. This proved to be be the peak quarter for MIC Model 3 deliveries.

That surged faded after Q121. Model 3 deliveries went into rapid decline the rest of the year versus the newly launched MIC Model Y.

Model Y was outselling Model 3 in less than 6 months. Tesla started exporting more Model 3s it couldn’t sell locally to Europe and elsewhere. They didn’t sell there either (Tesla China Sales Deflated in July and Tesla's China Sales and Market Share Continued to Shrink In August).

Q421 China deliveries for the entire EV market were boosted by the late rush to buy before subsidies were slashed. China will reduced NEV subsidies by 30% as of January 1st, and plans to end the subsidies altogether by December 31st.

Still, Q421 Model 3 deliveries dropped 33%.

And Yes, This Has Happened Before

If this all sounds familiar that’s because it is. I expected Model 3 to struggle in China versus Model Y because I have tracked similar trends since 2018, as I detailed again in Tesla: Don't Drive Angry, 2/8/21:

This pattern of surge, falter, and urge with expensive price cutting and incentives has characterized Tesla’s sales in all its models for more than two years, as I detailed again in What’s Going On With Tesla’s Demand? on 10/27/20.

So far, the strategy has failed to sustain same-store sales for any of Tesla’s existing models in all its major markets: the US, Europe, and China. Since 2018, Tesla has relied exclusively on incremental sales growth via new models and model expansion into new markets, plus now a new plant in China, for all its sales growth.

As a result:

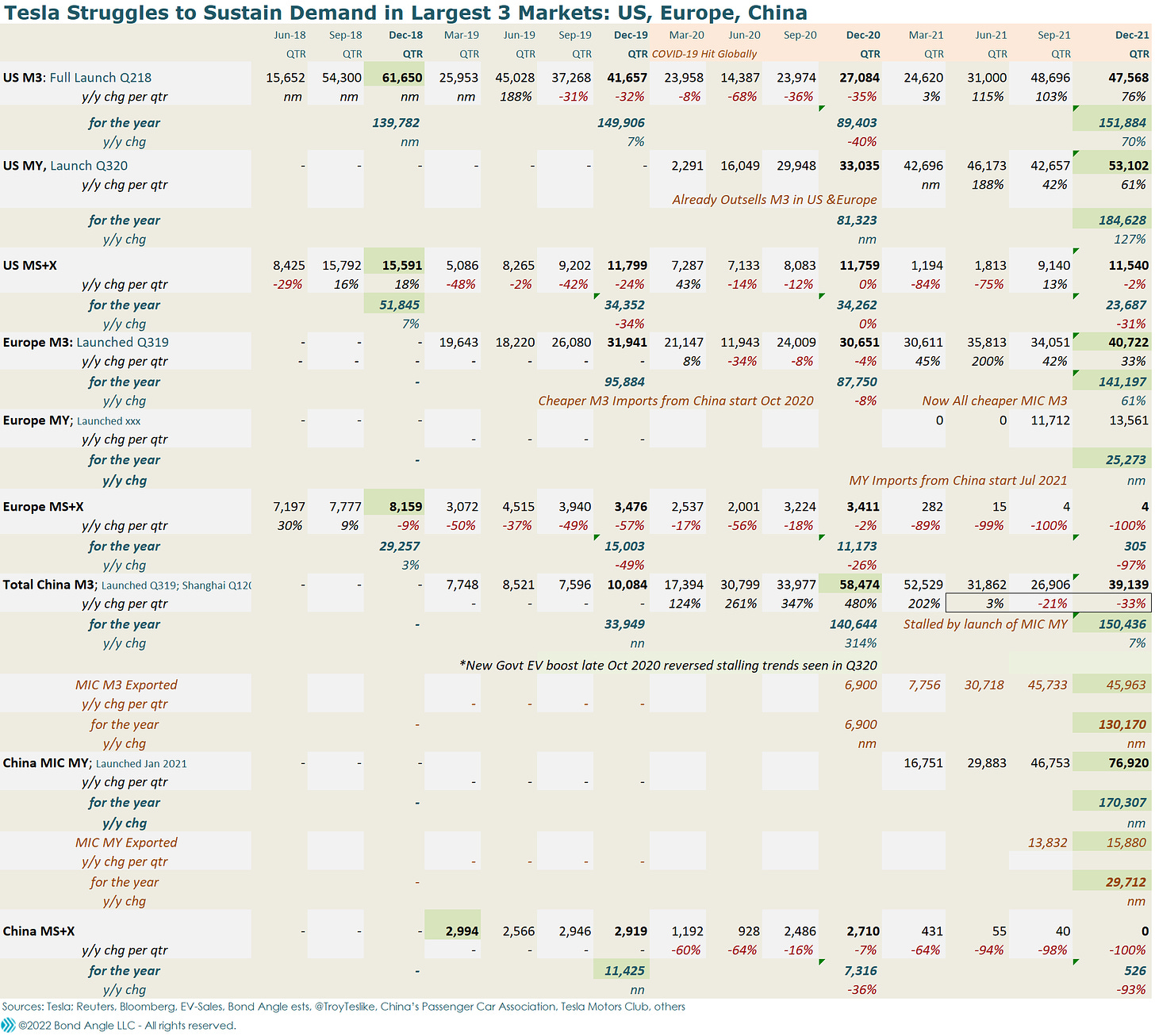

Model S & X sales peaked in Q218 when Model 3 launched at full scale in the US, long Tesla’s primary market;

US Model 3 sales peaked just two quarters later in December 2018 and have been in decline y/y ever since;

Model 3 sales in Europe peaked in four quarters as of December 2019 and have been in y/y decline the past three quarters;

MIC Model 3 sales stalled by the third quarter of its first year, even after six price cuts by September 30th and seven for the full year. Sales were reignited only after China implemented another generous EV-friendly policy (which helped all its competitors as well). But…

Odds are that MIC Model Y curtails MIC Model 3 in China just as it did in the US—and as it likely will in Europe.

And if past trends hold, Model Y sales could start to fade in the US by the third quarter this year.

How did my predictions for 2021 work out?

In China:

Deliveries of newly launched MIC Model Y quickly eclipsed struggling Model 3 in China, as projected.

Tesla continued to lose market share to local OEMs every month of the year.

This doesn’t bode well for Tesla’s aggressive capacity expansion already underway in Shanghai. Moreover, as I have noted, Tesla’s rapidly increasing volume of exports to Europe and other markets of cars it can’t sell in China bely CEO Elon Musk’s boast that Tesla would need to build several factories in China just to meet local demand.

In the US:

US Model Y deliveries slipped as expected in the third quarter versus Q1 and Q2—and even versus Q3 Model 3 deliveries.

US Model 3 and Model Y deliveries both rebounded in Q4, beneficiaries of comparatively less supply disruptions versus peers, but Model 3 ultimately outsold Model Y during the second half of the year.

And that is with US Q4 Model 3 deliveries slipping lower versus Q3. However, US Q4 Model Y deliveries still peaked higher at 53,102 than Model 3 deliveries have hit since 2018.

Weaker Model Y trends affirm Tesla’s difficulty to sustain same-store sales as I have tracked in all previous Models 3, S, and X. Bad news for the upcoming capacity expansion planned for Model Y with the new factory coming in Austin.

Model 3 deliveries in Q4 2021 as indicated at 47,468 remained 23% lower versus peak deliveries three years ago with 61,650 in Q4 2018.

Tesla’s notorious Cybertruck has been delayed indefinitely, as I expected. Not that I ever attributed a significant sales contribution to Cybertruck if it ever materialized.

In Europe:

Cheaper MIC Model 3s Tesla couldn’t sell in China did help revive deliveries in Europe, as expected. Still to come, I suspect, will be backlash from notable quality problems that have surfaced in the US and China but weirdly not aggressively or similarly addressed by Tesla via recalls in Europe—so far.

And, as expected, the pace of y/y growth in Europe Model 3s slowed markedly in the last two quarters when Tesla began to export MIC Model Y to Europe. (And I repeat here my caution noted above quality problems with Tesla’s MIC models).

And, just as in China, Tesla continued to lose market share across Europe—by a lot. Daily Kanban noted, for example, that 9 out 10 EVs sold in Germany, the largest EV market in Europe, are not Tesla’s.

This threatens Tesla’s planned capacity expansion for Europe with its new factory under construction—and still delayed—in Berlin.

The Challenge

Tesla’s biggest year ever ended with peak sales in Models 3 and Y—and lots of red flags.

Most of its sales achievements over the years have come when credible competition was thin or, as with 2021, its biggest competitors were impaired by comparatively more serious supply disruptions. Both these barriers are falling hard.

To meet the challenge, Tesla comes into 2022 with really only one model that can be described as still thriving. That’s Model Y, and it’s mostly a bigger version of Model 3—both little changed since 2018 and still just as problematic.

By comparison, Tesla’s rivals are running hot in every market with literally dozens of exciting new models and new model line-ups already out and coming in the next 2-3 years. The biggest threats are coming from Tesla’s toughest competitors—legacy automakers Ford (F), General Motors (GM), Toyota (TM), Stellantis (STLA), BYD, and more.

Tesla’s quirky Cybertruck, revamped Roadster, and Semi Truck, when and even if they ever appear—which is far from certain—will not move the needle against such competition. Tesla’s $35,000 Model 3 never really materialized because it couldn’t afford to make it. Its promised $25,000 MIC compact hatchback for China, Europe, and other markets will more likely eat into Model 3 and Y sales—whenever it finally appears.

If so, there’s a good chance that Tesla’s fourth quarter of 2021, its best quarter ever, might prove to be its peak quarter for a while.

Tesla repurchased its 5.3% senior notes in the third quarter of 2021 as I projected, though I doubt we’ve seen the last of Tesla as a bond issuer:

Now stay tuned for the second step I described: a quickly shopped, likely $2-4 billion inordinately low coupon bond deal, accompanied by a bump in credit quality ratings potentially to low investment grade (see Tesla's Car Business Finally Turned A Profit. Really. Time For A Big Bond Deal). It could even be appealing... if it’s priced at T+100 bps or better.

Until then, I have Tesla: Not Rated.

Contact Us:

Disclaimer

This publication is prepared by Bond Angle LLC and is distributed solely to authorized recipients and clients of Bond Angle for their general use. In addition:

I/We have no position(s) in any of the securities referenced in this publication.

Views expressed in this publication accurately reflects my/our personal opinion(s) about the referenced securities and issuers and/or other subject matter as appropriate.

This publication does not contain and is not based on any non-public, material information.

To the best of my/our knowledge, the views expressed in this publication comply with applicable law in the country from which it is posted.

I/We have not been commissioned to write this publication or hold any specific opinion on the securities referenced therein.

Bond Angle does not do business with companies covered in its

publications, and nothing in this publication should be construed as a solicitation to buy or sell any security or product.Bond Angle accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this publication and/or further communication in relation to this document.